Business

Mortgage Rates Dip Ahead of Fed’s Next Meeting, Prospects Remain Uncertain

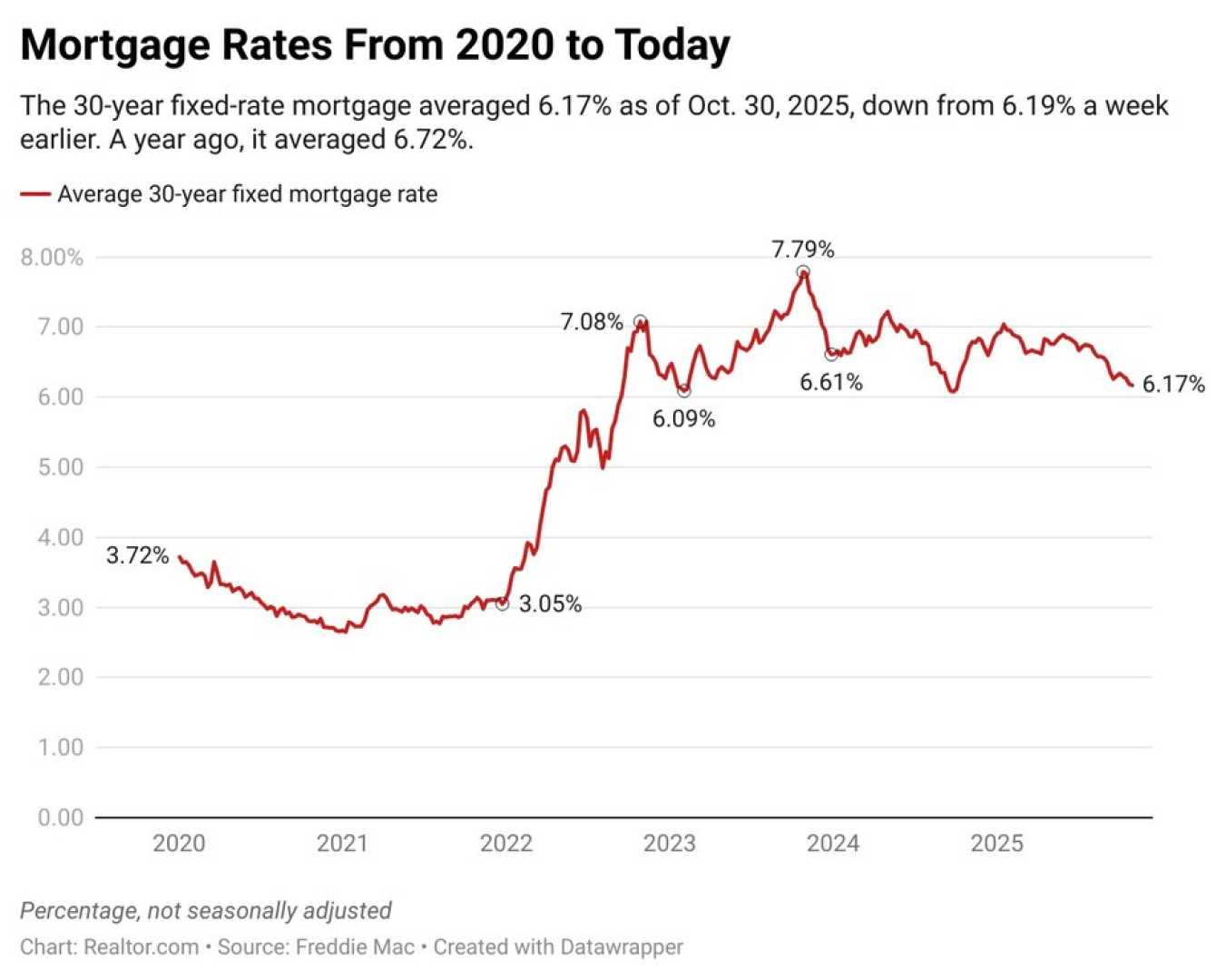

WASHINGTON, D.C. — The average rate for a 30-year fixed mortgage decreased to 6.17% as of October 30, 2025, marking a drop from the previous week, according to Freddie Mac. As potential buyers weigh their options, market experts advise caution.

Despite drops in rates, uncertainty looms as the Federal Reserve continues to navigate inflation and changing economic conditions. Many expected mortgage rates to decline further following recent Fed rate cuts, but they have fluctuated between 6% and 7% over recent months.

“Mortgage rates have fallen notably in recent months, but rising inflation and a cooling labor market may impact future fluctuations,” said Kara Ng, senior economist at Zillow Home Loans.

Refinancing remains a popular option for homeowners seeking to lower their monthly payments, particularly if their current rate exceeds the market average by at least 0.5%. Data shows that 82.8% of current homeowners hold mortgages with rates below 6%, keeping many locked into their loans.

The Federal Reserve recently cut the federal funds rate by a quarter-point, a move that generally influences mortgage rates. However, Robert Broeksmit, CEO of the Mortgage Bankers Association, noted that many lenders had already adjusted their rates in anticipation of such changes.

In recent weeks, some lenders have reported an increase in refinance applications, with a 9% jump in the refinance index noted in the Mortgage Bankers Association’s latest report.

“Refinancing can help borrowers save money or tap into home equity, but it’s vital to shop around to get the best deals,” said Odeta Kushi, an economist and real estate expert.

Current trends also indicate that rates may drop slightly further as more economic data is anticipated from the government. However, experts suggest potential homebuyers and existing homeowners consider locking in rates now, especially with projections indicating we may not return to pandemic-era lows of 2% or 3%.

With the incoming weeks pivotal for market trends, borrowers are encouraged to stay informed and prepared to act. The overall sentiment remains that while lower rates may appear, consistent volatility could frustrate discerning buyers.