Health

Medicare Part B Premiums to Rise in 2025: Here’s What You Need to Know

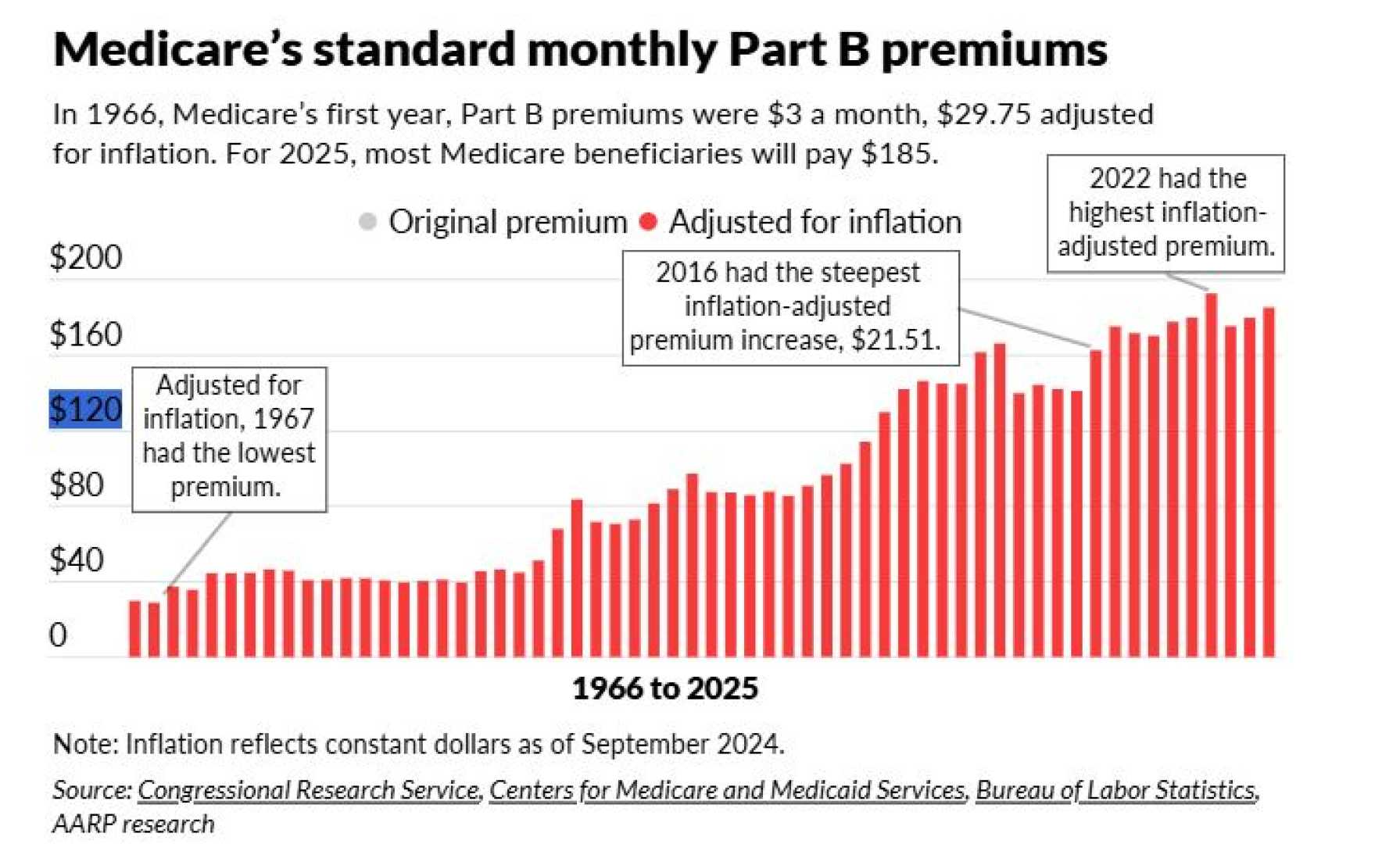

The Centers for Medicare and Medicaid Services (CMS) has announced significant changes to Medicare premiums for 2025, particularly affecting Part B beneficiaries. The standard monthly premium for Medicare Part B will increase to $185.00 in 2025, a rise of $10.30 from the 2024 premium of $174.70. This represents a roughly 6% increase.

The annual deductible for Medicare Part B will also see an increase, rising from $240 in 2024 to $257 in 2025, an increase of $17. These adjustments are primarily due to projected price changes and assumed utilization increases consistent with historical trends.

Higher-income Medicare beneficiaries will face additional costs through the Income-Related Monthly Adjustment Amount (IRMAA). For individuals with incomes between $106,001 and $394,000, the monthly premium will be $406.90 plus the standard $185.00, totaling $591.90. Those with incomes exceeding $394,000 will pay $443.90 in IRMAA plus the standard premium, resulting in a total of $628.90 per month.

For individuals who need immunosuppressive drug coverage after a kidney transplant, the premium will be $110.40 in 2025.

These premium increases will be automatically deducted from Social Security checks for beneficiaries who are already receiving Social Security benefits. Those not yet receiving Social Security benefits but paying for Medicare Part B will need to ensure they are paying the increased amount starting in January 2025.

In addition to Part B changes, Medicare Part A costs are also increasing. The inpatient hospital deductible for Part A will rise to $1,676 in 2025, up $44 from 2024. Coinsurance rates for extended hospital stays and skilled nursing facilities will also increase slightly.

Medicare Part D, which covers prescription drugs, will see changes as well. While the average monthly premium for a stand-alone Part D plan is projected to decrease to $40 in 2025, high-income beneficiaries will still face income-related adjustments. A significant change for Part D is the introduction of a $2,000 out-of-pocket cap on prescription drugs, expected to benefit nearly 3.2 million Americans.