Business

Mortgage Interest Rates See Mixed Movements Ahead of Fed Meeting on November 7, 2024

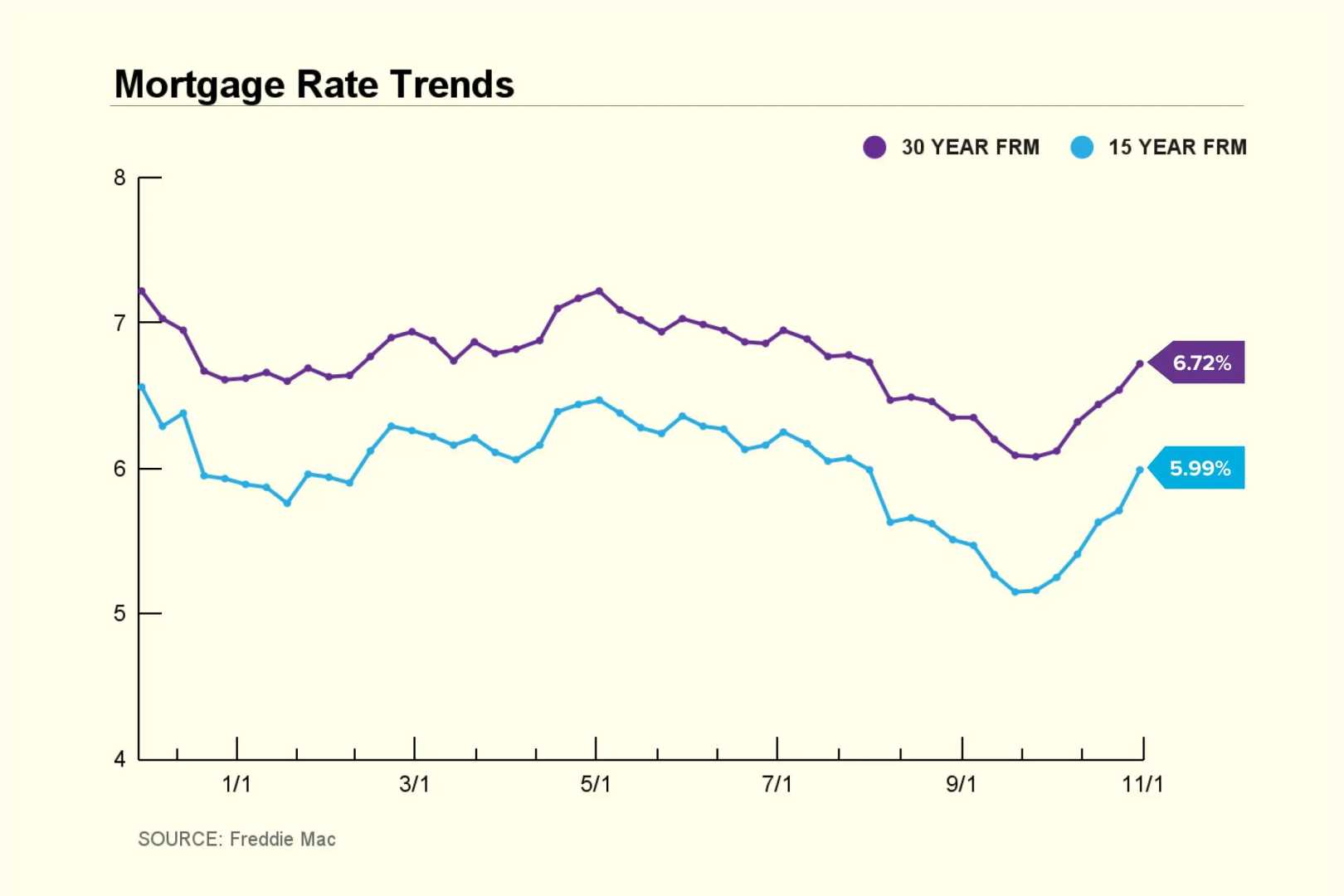

As of November 7, 2024, mortgage interest rates have exhibited mixed movements, with some rates increasing and others decreasing slightly. The average rate for a 30-year fixed mortgage has risen to 6.89%, an increase of 0.01% from the previous week.

The 15-year fixed mortgage rate, however, has seen a slight decrease, dropping to 6.13%, a reduction of 0.01% from last week. This contrasts with the 5/1 adjustable-rate mortgage (ARM), which has increased to 6.20%, a rise of 0.06% over the same period.

Jumbo loan rates have also increased, with the 30-year fixed jumbo mortgage rate now at 6.86%, up 0.05% from the previous week. Refinance rates have followed a similar trend, with the 30-year fixed refinance rate rising to 6.93%, an increase of 0.03% over the last seven days.

The Federal Reserve‘s decision on interest rates, announced later in the day, is expected to have a significant impact on mortgage rates. Despite the current increases, experts remain optimistic about the long-term outlook, suggesting that rates may ease down in 2024.

Economic indicators, such as the yield on 10-year Treasury notes, which decreased to 4.359% from 4.461%, are seen as favorable for mortgage rates. Additionally, initial jobless claims and the U.S. productivity report have put downward pressure on interest rates, although these effects are temporary and subject to the broader economic and policy landscape.