News

Interest Resumes for Student Loan Borrowers in SAVE Program

MINNEAPOLIS, Minn. — Student loan borrowers in the Saving on a Valuable Education (SAVE) program began to see their interest charges resume on August 1, 2025, after a lengthy pause during the pandemic. With this change, about 7.7 million Americans are facing increased monthly payments and growing debt.

Financial experts estimate that the average borrower will incur an additional $3,500 in interest charges annually, equating to roughly $300 monthly. This shift comes amid ongoing restructuring of the nation’s student loan system and follows recent legal actions against Biden-era debt relief programs.

Mark Kantrowitz, a higher education expert, expressed concern about the implications of remaining in the SAVE forbearance. “If they stay in forbearance, it will just dig them into a deeper hole,” he said. Borrowers in the program are not making progress toward loan forgiveness, which is a significant concern for many.

Before the interest pause, borrowers could expect to see their balances increase as they remained in the program, according to a representative from the Minnesota Department of Commerce. About 700,000 residents in Minnesota have student loan debt, with around 85,000 of them in default.

“It’s definitely hit me that my loans are going to be a lot more expensive now,” said Logan Johnson, a University of Minnesota senior. He noted that with the looming payments and interest, his financial uncertainty has grown.

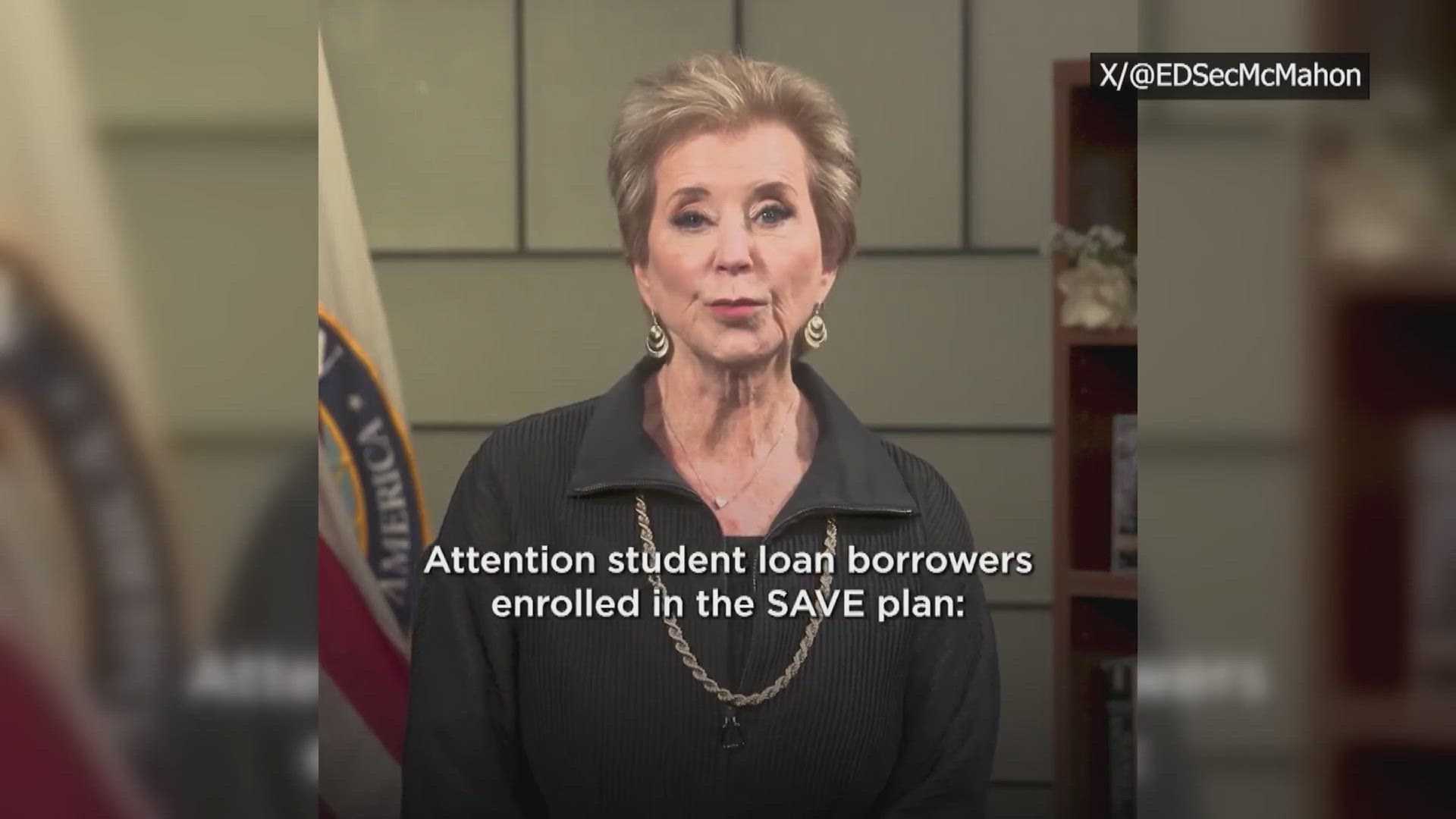

The SAVE plan was introduced by the Biden administration to assist financially strapped borrowers, but has recently faced obstacles. The Trump administration’s new legislation will eliminate the program and enforce stricter repayment options by July 2028.

Experts highlight that borrowers should consider switching to an alternative repayment plan soon. Income-driven repayment (IDR) options, like Income-Based Repayment (IBR), cap monthly payments based on a borrower’s income and can lead to potential loan forgiveness after a certain number of years.

Justin Gandrud, a financial advisor, emphasized the importance of assessing repayment options immediately. “This is a perfect time to analyze your situation,” he said. “If you’re a borrower who qualified for SAVE, you have to see this as a turning point.”

The Department of Education is expected to begin reaching out directly to affected borrowers to help them navigate these transitions. However, many borrowers feel anxious with this increasing financial burden.

As student loan repayments resume, financial literacy experts encourage borrowers to investigate options that best suit their financial circumstances to avoid overwhelming debt.