Business

Costco Shares Rally After Early Dip, Investors Remain Optimistic

NEW YORK – July 8 – Costco Wholesale Corp (NASDAQ: COST) shares made a remarkable recovery on Monday, reversing early losses to end the day with significant gains. The stock closed at $992.18, up 5.16 (+0.52%), demonstrating strong investor confidence in high-quality consumer staples.

The trading day started on a low note, with Costco shares opening at $976.20 after closing at $987.02 the previous session. This opening price acted as a turning point, as buying interest surged, pulling the stock out of the early dip.

Costco’s stock gradually rose throughout the day, reaching an intraday high of $992.89 just before the market closed. This upward movement indicates strong support from both institutional and retail investors, suggesting that momentum is building.

Technical analysts noted the importance of the mid-morning low at $976, which may serve as a crucial support level. The sharp recovery signals that many investors see pullbacks as buy opportunities, a positive trait that can indicate a strong uptrend.

Looking ahead, the stock’s immediate challenge will be to surpass the $1,000 milestone. Achieving this target could attract more buyers, including algorithmic traders, who may view the four-digit mark as a significant breakthrough.

Costco’s price action on Monday moves the stock closer to its 52-week high of $1,078.24. Although it still has a way to go, the trend suggests that this peak might be within reach in the near future.

The stock is trading well above its 52-week low of $793.03, reflecting a robust rally in the last year. However, pre-market data for the next trading session showed a slight dip to $991.80, a normal adjustment following the prior day’s activities.

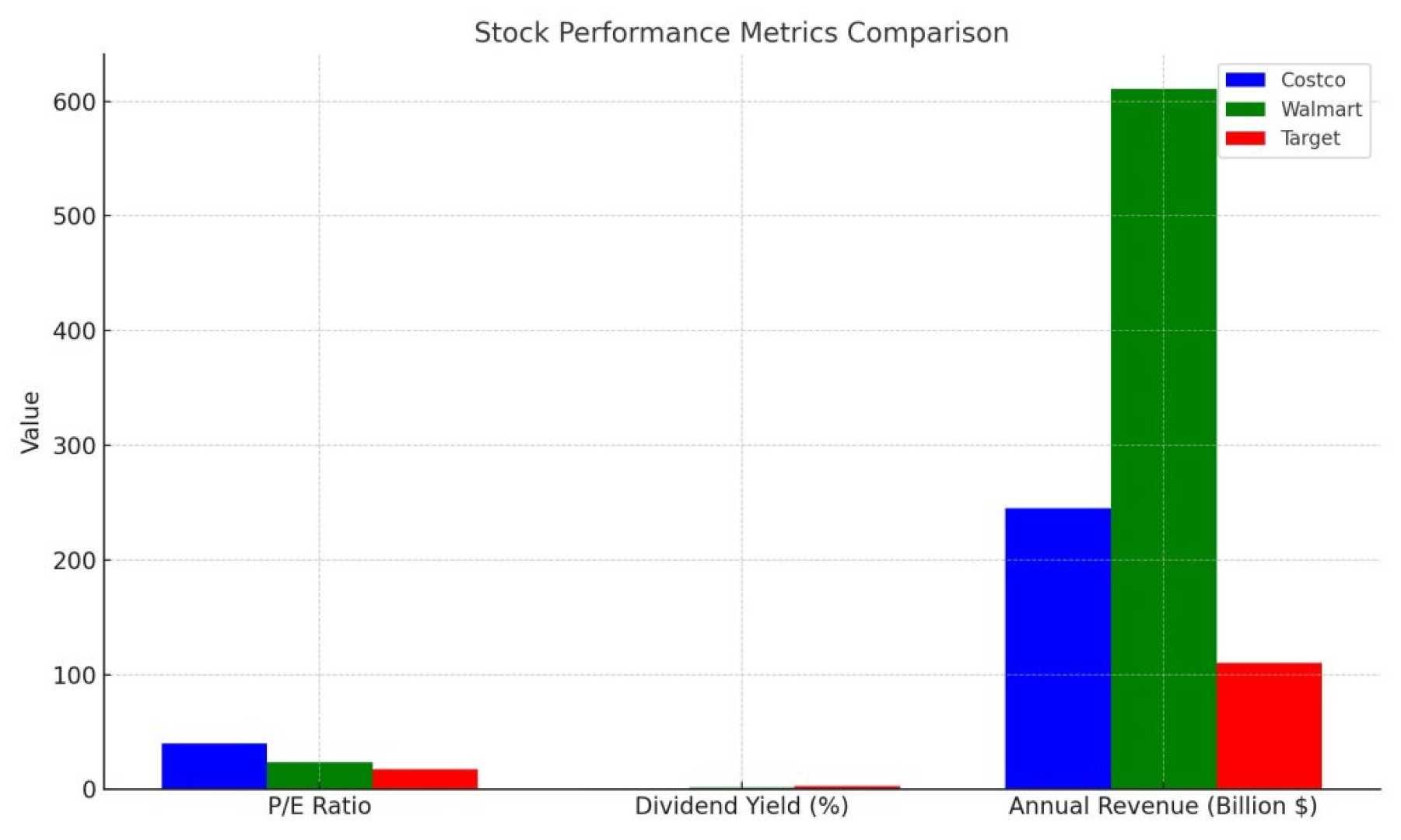

Despite this minor setback, Costco’s strong fundamentals support long-term investor interest. The company currently has a Price-to-Earnings (P/E) ratio of 56.28, a number that far exceeds the S&P 500 average. This high valuation reflects market confidence in Costco’s potential for growth and profitability.

The company also pays a quarterly dividend of $1.29 per share, symbolizing a steady return to shareholders. While the dividend yield is modest at 0.52%, Costco is known for frequently issuing special dividends, which can reward long-term investors.

Costco boasts a market capitalization of approximately $440 billion, placing it in the mega-cap category and making it a crucial stock for global investment portfolios.

Looking forward, investors are eager to see if Monday’s positive performance can lead to a sustained rally toward all-time highs. Questions remain about whether the stock can maintain momentum or struggle due to its high valuation and external market pressures.

Key concerns include the potential impacts of rising competition from online retailers and fluctuating consumer spending. Market participants will closely monitor the price action around the $1,000 level, as it will likely dictate the next course for Costco.

Monday’s trading session epitomized the market’s faith in Costco. The company rebounded from a rocky start, solidified its position, and closed with strong momentum, leaving investors hopeful for future gains.