News

IRS Refunds Delayed as Tax Season Awaits Millions

Washington, D.C. — As the tax season progresses, thousands of Americans are still waiting for their tax refunds from the Internal Revenue Service (IRS), which typically issues most refunds within 10 to 21 days of filing. The deadline for filing tax returns was April 15, and many taxpayers now look for relief as they await their refunds.

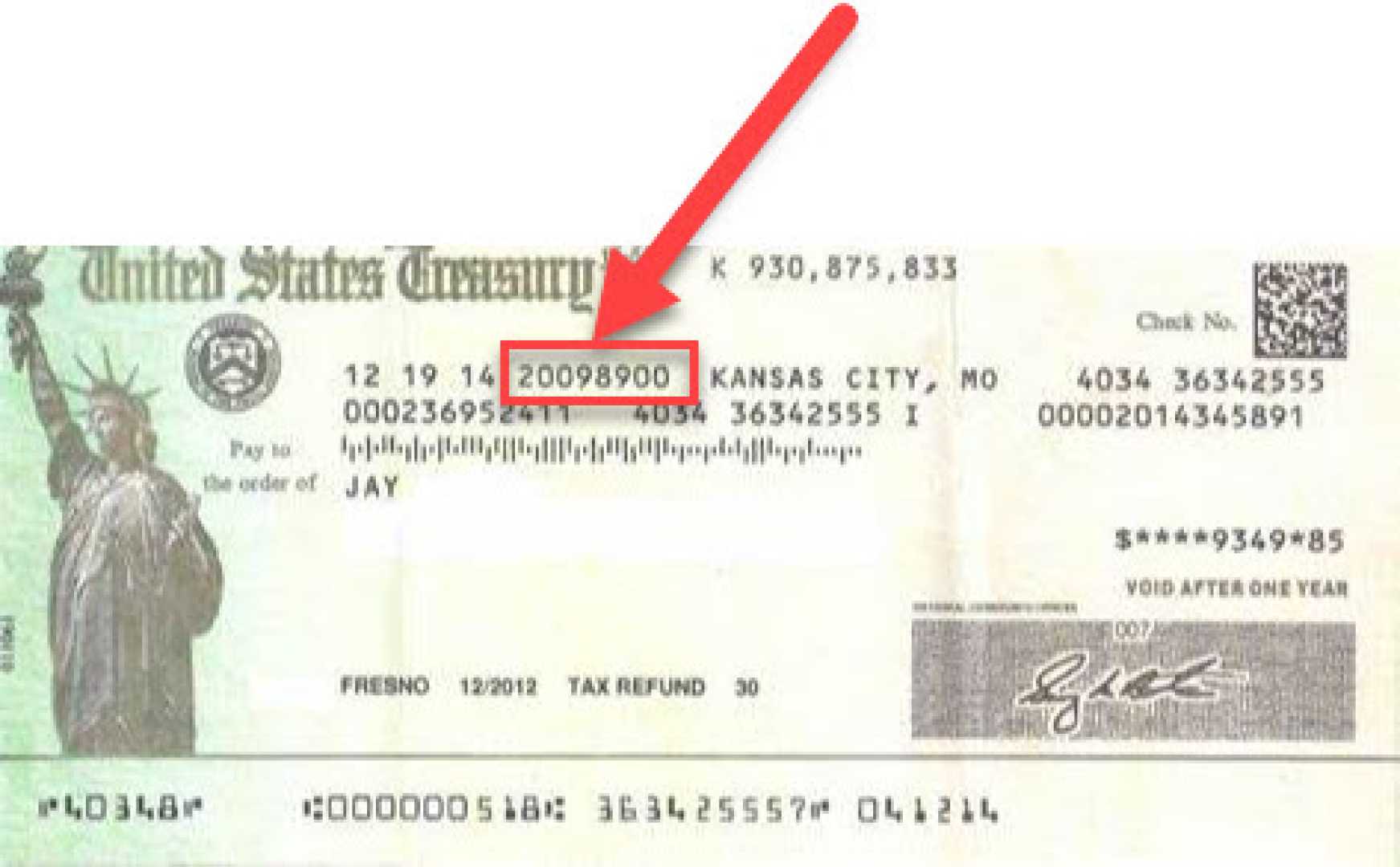

The IRS highlights that various factors influence the timeframe for processing refunds, including the filing date, the method of submission, and any tax credits claimed. Filing electronically tends to expedite the process, with those choosing direct deposit receiving funds faster than those opting for paper checks.

However, delays can occur, especially for individuals who claimed special tax credits like the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC). The IRS employs enhanced verification methods for these credits to combat potential fraud, which can prolong the refund issuance.

As of April 11, approximately 74.9 million refunds had been distributed, totaling about $228.7 billion, which reflects a nearly 4% increase from 2024. The average refund amount this year reached $3,055, a rise from $2,948 in the previous year, according to data from the IRS.

Taxpayers who submitted their electronic returns between April 14 and 20 and selected direct deposit should expect to see their refunds between May 5 and May 11. For those who filed in late March and opted for a paper check, funds are expected to arrive by May 5, 2025.

Taxpayers can track their refund status using the “Where’s My Refund?” tool on the IRS website, which provides updates approximately 24 hours after e-filing. Those expecting checks may need to wait several weeks based on mailing times.

As taxpayers continue to navigate the delays, the IRS urges individuals to ensure all required information is accurate and to respond promptly to any requests for identity verification to avoid additional holdups.