Business

Mortgage Rates Dip Amid U.S. Economic Uncertainty

LOS ANGELES, CA — The average 30-year fixed-rate mortgage (FRM) has dipped to 6.81% as of June 20, 2025, marking a slight decrease as the housing market navigates uncertain economic conditions.

The steady decline in mortgage rates comes after comments from Federal Reserve Vice Chair Bowman on potential rate cuts during the July meeting. This follows similar sentiments expressed by Fed’s Waller the previous week. Market expectations about rate cuts can influence bond markets, which directly affect mortgage rates.

Data from mortgage data company Optimal Blue shows that the average 15-year FRM has also declined to 5.96%. These shifts provide a glimmer of hope for homebuyers as they navigate a market characterized by rising property values and economic fluctuations.

Sam Khater, chief economist at Freddie Mac, noted, “Mortgage rates moved lower, with the average 30-year fixed rate reaching a four-week low.” He believes more available inventory and lower mortgage rates might encourage potential homebuyers to re-enter the market.

Despite these positive changes, the backdrop remains complex with high inflation and concerns over economic stability. Many experts predict a volatile period ahead, particularly if inflation rises or global events disrupt the market.

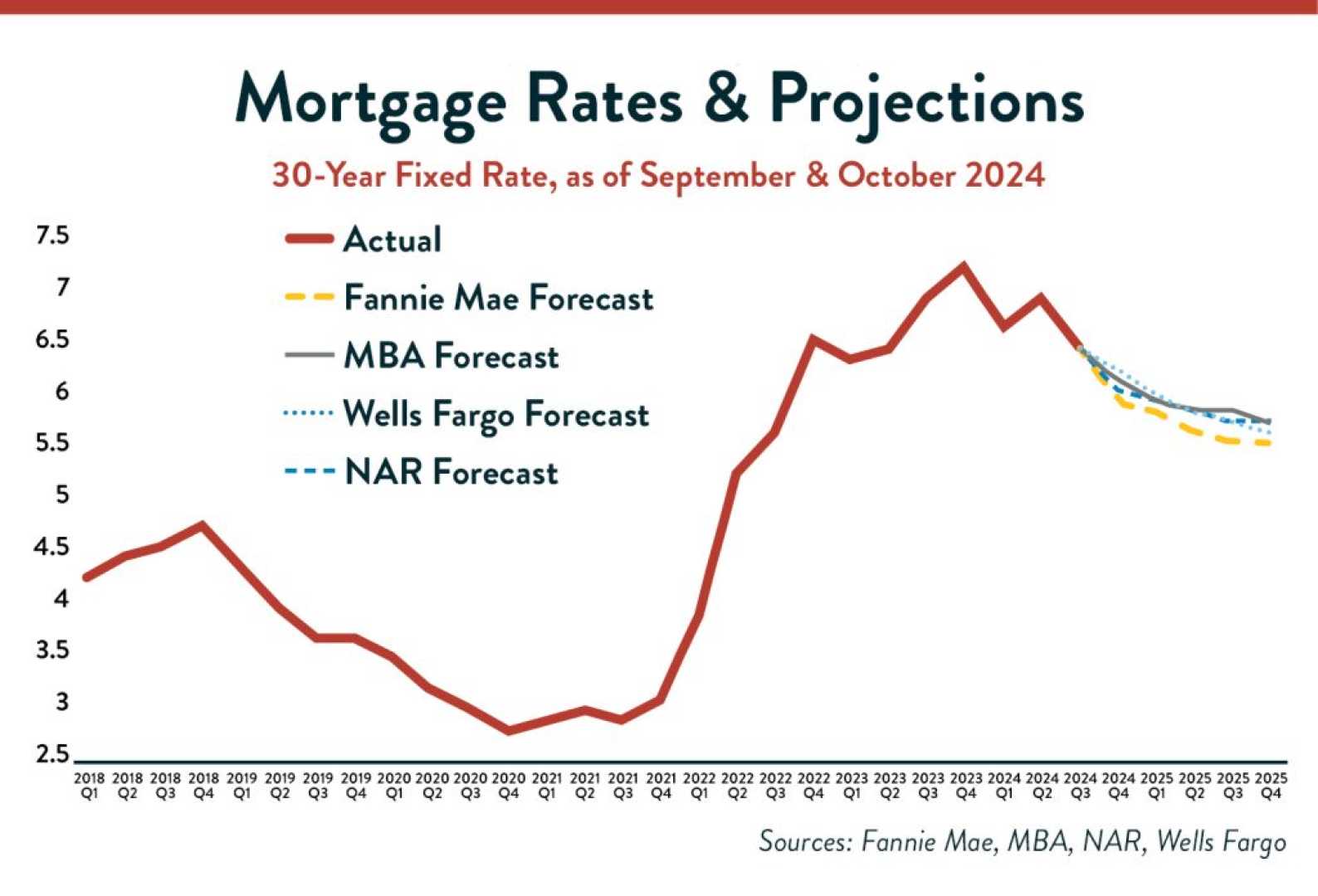

The outlook for mortgage rates remains mixed. Some analysts expect further decreases later in summer 2025 if current inflation trends continue. Conversely, if U.S. debt and deficit concerns worsen, rates may increase.

As economic conditions remain unpredictable, homebuyers are advised to shop around for the best mortgage rates and consider different loan options. The right financial strategy will depend on individual circumstances and the evolving market landscape.