News

U.S. Inflation Cools to 2.1% in September, Nearing Fed’s Target

Inflation in the United States continued to decline in September, bringing the annual rate closer to the Federal Reserve‘s target of 2%. According to data released by the Commerce Department on Thursday, the Personal Consumption Expenditures (PCE) price index, which is the Fed’s preferred measure of inflation, showed a 2.1% increase in prices for the year ending in September. This is a decrease from the 2.3% recorded in August and aligns with economists’ predictions based on FactSet consensus estimates.

The cooling of inflation is seen as positive news for both the Federal Reserve and the Biden administration, as it indicates that the Fed’s efforts to manage inflation are yielding results. Over the past two years, inflation has been gradually decreasing, and the latest figures suggest this trend is continuing.

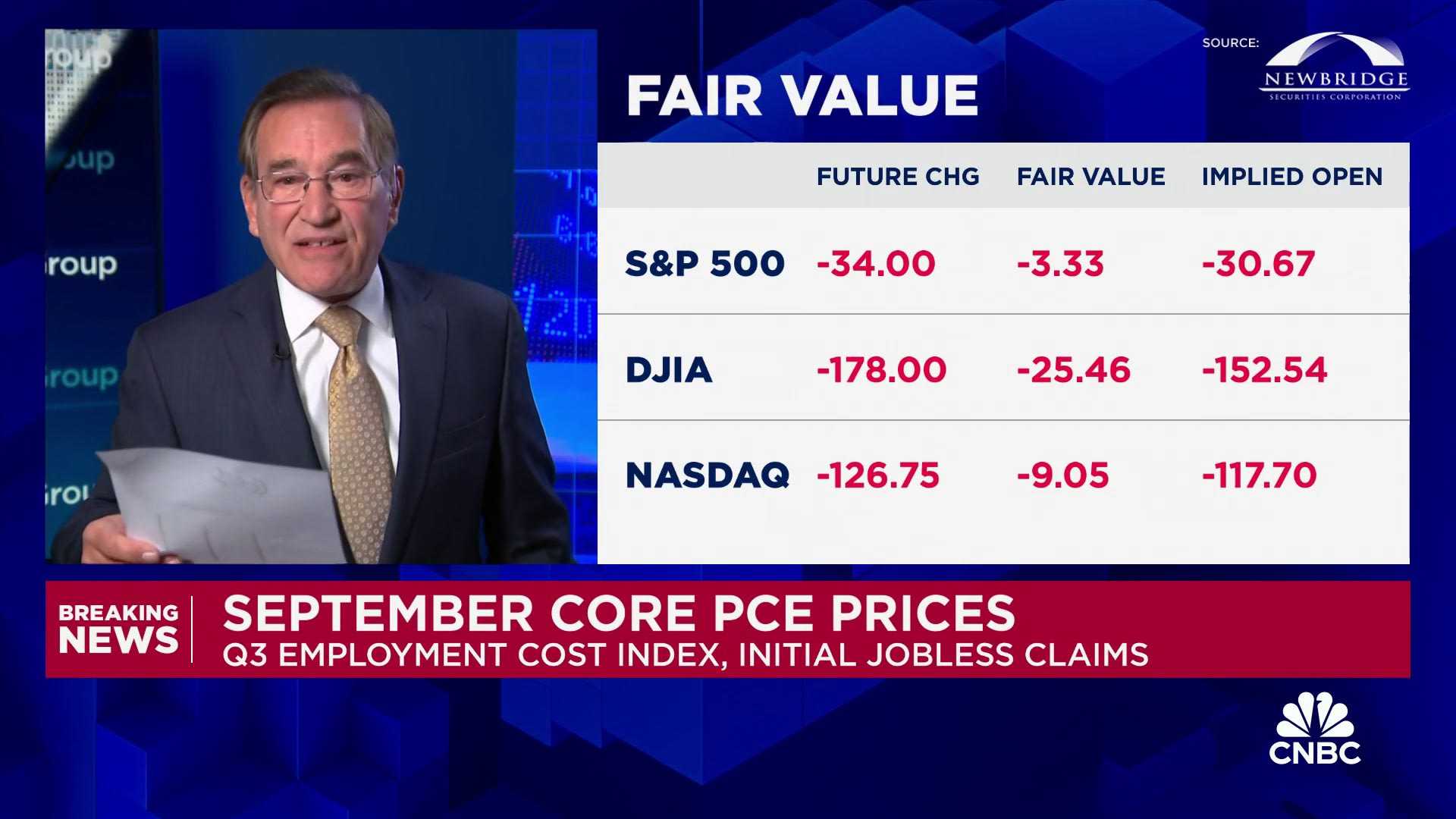

However, beneath the surface, some price increases remain persistently high. The core PCE index, which excludes the volatile costs of food and energy, rose by 2.7% in September compared to the previous year. On a monthly basis, core inflation also saw a slight uptick. This suggests that while significant progress has been made, there is still more work to be done to fully manage inflation.

The Federal Reserve has been actively managing inflation by adjusting interest rates. After significant rate hikes in 2022 and early 2023 to temper economic activity, the Fed reduced rates by half a percentage point in September, marking the first decrease in four years. The latest inflation data may influence the Fed’s decisions on future interest rate adjustments, with some economists cautioning that inflation might remain stubborn in the coming months.