Business

February Inflation Rate Eases to 2.8%, Tariff Concerns Loom

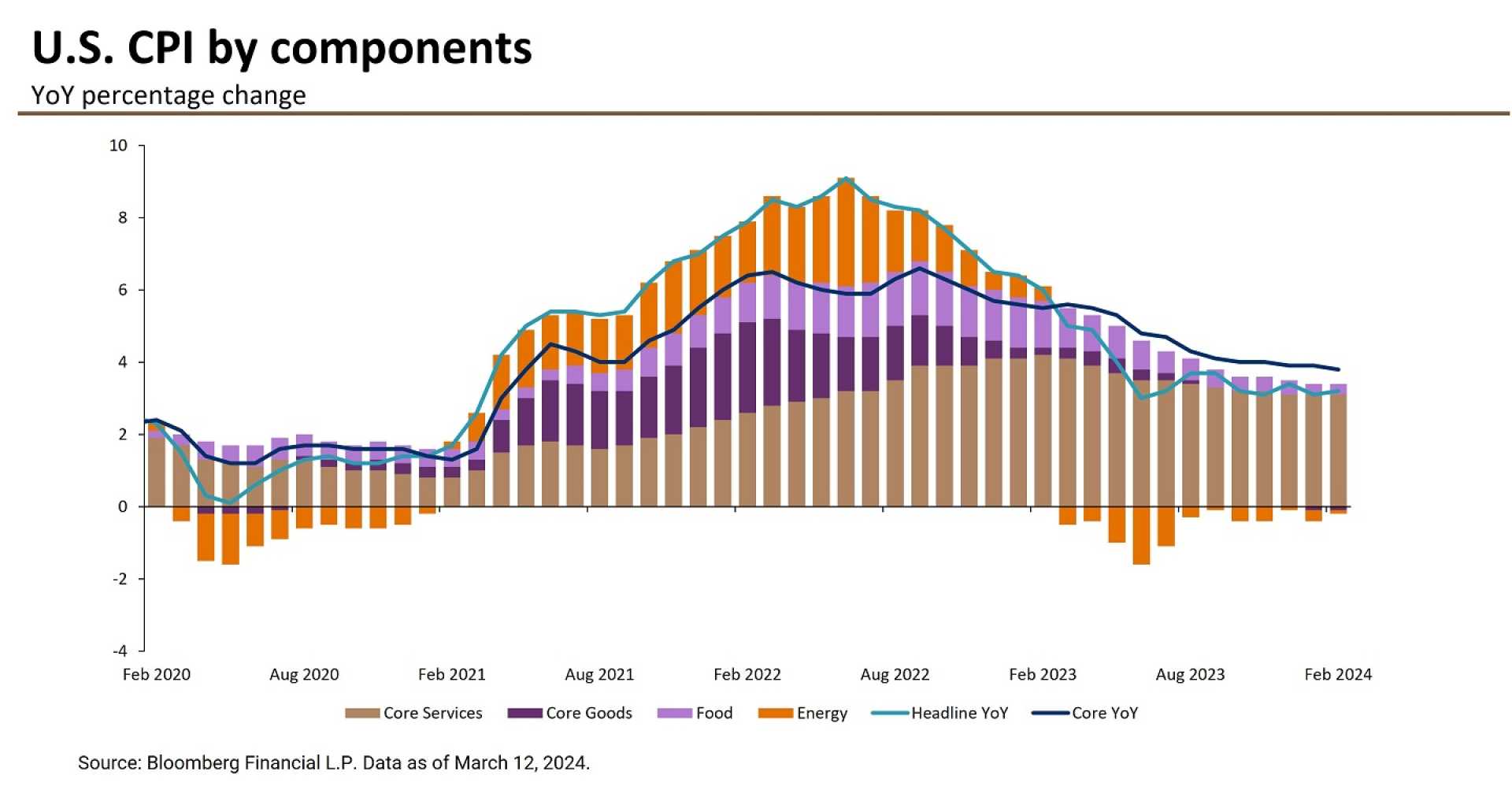

WASHINGTON, D.C. — Consumer prices rose by 2.8% in February compared to a year ago, as reported by the Bureau of Labor Statistics on Wednesday. The increase, a slight moderation from the 3% recorded in January, comes amid ongoing concerns about the impact of tariffs on inflation.

The Consumer Price Index (CPI) adjusted seasonally registered a 0.2% increase for February, lower than economists’ median estimate of a 0.3% rise, signaling a possible plateau in inflation rates. Excluding volatile food and energy prices, the core CPI also climbed by 0.2% on the month, marking a 12-month annual increase of 3.1%, the lowest since April 2021.

“The market’s interpretation is appropriate. We still don’t know how inflation will behave with the new tariff regime,” said Thomas Simons, chief U.S. economist at Jefferies. “At least for now, the momentum is moving in the Fed’s favor.”

Shelter costs, which account for more than one-third of the overall CPI, increased by 0.3%, contributing to roughly half of the monthly CPI uptick. The annual growth in shelter costs at 4.2% was the smallest since December 2021. Moreover, used vehicle prices rose 0.9% while clothing prices increased by 0.6%.

In food prices, some items saw dramatic increases, particularly eggs, which surged by 10.4% last month, making the year-over-year rise reach an astounding 58.8%. The broader food index, encompassing meat, poultry, and fish, grew by 7.7% from the previous year. Conversely, airline fares fell by 4% since January.

Federal Reserve policymakers are closely monitoring inflation trends. Despite the tariff disruptions and uncertainties, officials have indicated that tariffs typically have modest impacts on inflation. However, ongoing trade tensions between the U.S. and other countries could precipitate broader inflationary risks if prices continue to rise.

<p“Today’s CPI report shows inflation is declining and the economy is moving in the right direction under President Trump,” Karoline Leavitt, White House press secretary, said in a statement. “This inflation report is much better than predicted.”

The inflation data comes at a critical moment as the U.S. economy faces internal pressures alongside geopolitical tensions, including President Trump’s newly implemented 25% tariffs on steel and aluminum, provoking retaliation from the European Union.

Kevin Gordon, senior investment strategist at Charles Schwab, emphasized the market’s uncertainty regarding inflation, attributing much of the unrest to tariffs rather than CPI data. “The uncertainties associated with policy are a much stronger force in the market,” he stated.

Going forward, markets expect the Federal Reserve to hold interest rates steady when it meets next week, maintaining its target range between 4.25% and 4.5%. However, analysts suggest that increasingly negative economic growth trends may prompt a shift in policy later this year. The Atlanta Fed‘s GDPNow tracker has recently projected a 2.4% decline for the first quarter, which would be the first negative growth quarter in three years.