Business

Did Trump’s Social Media Post Influence Stock Market Surge?

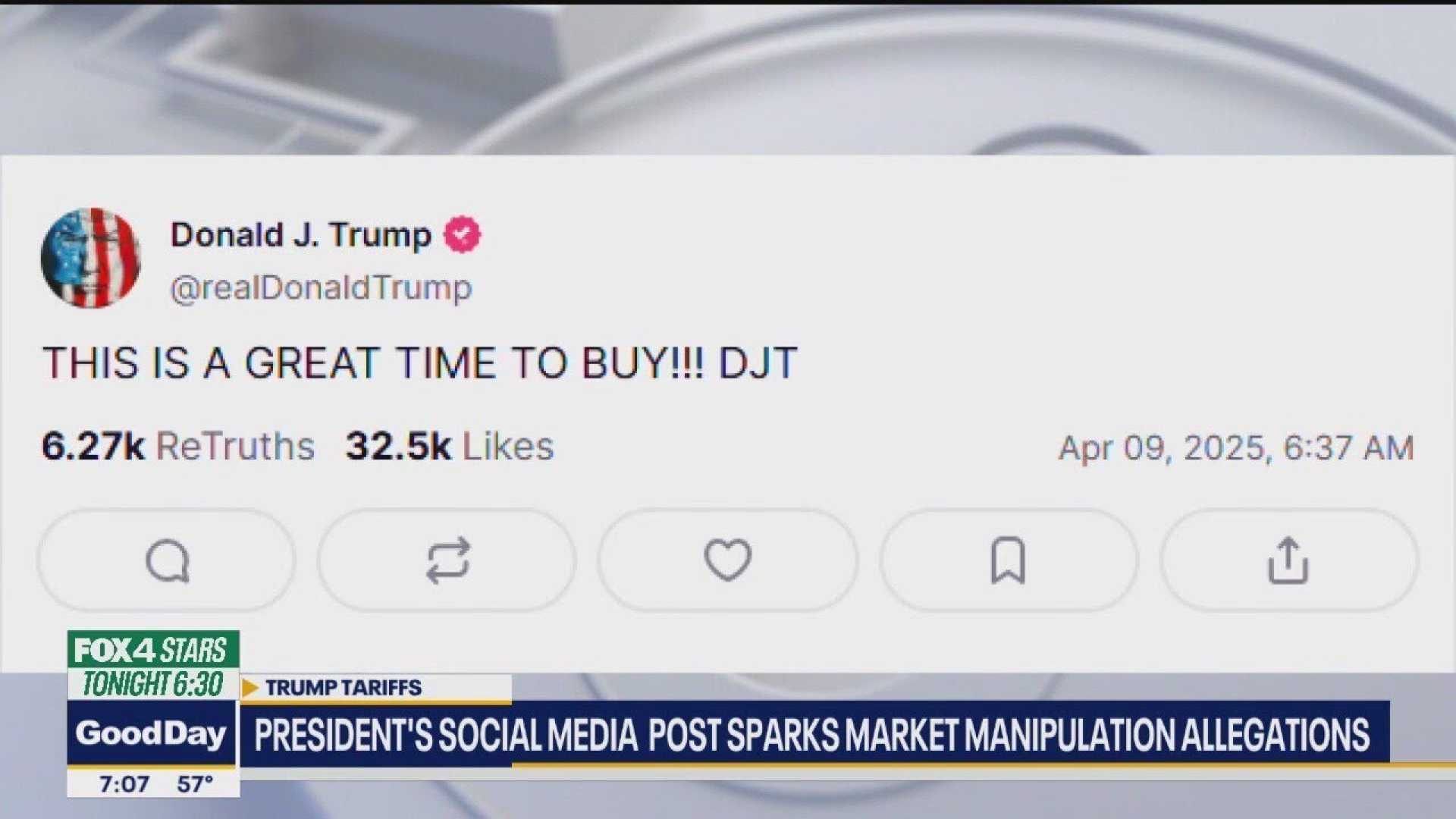

WASHINGTON, D.C. — President Donald Trump is facing scrutiny after posting on social media that it was a “great time to buy” stocks, just hours before announcing a surprise 90-day pause on additional trade tariffs not affecting China, a move that triggered significant stock market gains worldwide.

On Wednesday morning, shortly after U.S. markets opened, Trump made his statement via his Truth Social platform. Less than four hours later, he revealed the tariff pause, causing stocks in the S&P 500 to close up more than 9%, while the Nasdaq surged by over 12%. This dramatic announcement sent share indexes soaring across Asia and Europe as well, with Japan’s Nikkei 225 up 9% and London’s FTSE 100 climbing by up to 4% during early trading.

The timing of Trump’s social media post raised eyebrows, especially since he typically does not sign off with his initials. Coincidentally, the letters “DJT” correspond to the ticker for Trump Media & Technology Group, the parent company of Truth Social, whose stock rose by 22% following his announcement. This has sparked accusations of market manipulation among critics.

“These constant gyrations in policy provide dangerous opportunities for insider trading,” said Democratic Senator Adam Schiff. “Who in the administration knew about Trump’s latest tariff flip-flop ahead of time? Did anyone buy or sell stocks, and profit at the public’s expense? I’m writing to the White House – the public has a right to know.”

Fellow Democratic Senator Chris Murphy echoed similar sentiments on social media, suggesting that an “insider trading scandal is brewing” due to the timing of Trump’s post. Alexandria Ocasio-Cortez, a Democratic representative from New York, called for all members of Congress to disclose their stock purchases made in the last 24 hours, highlighting a significant potential ethical breach.

Responding to queries on the timing of his decision to pause tariffs, Trump stated, “For a period of time. I would say this morning. Over the last few days, I’ve been thinking about it.” Meanwhile, White House Press Secretary Karoline Leavitt insisted that the tariff pause was a part of Trump’s negotiated strategy and part of the “art of the deal.”u00a0

Amidst the volatility, some political figures have capitalized on market fluctuations. Republican Congresswoman Marjorie Taylor Greene revealed that she made several stock purchases on April 3 and 4, coinciding with prior negotiations regarding tariffs. Stocks in major technology companies such as Amazon and Apple also surged dramatically following the tariff pause.

While most tariffs were paused, Trump escalated the tariff on Chinese imports to 125%, raising concerns about retaliatory measures from Beijing. Despite a pause in new country-specific tariffs, economists note this move will likely invite increased tension in U.S.-China trade relations.

In the wake of the announcements, experts noted that the pause in tariffs marked one of the most significant surges in stock indices since World War II, with the S&P 500 experiencing a one-day gain of 9.5%. Conversely, those who sold stocks in response to earlier market declines incurred losses.

Veljko Fotak, an associate finance professor, remarked on the disarray within Trump’s administration regarding the unexpected policy shift, stating, “The pause undercut a lot of the people who are supposedly in charge – they seemed caught off-guard and unaware of the policy change.”

Democratic lawmakers are now calling for an investigation into possible market manipulation, alleging that Trump’s actions may have been designed to influence market conditions for personal or political gain. Schiff has stated, “Congress must find out” if Trump’s inner circle profited from the stock market fluctuations.

As scrutiny around Trump’s recommendations and timing increases, financial experts and lawmakers alike are left to ponder the implications for investor trust and market integrity moving forward.