Business

Klarna Raises $1.37 Billion in U.S. IPO, Valuation Drops Significantly

NEW YORK, NY — Buy-now, pay-later lender Klarna announced on Tuesday it has raised $1.37 billion in its U.S. initial public offering (IPO). The IPO paves the way for a market entry that may influence future high-growth fintech listings.

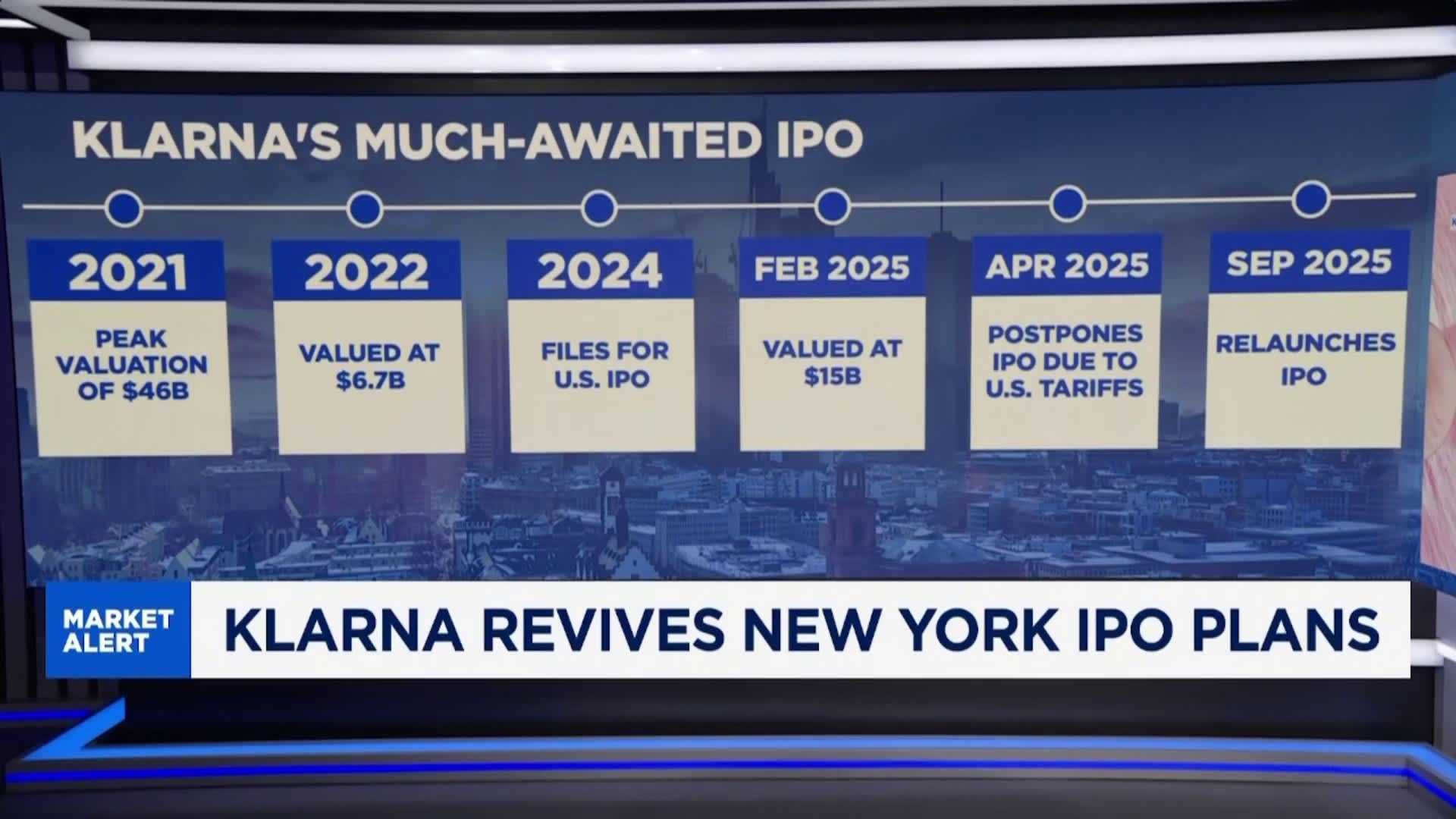

The Swedish company, backed by Sequoia Capital, sold 34.3 million shares at $40 each, exceeding its targeted price range of $35 to $37. According to reports, the IPO values Klarna at $15.11 billion, considerably lower than the more than $45 billion valuation it reached in 2021.

Klarna’s valuation fell to $6.7 billion in 2022 due to rising interest rates and inflation, which also impacted its financial performance. The offering was oversubscribed by 25 times, indicating strong investor interest in the company.

The firm, which has long planned a New York listing, had previously paused its efforts in April when escalating U.S. tariffs created volatility in global markets. Founded in 2005, Klarna had been profitable until its U.S. expansion in 2019, just before the online shopping surge driven by the COVID-19 pandemic.

While the company reports a growing user base and increased gross merchandise value, it continues to struggle with profitability. Losses swelled to $52 million for the quarter ending June 30, up from $7 million a year earlier, even though revenue climbed to $823 million from $682 million.

Rudy Yang, a senior analyst at PitchBook, commented, “While the market is open again to fintech listings, companies will be judged quickly on their ability to balance growth with profitability in a tougher macro backdrop.”

Klarna operates as a digital-first neobank. Its peer, Chime, saw a 59% rise in its Nasdaq debut in June, but trades below the original issue price as of the last close. Analysts believe Klarna’s strong brand recognition may enhance its competitive positioning in the fintech space.

Kat Liu, vice president at IPO research firm IPOX, noted, “The sector is highly competitive and rapidly evolving, and brand recognition, where Klarna remains strong, is often as critical as the business model.”

Despite challenging economic conditions, U.S. consumer spending has remained resilient. Alternative payment services like Klarna, which allow customers to divide payments into interest-free installments, continue to see stable demand. For the year ending June 30, transaction and service-based fees contributed to 75% of Klarna’s revenue, the lowest share since 2022, while interest income rose to 25%.

<p“Since Klarna’s BNPL model depends on both transaction volume and repayment rates, lower spending may reduce merchant fee capture while raising the risk of credit losses,” Liu said.

Klarna will start trading on the New York Stock Exchange under the ticker symbol “KLAR” on Wednesday.