Business

Freddie Mac Reports Significant Drop in Mortgage Rates

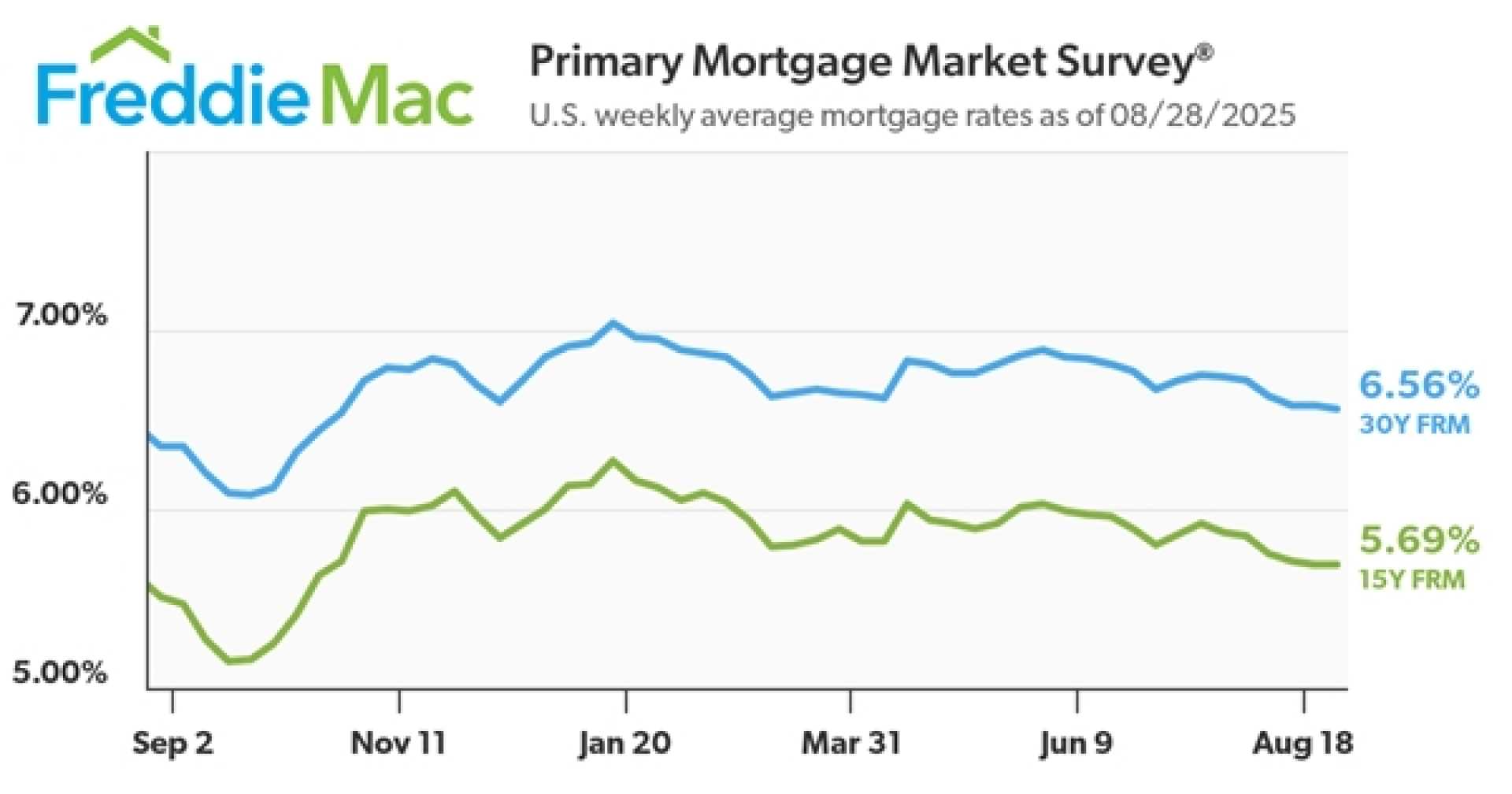

MCLEAN, Va., Sept. 11, 2025 – Mortgage rates saw a significant decline this week, according to Freddie Mac‘s latest Primary Mortgage Market Survey. The report indicates that the average rate on a 30-year fixed-rate mortgage (FRM) fell to 6.35%, down from 6.50% the previous week, marking the largest weekly drop within the past year.

Freddie Mac’s chief economist, Sam Khater, noted, “Mortgage rates are headed in the right direction and homebuyers have noticed, as purchase applications reached the highest year-over-year growth rate in more than four years.” This surge in purchase applications reflects a renewed interest in homebuying amidst the changing rates.

The average rate on the 15-year fixed mortgage also decreased, falling to 5.50% from 5.60% the prior week. A year ago, these rates were significantly lower, sitting at 6.20% and 5.27%, respectively.

Data from the Mortgage Bankers Association revealed that the index tracking refinance applications increased by 12.2%, the highest level seen in nearly a year, suggesting that many homeowners are taking advantage of the lower rates. Refinancing accounted for almost half of all mortgage applications reported last week.

The housing market has struggled in the past year, facing high borrowing costs, high property prices, and limited inventory. However, recent trends indicate a possible turning point. The supply of existing homes for sale is slowly increasing, and annual price hikes have begun to stabilize.

Khater added, “The supply of homes has been inching higher, and interest rates now appear poised to ease further in the coming weeks, possibly as early as the next Federal Reserve meeting.” The Fed’s current benchmark rate has remained steady since last December, causing concerns over inflation driven by tariffs. However, the latest job reports may push the Fed towards easing these rates to rekindle the housing market.