Education

Education Department Suspends Student Loan Forgiveness Applications for Three Months

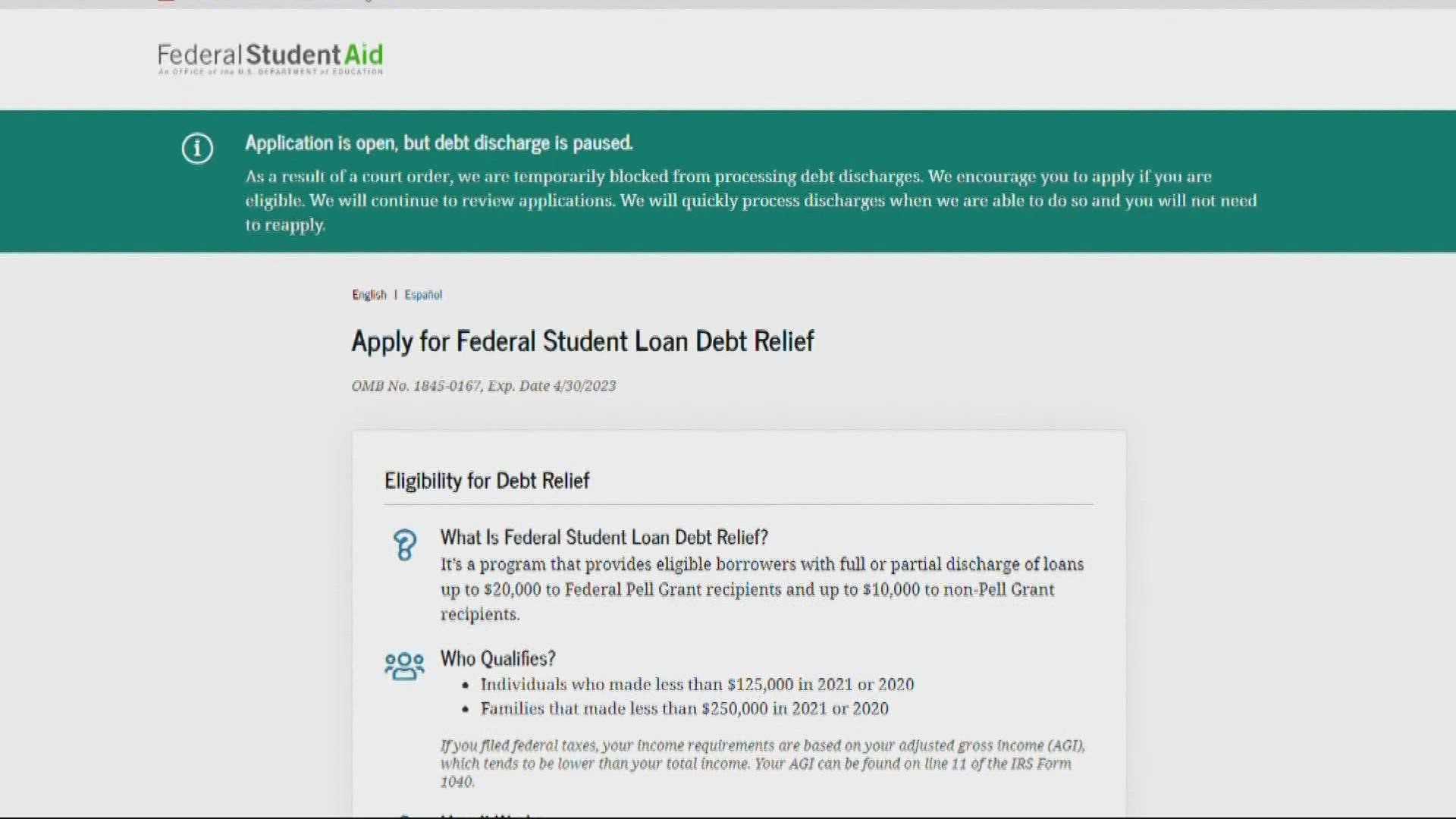

WASHINGTON, D.C. — The U.S. Department of Education has instructed student loan servicers to halt all student loan forgiveness applications for a period of three months, according to a memo obtained by The Washington Post. This decision affects servicers such as MOHELA, Aidvantage, and Nelnet, which manage loans on behalf of the Department of Education.

The memo specifically directs loan servicers to stop accepting and processing all income-driven repayment (IDR) and consolidation applications. It notes that this suspension may be extended beyond three months or possibly lifted early. Moreover, borrowers already enrolled in IDR plans who are making payments will not be allowed to recertify during this time.

As reported, the suspension also affects pending applications submitted online and via paper forms. While borrowers can still submit a paper loan consolidation application, access to income-driven options is currently unavailable. This guidance adds confusion for millions of borrowers, further complicating their financial situations.

The Education Department’s directive effectively limits borrowers to the standard 10-year repayment plans, alongside graduated and extended repayment plans. Four IDR plans designed to make payments more manageable—Pay As You Earn, Income-Based Repayment, Income-Contingent Repayment, and Saving on a Valuable Education—are meant to tie payments to earnings, which helps retain affordability for borrowers.

Public Service Loan Forgiveness (PSLF) remains open for new enrollment for those in qualifying occupations, yet, for many borrowers, those who were dependent on the IDR plans to secure loan forgiveness may find themselves in a precarious position. For instance, individuals enrolled in the SAVE plan, which was designed to expedite loan cancellations, may have their qualifying payments paused due to current legal challenges.

Adam Minsky, an educational finance expert, has highlighted the implications of this suspension. A borrower earning $50,000 a year with $50,000 in student debt would have benefitted substantially under the SAVE plan, paying a mere $12,345 with potential loan forgiveness. Conversely, without IDR options, they could face a repayment total exceeding $68,000, representing an astronomical increase of $55,000.

The recent court injunction against the SAVE plan, instituted by Missouri Attorney General Andrew Bailey and six GOP-led states, has led to this abrupt policy change. The lawsuit challenges President Biden‘s authority to implement the SAVE plan created in 2023, which was intended to reduce financial burdens on borrowers.

Since the 8th Circuit Court’s decision was announced, IDR plan applications have been rendered unavailable, causing apprehension among borrowers. The Department of Education is reportedly reviewing these applications to assure compliance with the court’s ruling while making adjustments to the lending framework.

Education experts have suggested that the situation could normalize within a few months as changes are implemented. Betsy Mayotte, president of the Student Loan Ranger, expressed optimism that the applications might resume shortly but acknowledged the urgency of the matter.

Student loan borrowers facing immediate financial difficulties are encouraged to reach out to their servicers. Options may include deferring their loans or seeking forbearance, though borrowers should be wary of accruing interest during forbearance periods.

As uncertainty looms over the future of student loan repayment options, advocates are urging the Education Department to act swiftly to restore access to affordable repayment plans. Persis Yu, deputy executive director of the Student Borrower Protection Center, condemned the department’s decision as detrimental to many working families.