Business

Forex Market Update: Key Trading Levels and Economic Insights

The latest market trends reveal key trading levels for various currency pairs and financial instruments, including AUDJPY, AUDUSD, EURGBP, EURJPY, GBPJPY, GBPUSD, NZDJPY, NZDUSD, USDJPY, USD Index, Gold, and the S&P 500. The financial landscape continues to fluctuate, influenced by global economic factors.

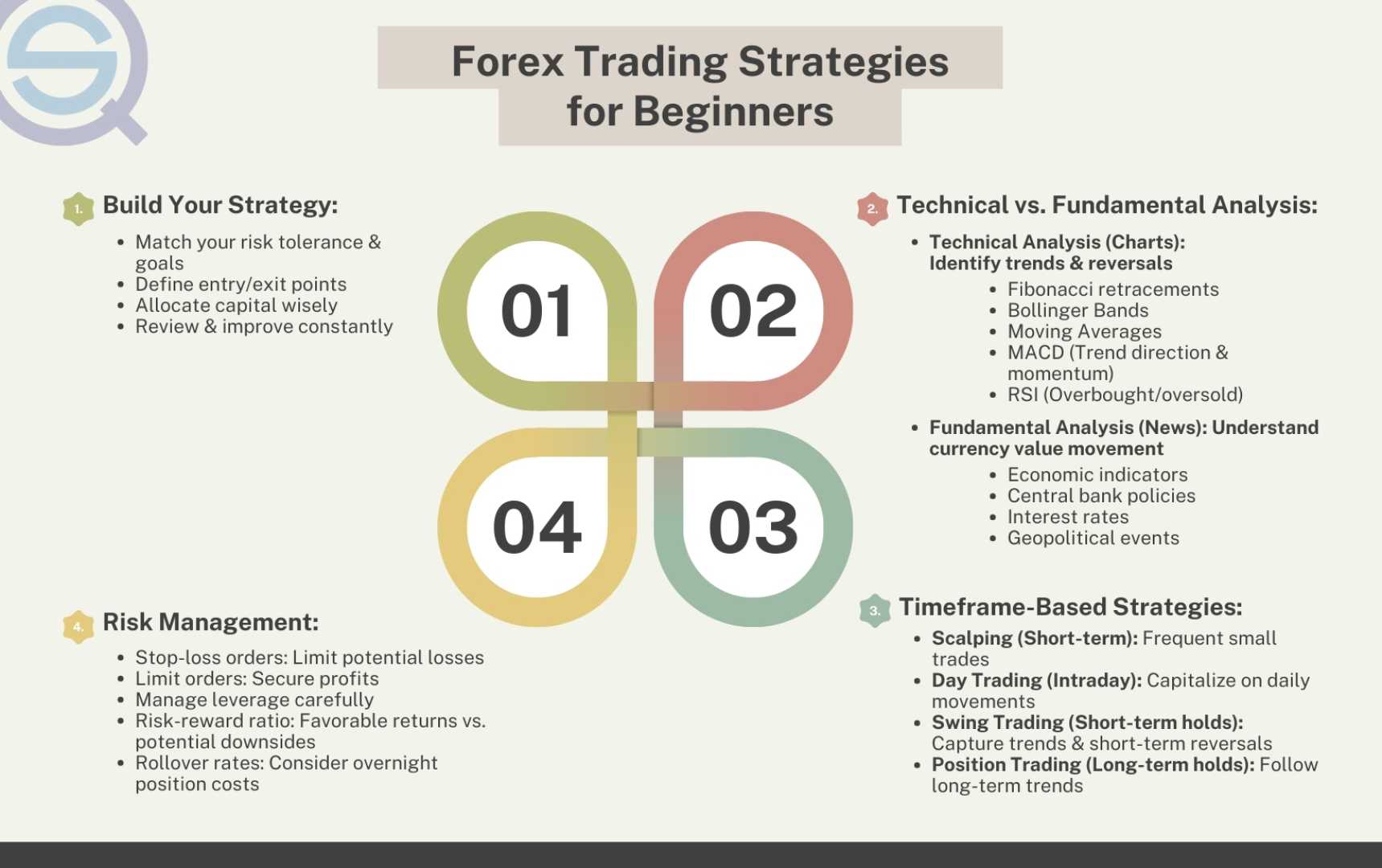

Traders are advised to be aware of the inherent risks associated with foreign exchange and derivatives trading. As highlighted by ACY Securities Pty Ltd, trading in these markets involves a high level of risk. Investors are encouraged to carefully consider their investment objectives, risk tolerance, and trading experience. It is crucial not to invest funds that one cannot afford to lose. ACY Securities Pty Ltd, regulated by the Australian Securities and Investments Commission, provides general advice and emphasizes that such advice does not consider individual financial situations or needs.

The GBP/USD maintains a positive trajectory, trading near 1.3300. This stability follows the Bank of England‘s decision to keep the policy rate unchanged at 5%, with a single policymaker advocating for a 25 basis points cut. Investors now turn their attention to forthcoming U.S. data releases for further direction.

The EUR/USD remains stable, trading around 1.1150, buoyed by an improved risk mood following a 50 basis points rate cut by the Federal Reserve. Market participants await U.S. macroeconomic data and European Central Bank officials’ comments for additional insights.

Gold, denoted as XAU/USD, has experienced a slight increase, trading again in the $2,580s. This comes after a decline to the $2,540s, post the Federal Reserve’s interest rate decision. The 10-year U.S. Treasury bond yield remains above 3.7%, which limits the upward momentum for Gold prices.

Solana Lab‘s announcement of its second phone, the ‘Seeker‘, scheduled for a 2025 release, has captured attention. During Token2049, a prominent global conference for cryptocurrency, Solana’s General Manager Emmett Hollyer referred to the new device as a “rewards magnet” for users.

Anticipation builds for the Bank of England’s forthcoming interest rate decision following a close call in August. This decision is expected to provide insights into the bank’s future policy actions and its bond sales strategy.

In a recent review, the FXStreet team conducted an independent analysis of Moneta Markets, a broker noted for being particularly suitable for novice to intermediate forex traders seeking to expand their knowledge base.