Business

IRS Announces Increased 401(k) Contribution Limits for 2025

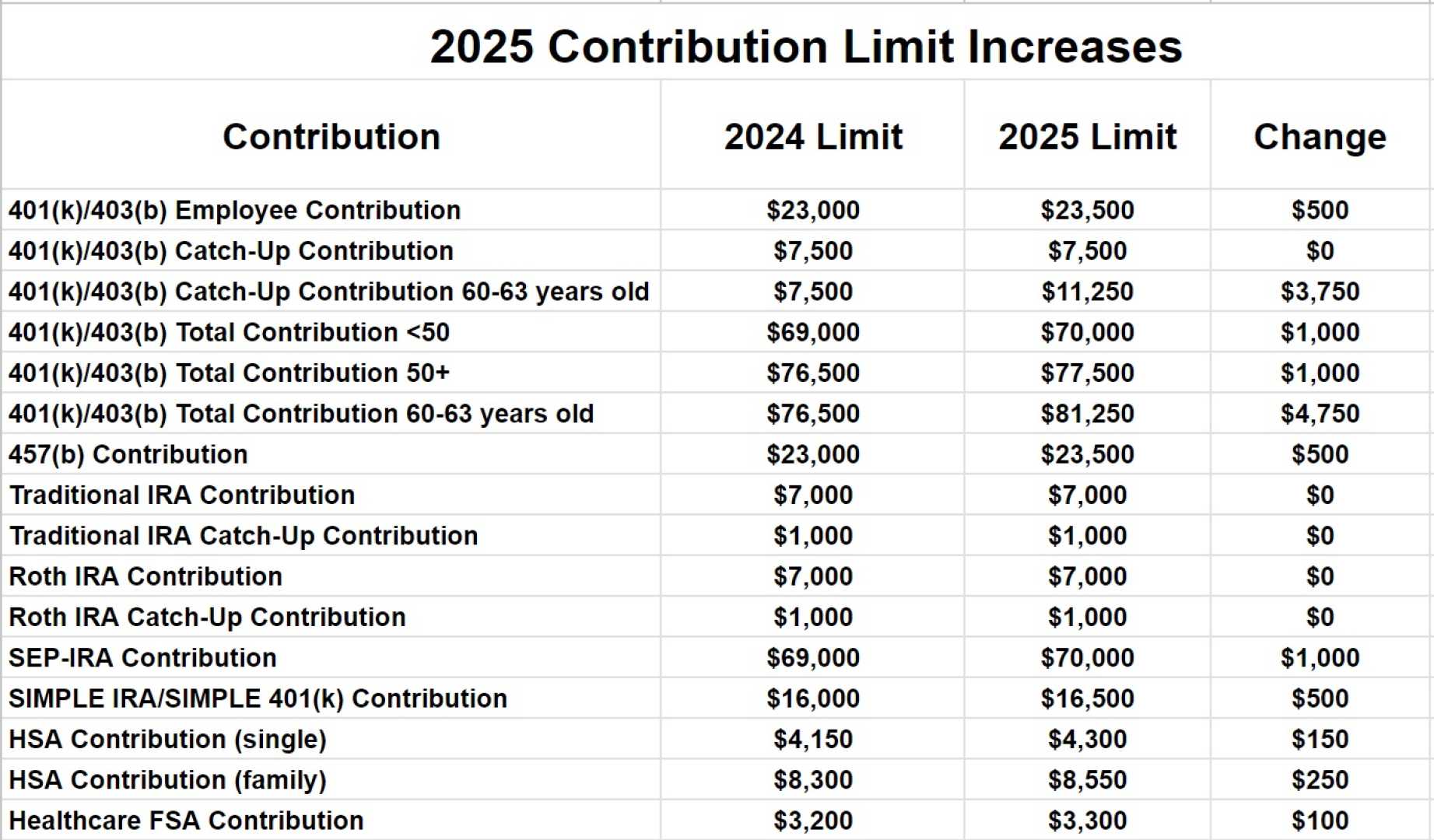

The Internal Revenue Service (IRS) has announced the updated contribution limits for 401(k) and other retirement plans for the year 2025. These changes reflect the latest cost-of-living adjustments and are designed to help workers save more for their retirement.

For 2025, the annual limit on elective deferrals for 401(k), 403(b), and 457 plans has increased to $23,500, up from $23,000 in 2024. This limit includes all elective employee salary deferrals and any contributions made to a designated Roth account within these plans.

Additionally, individuals aged 50 and over are eligible for catch-up contributions. For 2025, the catch-up contribution limit remains at $7,500 for those who are not 60, 61, 62, or 63. However, for those in the 60-63 age range, the catch-up contribution limit has been increased to $11,250, thanks to changes made by the SECURE 2.0 Act.

The total combined limit for employer and employee contributions to 401(k) and other defined contribution plans has also increased. For 2025, this limit is $70,000, up from $69,000 in 2024. When including catch-up contributions, the total limit can reach $77,500 for those 50 and older, or $81,250 for those aged 60, 61, 62, or 63.

The IRS has also increased the annual limit on compensation that can be taken into account for contributions and deductions to $350,000 for 2025, up from $345,000 in 2024. This adjustment affects various types of qualified plans and simplified employee pension plans (SEPs).