Business

Falling Credit Scores Signal Economic Trouble for Younger Americans

New York, NY — Credit scores for Americans have dropped at the fastest rate since the Great Recession. The national average FICO score fell by two points this year, down to 715, according to a recent report from the analytics company FICO. This marks the first decline of this magnitude since 2009.

The decrease in credit scores is linked to a growing number of borrowers defaulting on car loans, credit cards, and personal loans. Notably, younger Americans, particularly Generation Z, are facing severe financial pressures as they struggle with high student debt and a tough job market.

FICO’s data reveals that Generation Z experienced an average score drop of three points, the sharpest decline of any age group in recent years. Tommy Lee, a senior director at FICO, explained the economic divide: “We’ve seen a K-shaped economy where those with wealth tied to the stock market are thriving, while others struggle with high rates and affordability problems.”

After a period of steady growth in credit scores from 2013 to 2024, the recent declines are alarming. Delinquency rates on personal loans, auto loans, and credit cards are at their highest levels since 2009, leading analysts to suggest that current trends resemble conditions typical of a recession.

The report shows that 14% of Gen Z borrowers have seen their credit scores drop by 50 points or more in the past year, a notable increase compared to previous years. One major factor contributing to this crisis is the resumption of student loan payments, which had been paused during the Covid pandemic. Notably, approximately one-third of Gen Z members have student loans.

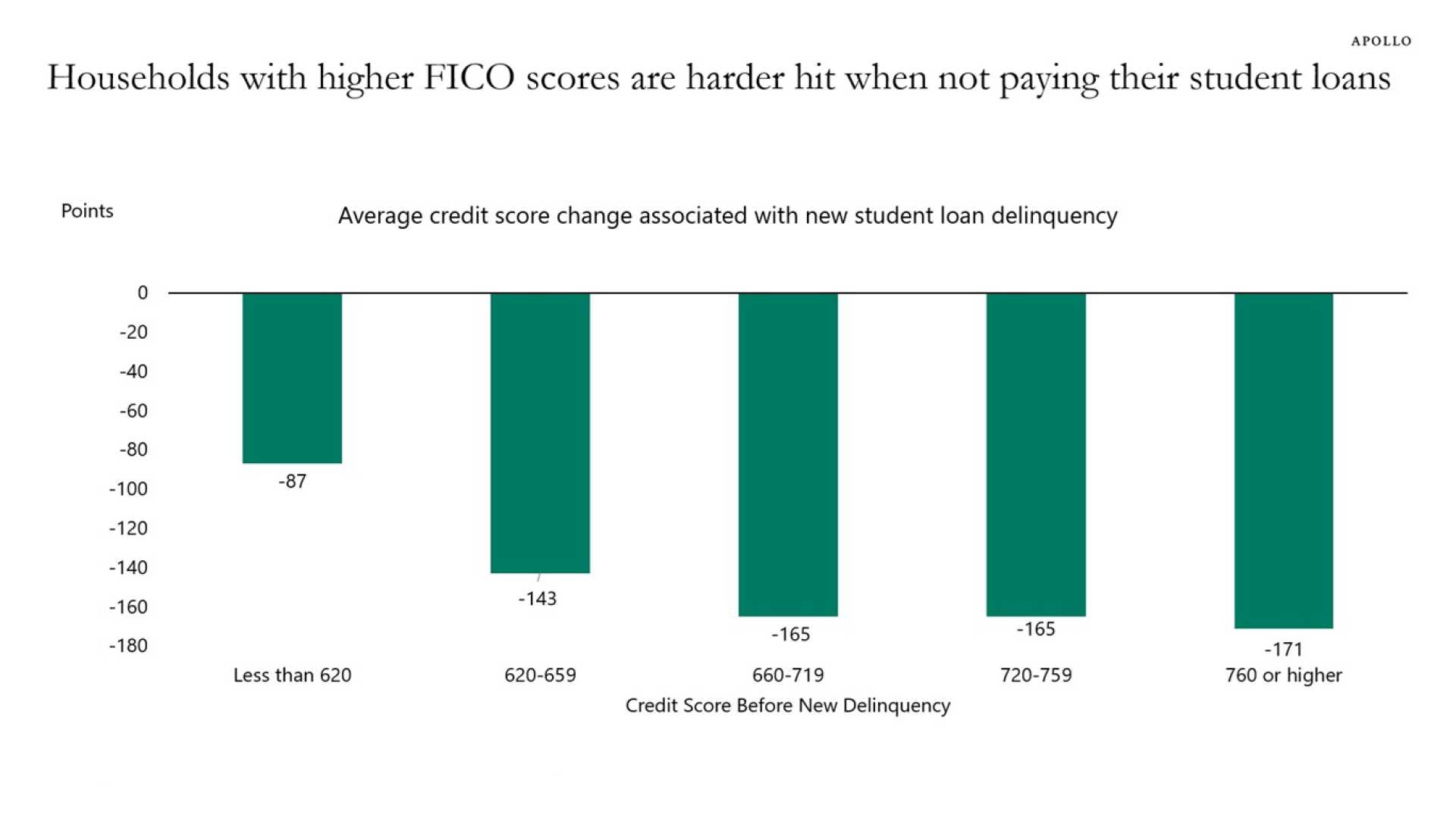

As the Department of Education re-initiated loan collections, many borrowers found delinquencies appearing on their credit files. Between February and April, over 6 million consumers had such delinquencies reported, resulting in a record high delinquency rate of 29% among borrowers.

Moreover, Dimitri Tsolakis, a recent college graduate, spoke about his struggles. “It took me 14 months to find a full-time job, and now I’m underpaid,” he said, referring to his role as a secretary. With $35,000 in student debt, Tsolakis is prioritizing car payments over loan repayments.

Research from the Federal Reserve Bank of Philadelphia indicated that about 19% of consumers have skipped bills or reduced spending to manage financial strains over the past year, a slight increase from the previous year. Younger Americans, especially, lean heavily on credit cards and other loans to make ends meet.

As these financial challenges unfold, Sue Murphy from Philadelphia recounted her experience with student loans. To afford her daughter’s education, she took on a $70,000 parent PLUS loan and works two jobs to cover $500 monthly payments. “It feels like it doesn’t pay to be an honest, hardworking citizen anymore,” she lamented.

Despite these troubling trends, mortgage delinquency rates remain low, suggesting that older, more financially established homeowners are weathering economic storms better than younger generations.

The mounting evidence points to a disconnect between Wall Street’s successes and Main Street’s struggles. As stock markets hit record highs, many everyday Americans face ongoing financial hardship.