Business

Mortgage Rates Surge Ahead of Election and Fed Decisions

Mortgage rates have seen a significant increase in the first week of November, impacting potential homebuyers and those looking to refinance. As of November 5, 2024, national mortgage rates have risen across all loan terms compared to the previous week. The average rate for a 30-year fixed mortgage has jumped to 6.93%, an increase of 7 basis points from the previous week and up from 6.46% a month ago.

The 15-year fixed mortgage rate also saw an increase, rising to 6.20%, a 3 basis point hike from the previous week. The 5/1 adjustable-rate mortgage (ARM) averaged 6.39%, adding 8 basis points since the same time last week. Jumbo mortgage rates followed a similar trend, with the average 30-year fixed jumbo mortgage rate increasing to 6.98%, up 12 basis points from the previous week.

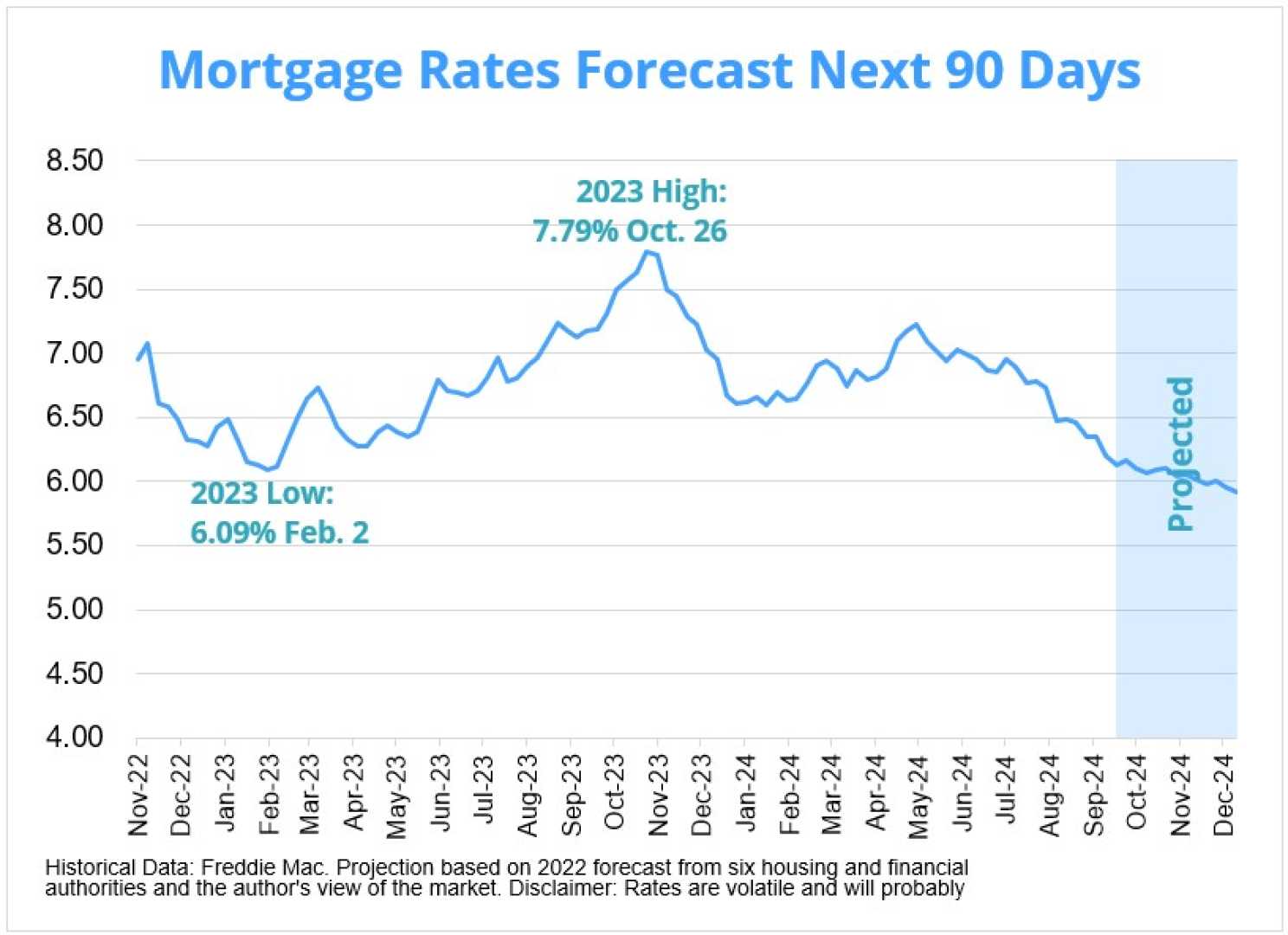

These rate increases are partly attributed to economic indicators and the anticipation of Federal Reserve decisions. Despite the Fed’s recent rate cut in September, mortgage rates have continued to rise. The Fed is expected to meet soon, and there is a strong consensus that another rate cut could occur, potentially stabilizing or reducing mortgage rates in the near future.

The impact of these rate changes is significant for borrowers. For example, at the current average rate, a $100,000 loan on a 30-year fixed mortgage would result in a monthly payment of $660.61 in principal and interest, an increase of $4.68 per $100,000 compared to last week.

Experts suggest that while mortgage rates may experience short-term volatility due to election results and Fed decisions, there could be more clarity and potentially lower rates in the coming months if the Fed continues its rate-cutting path.