Business

Kraft Heinz Faces Challenges Amid High Dividend Yield

CHICAGO, IL — Kraft Heinz Company, a major player in the packaged food industry, is navigating challenging financial waters amidst a dividend yield of 5.3%. The yield, which surpasses many high-yield savings accounts and 10-year Treasury bonds, raises questions about the sustainability of the company’s payouts, especially as net sales and growth remain stagnant.

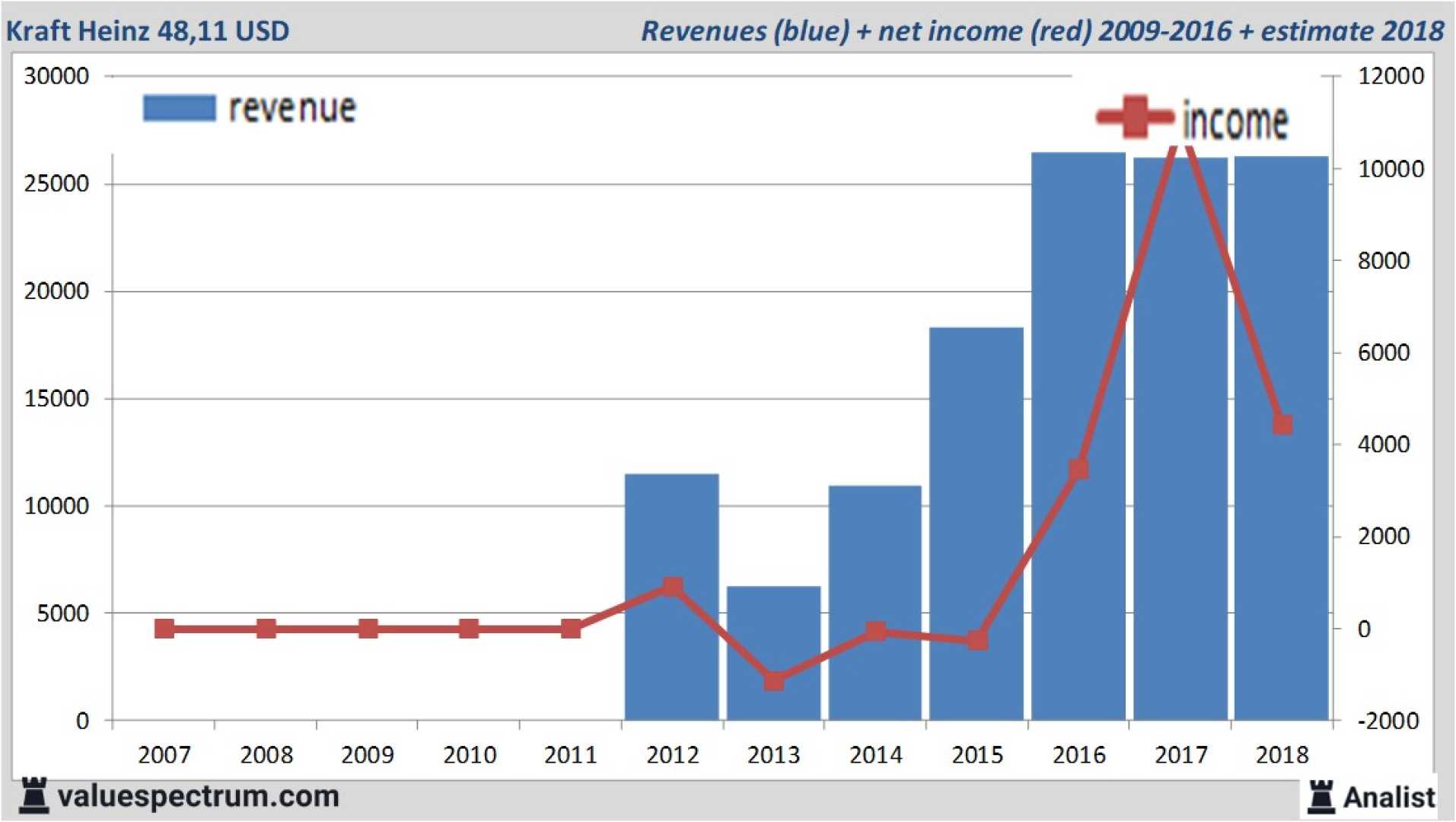

The company’s performance has shown mixed results as its net sales declined by 3% in 2024 while adjusted operating income rose by 1.2% and adjusted earnings per share (EPS) increased by 2.7%. Notably, free cash flow (FCF) stood out with a 6.6% year-over-year increase, providing Kraft with $3.2 billion that was primarily used for dividends and share repurchases.

Despite this substantial FCF, guidance for the upcoming year indicates organic sales may dip by 2.5%, with adjusted EPS expected to fall by 12.3% at the midpoint. “While the guidance isn’t encouraging, Kraft continues to generate sufficient FCF to support its dividend,” said a financial analyst familiar with the company’s operations. “Having flat dividends allows room to manage liquidity more effectively.”

Investors are understandably cautious since Kraft slashed its quarterly payout from $0.625 to $0.40 per share back in 2019, a move considered necessary then given the company’s performance. Since that cut, the payout has remained unchanged for 25 quarters—a sign that raising the dividend has not been feasible amidst sustained underperformance. As the stock price drops, the dividend yield appears more attractive, potentially tempting investors, but concerns linger regarding another possible reduction.

Charts indicate that Kraft’s stock price significantly fell since the dividend cut, although the lower payout was essential for affordability. Additionally, Kraft’s balance sheet shows improvement: its long-term debt is reduced, and its leverage ratios, such as financial debt-to-equity and debt-to-capital, have also fallen. The company holds investment-grade credit ratings—BBB from S&P Global and Fitch Ratings, and Baa2 from Moody's—though these ratings are on the lower end of the scale.

Kraft’s sturdy FCF and improved balance sheet offer a buffer to maintain its dividend, even with pressures from tariffs and fluctuating consumer demand. Investor sentiment remains cautious, as experts advise selecting companies capable of thriving even in adverse conditions.

As Kraft’s operational hurdles continue, the company faces the greater challenge of maintaining market share in an evolving culinary landscape. Competing with brands like PepsiCo, which has successfully diversified its product offerings and tapped into trends favoring healthy snacks and convenient meal options, will be critical for Kraft’s long-term strategy.

While Kraft Heinz’s dividend looks stable, investors may need a long-term perspective concerning the company’s growth. Current stock valuations appear attractive with a price-to-earnings ratio of just 13.4 and a price-to-FCF ratio of 12.2, suggesting Kraft can be viewed as a solid value investment for those looking to increase their passive income.

As investment analysts survey the market, they stress the importance of acting before opportunities have passed, with top recommendations for companies poised for significant gains in the near future.