Business

Intel Earnings Report Set for Major Market Impact This Week

NEW YORK, NY — Intel Corporation is gearing up to report its second-quarter earnings this Thursday, with significant attention from investors and analysts alike. The company has seen its stock rally by 20% since June, driven by hopes for a turnaround under new CEO Lip-Bu Tan.

Despite the rise, analysts caution that Intel’s foundry business may undergo an overhaul that could result in substantial write-offs. Data suggests significant attention on these developments as they could dramatically influence Intel’s future outlook.

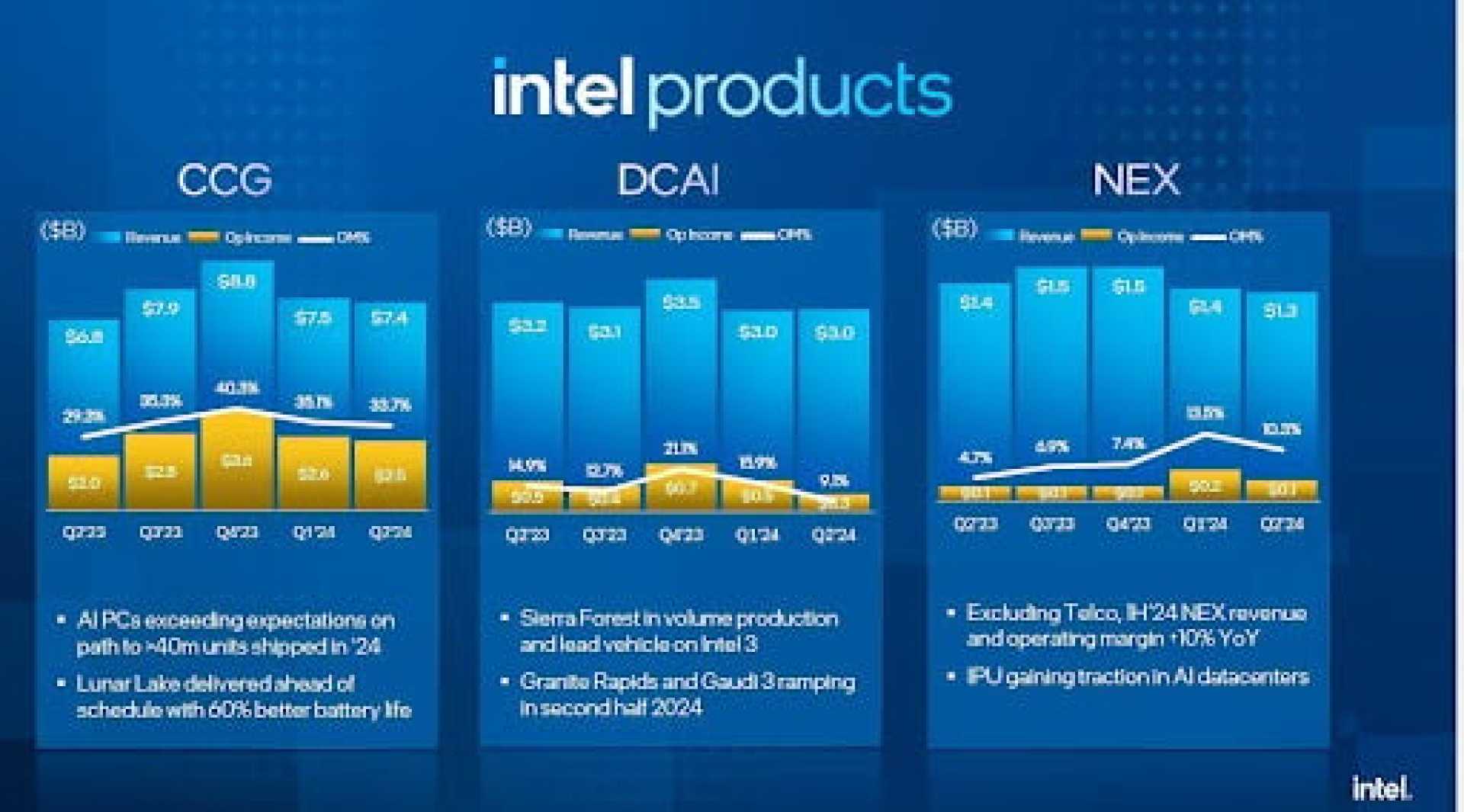

In its upcoming report, Intel anticipates quarterly revenue of $11.93 billion, reflecting a 7% decrease from the same quarter last year. The company is also expected to show adjusted net income of $74.5 million, or 2 cents per share, which is the same as last year’s results. Revenue from the foundry division is projected to fall to about $3.98 billion, a 7% decline.

Stacy Rasgon, an analyst at Bernstein, raised concerns regarding the relevance of these earnings figures due to the potential changes in Intel’s strategy. All 11 analysts monitoring Intel currently hold a “hold” rating, with the average price target around $22, slightly below its latest trading price.

Meanwhile, Intel isn’t the only company making headlines this week. Major American firms including Alphabet and Tesla are also set to release their quarterly reports. Expectations are high, especially as these results may offer insights into broader market sentiment.

Investors are particularly attentive to the tech sector, where volatility has been a theme in recent months. Analysts predict that if leading firms like Alphabet and Tesla perform well, it might bolster other tech stocks, including Intel. Conversely, underwhelming earnings could shift investor focus toward emerging markets.

As the week unfolds, the impact of these earnings reports will be closely monitored by market experts, who are navigating an uncertain economic landscape.