Business

KRN Heat Exchanger IPO Set to Raise Rs 341.95 Crores

The Initial Public Offering (IPO) of KRN Heat Exchanger and Refrigeration Limited is scheduled to open with a book-built offer amounting to Rs 341.95 crore. The company plans to issue 1.55 crore shares in this public offering.

Investors can subscribe to the shares between September 25 and September 27, 2024. The allotment of shares is anticipated to occur on September 30, 2024, with the listing expected on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) on October 3, 2024.

The IPO price range has been set from Rs 209 to Rs 220 per share, with a minimum application size of 65 shares. Retail investors need to invest at least Rs 14,300, while the minimum investment for small non-institutional investors is 14 lots or 910 shares, amounting to Rs 2,00,200. Big non-institutional investors are required to invest in 70 lots or 4,550 shares, equating to Rs 10,01,000.

The IPO’s lead management is being handled by Holani Consultants Private Limited, with Bigshare Services Pvt Ltd appointed as the registrar.

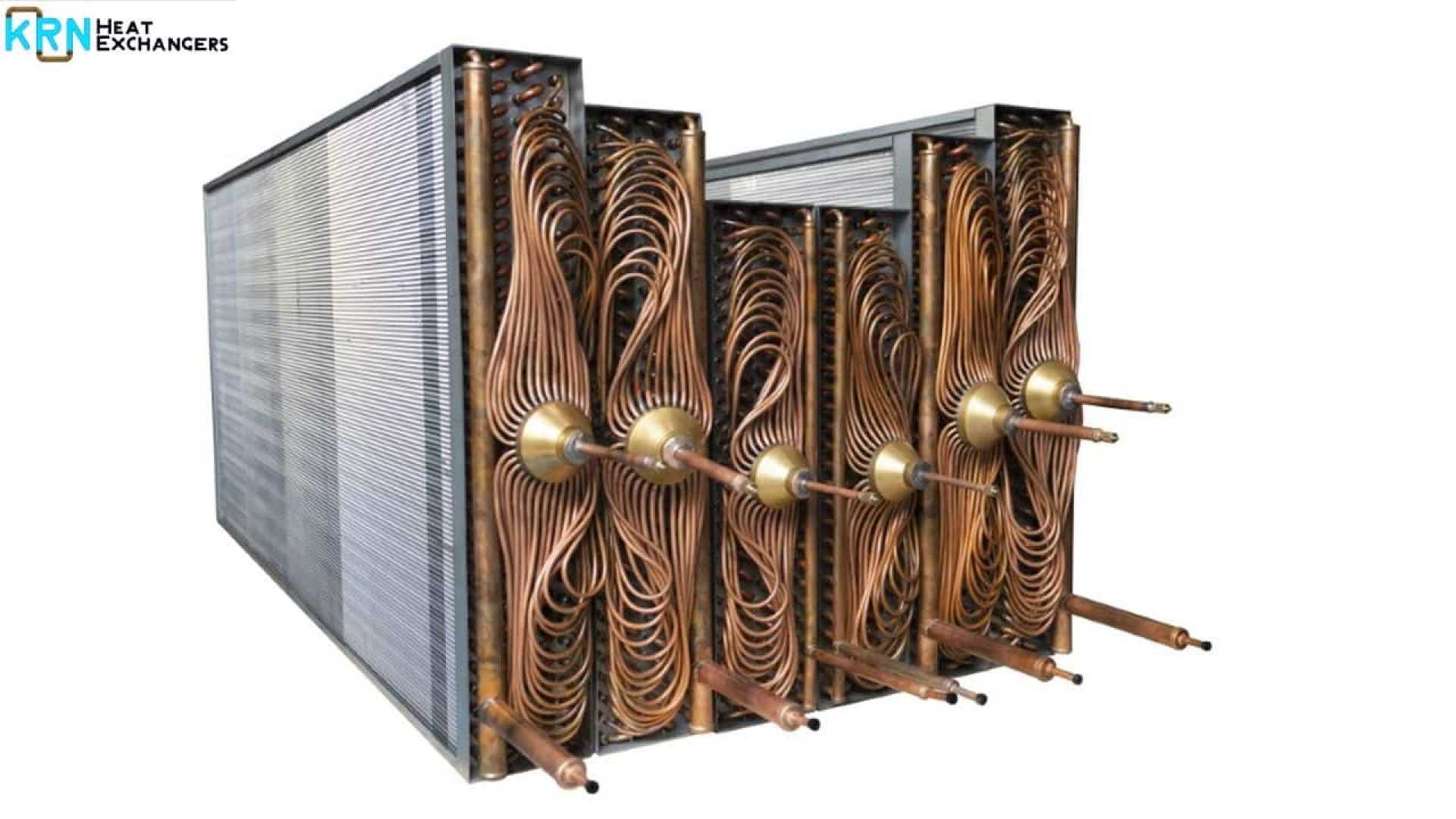

KRN Heat Exchanger specializes in the manufacturing of tube-type heat exchangers, focusing on copper and aluminum fins, heat exchangers, water coils, condenser coils, and evaporator coils. The firm produces heat exchanger tubes in diameters ranging from 5 mm to 15.88 mm, catering to domestic, commercial, and industrial applications.

The company collaborates with prominent clients such as Daikin Airconditioning India Pvt Ltd, Schneider Electric IT Business India Pvt Ltd, Kirloskar Chillers Private Ltd, Blue Star Ltd, Climaventa Climate Technologies Pvt Ltd, and Frigel Intelligent Cooling Systems India Pvt Ltd. It also exports its products to several countries, including the UAE, USA, Italy, Saudi Arabia, Norway, the Czech Republic, Germany, and the UK.

The KRN Heat Exchanger and Refrigeration Ltd operates a state-of-the-art manufacturing facility in Neemrana, Rajasthan, encompassing 7,800 square meters.

The company’s financials reveal significant growth, with business operation income increasing from Rs 15,611.46 lakh in fiscal 2021-22 to Rs 24,748.08 lakh in 2022-23, marking over 58% growth year-on-year. The revenue continues to rise, reaching Rs 30,828.31 lakh in fiscal 2023-24, a 24% year-on-year increase.

Despite its growth, the company faces some risks, primarily due to its dependency on top customers, which could affect its financial and operational stability if there’s a delay or cancellation of orders. Furthermore, KRN Heat Exchanger is reliant on a limited number of raw material suppliers, and any disturbance in supply could impact its operations.

According to the company’s Red Herring Prospectus, the IPO proceeds will be used to establish a new manufacturing facility for its wholly-owned subsidiary, KRN HVAC Products Pvt Ltd, and for general corporate purposes. The IPO is tagged as a mainline IPO and will be spearheaded by Mr. Santosh Kumar, the founder and managing director of the company.