Business

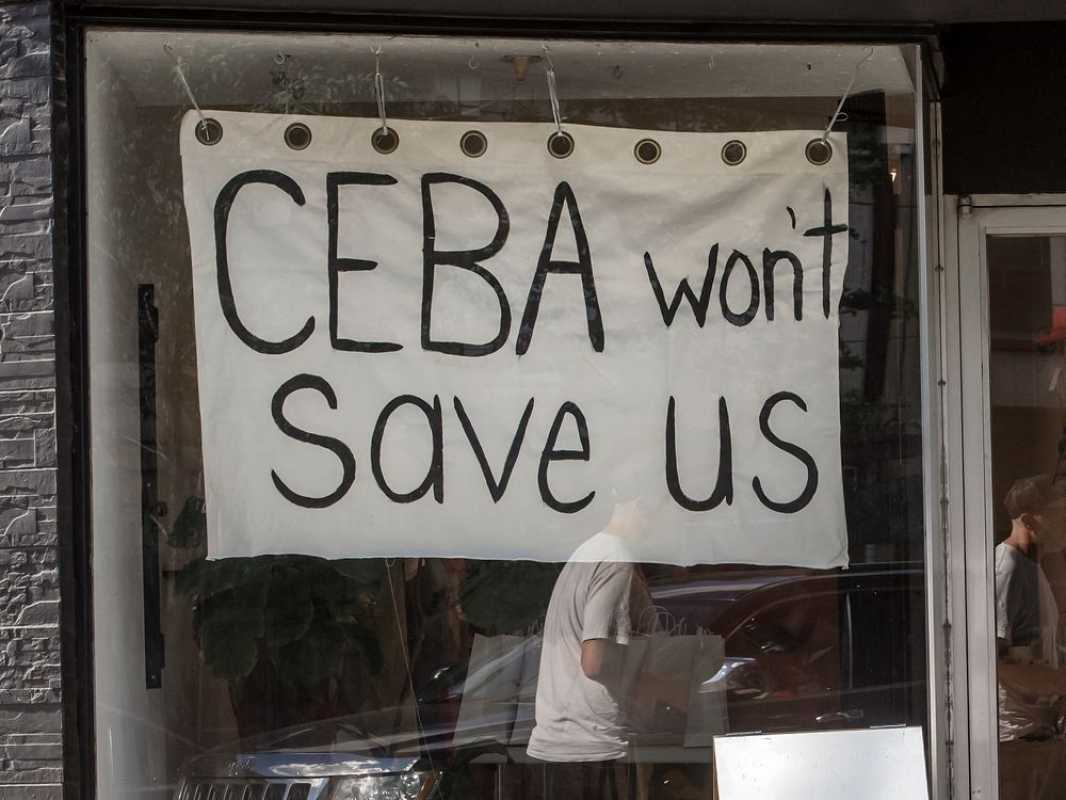

Deadline for CEBA loan forgiveness passes without extension from Ottawa

The deadline for repayment of the loans issued as part of the Canada Emergency Business Account (CEBA) has passed without an extension from the federal government. Eligible CEBA loan holders who did not repay their balance by January 18 will not receive loan forgiveness of up to 33%, equivalent to $20,000. Instead, businesses will see their CEBA debt increase by 50% from $40,000 to $60,000.

Prime Minister Trudeau announced that the government will not be extending the deadline, stating that it is time to wind down pandemic programs. The Canadian Federation of Independent Business (CFIB) expressed disappointment with the decision, highlighting the loss of the forgivable portion for many small businesses. CFIB had previously called for a two-year extension or at least a one-year extension with access to the forgivable portion.

In a survey conducted by CFIB, 41% of more than 500 members stated that they would have difficulty repaying their CEBA loans. The organization has been advocating for clarity and consistency from the government and banks throughout the CEBA process.

While CFIB expressed concern, one CEBA loan recipient, Thomas Watson, supported the government’s decision. Watson, the owner of Guardsman Insurance Services in Ottawa, believed it would be unfair to forgive unpaid balances as it penalizes businesses that had already repaid their loans.