Business

Inflation Rises as Fed Prepares for Rate Cuts Amid Economic Concerns

WASHINGTON, D.C. — Key inflation reports are set to be released this week, with early forecasts indicating price increases for August. The Bureau of Labor Statistics will publish data on the producer price index on Wednesday, followed by the consumer price index the next day. Economists predict a monthly rise of 0.3% across these indexes.

The annual consumer price index (CPI) is expected to hit 2.9%, up from 2.7% in July and the highest since January. The increase puts the CPI further away from the Federal Reserve‘s target of 2%. However, core inflation, which excludes volatile food and energy prices, is predicted to remain steady at 3.1%.

James Knightley, chief economist at ING, commented, “While the overall rates are higher than the Fed would like, core inflation’s stability indicates they may still pursue a rate cut.” The inflation uptick is anticipated to stem largely from tariff-sensitive goods rather than services, which make up a larger part of the U.S. economy.

Market analysts view tariffs as one-time price increases that are unlikely to have a lasting impact on inflation. Knightley added, “The U.S. economy is predominantly service-oriented, which softens the impact of these tariff increases on overall inflation.”

Concerns are growing that rising prices could increase pressure on consumers, particularly as wages are not keeping pace with inflation. “When you consider the combined impacts of rising prices, stagnant incomes, and wealth concerns, it creates a toxic environment for economic growth,” Knightley noted.

On the stock market front, shares continued to climb as traders anticipate rate cuts later this month. The technology sector saw mixed results, with major firms such as Broadcom reporting strong earnings while Nvidia faced trimmed targets due to heightened competition.

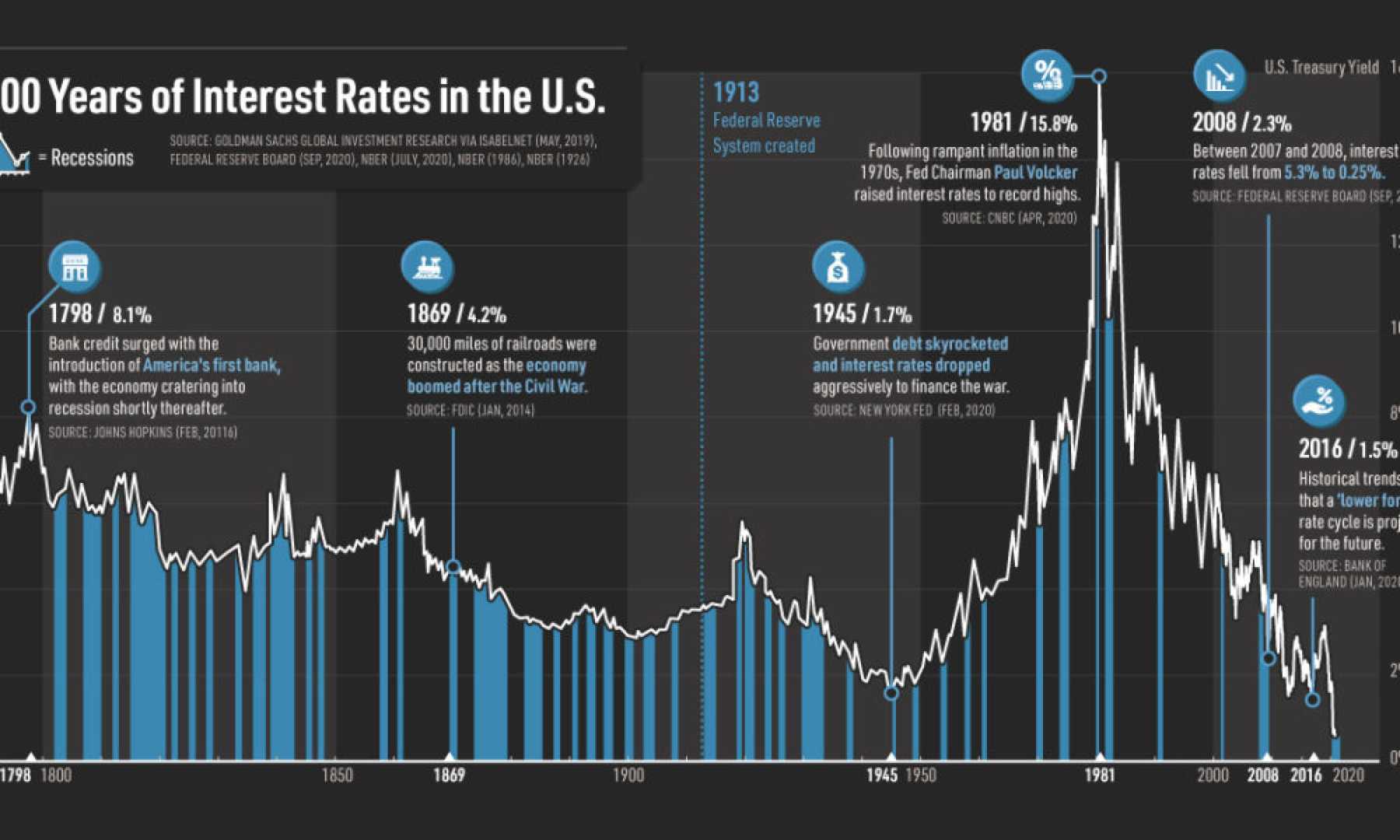

The Federal Reserve’s upcoming meeting is drawing attention, especially as traders now see a 100% likelihood of at least a quarter-point interest rate cut. Recent employment numbers have fueled these expectations, with the market closely watching this week’s inflation data to gauge further policy shifts.

In addition, the yields on 10-year Treasury bonds fell to 4.04%, reflecting declining borrowing costs in anticipation of lower rates. Meanwhile, gold prices hit highs, with futures climbing to $3,680 an ounce.

As inflationary pressures persist, the Fed’s approach in the coming months will be critical as traders anticipate future interest rate cuts.