Business

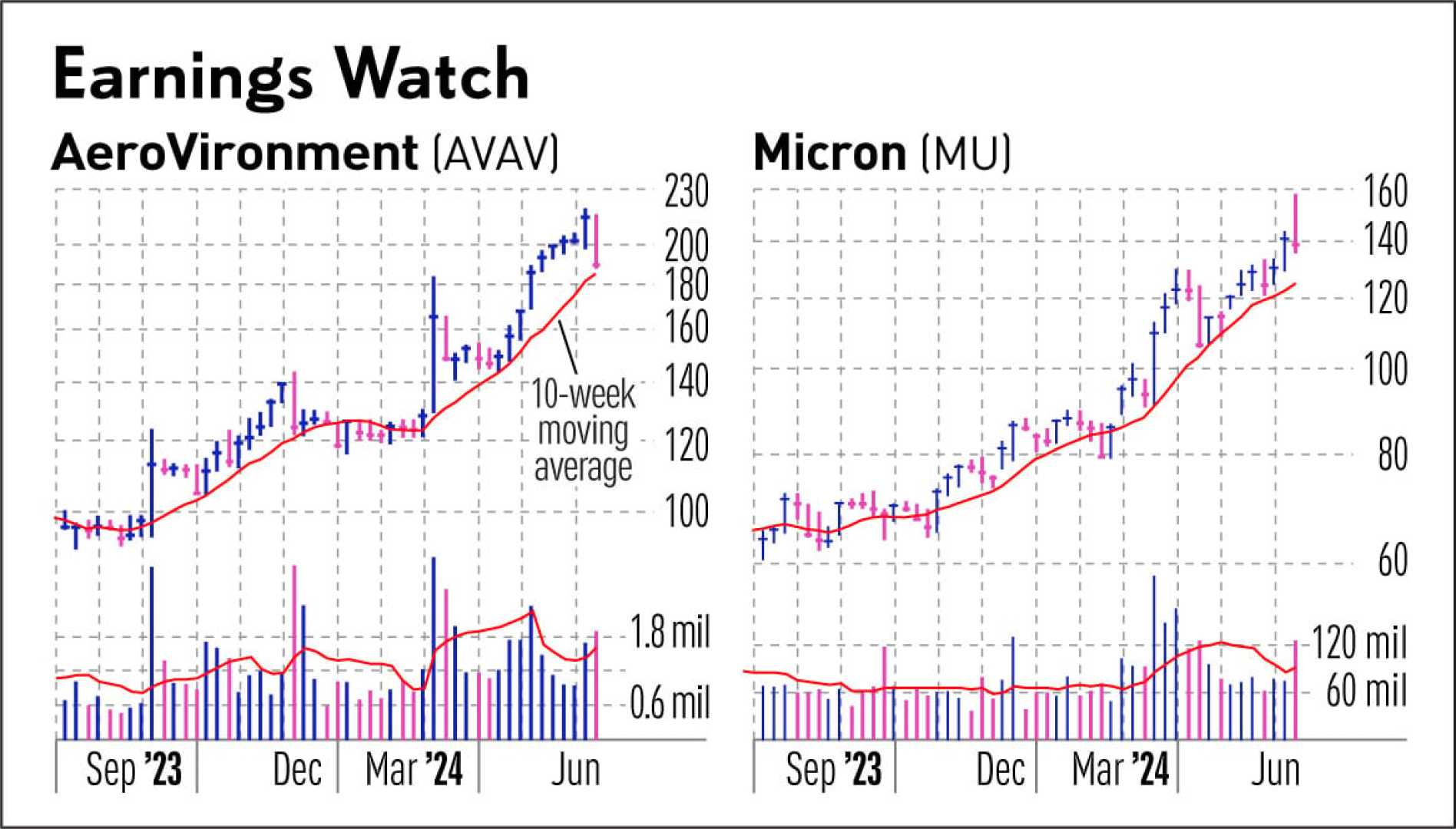

Micron Technology Stock Surges Amid AI-Driven Growth Prospects

Micron Technology Inc., a leading provider of innovative memory and storage solutions, has seen its stock gain significant attention in recent days due to its strong position in the burgeoning artificial intelligence (AI) market. The company, which operates through segments such as Compute & Networking Business Unit, Mobile Business Unit, Storage Business Unit, and Embedded Business Unit, is poised to benefit from the rising demand for AI servers and related technologies.

Analysts have highlighted Micron Technology as one of the key beneficiaries of the AI industry, which is projected to become a $187 billion market in 2024. This growth is driven by the increasing need for advanced memory and storage solutions in AI servers, cloud computing, and other high-performance applications. As a result, investors are looking at Micron as a potential alternative to other tech giants like Nvidia, given its lower valuation and promising growth prospects.

In its latest earnings report, Micron Technology delivered a beat-and-raise quarter, which has further boosted investor confidence. The company’s ability to outperform expectations and raise its guidance has been seen as a positive indicator of its future performance. This strong financial performance, coupled with the tailwinds from the AI sector, suggests that Micron’s stock could continue to see upward momentum in the coming year.

However, market volatility and ongoing tech tensions between the U.S. and China could potentially impact Micron’s stock price. Despite these challenges, the company’s diversified product portfolio and strategic positioning in key markets make it an attractive option for investors looking to capitalize on the AI boom).