Business

Netflix Announces 10-for-1 Stock Split to Enhance Accessibility

LOS GATOS, Calif. — Streaming giant Netflix has announced a 10-for-1 stock split following a remarkable rally that saw shares surpass $1,000 for the first time in February 2025. The split is set to take effect on November 17.

The decision was made after the close of trading on November 14, as shareholders on record as of November 10 will receive nine additional shares for every share they currently own. This move comes as Netflix ranked as the 12th-highest-priced stock in the market.

Morningstar senior analyst, who spoke on the condition of anonymity, indicated that Netflix’s strong brand appeal makes the stock attractive to individual investors. However, he noted that the high price has likely resulted in an institutional skew among shareholders. ‘I’d guess that the high dollar price of the stock has led to a greater institutional skew than it would be otherwise,’ he said.

In light of the stock split, Netflix shares will drop from around $1,100 per share to approximately $110. This increase in the number of outstanding shares does not change the company’s overall value, but it makes individual shares more accessible, potentially improving liquidity and attracting more buyers.

Dolgin, another analyst, emphasized that the split would not impact Netflix’s fundamentals. ‘I’d expect the split would apply upward pressure to the stock because it will become more accessible to retail buyers,’ he said, adding that it could result in increased demand.

Despite the positive outlook, Dolgin cautioned that ‘none of this will supersede fundamentals as news and results occur, and we still believe the stock is fundamentally overvalued and should ultimately trade lower.’

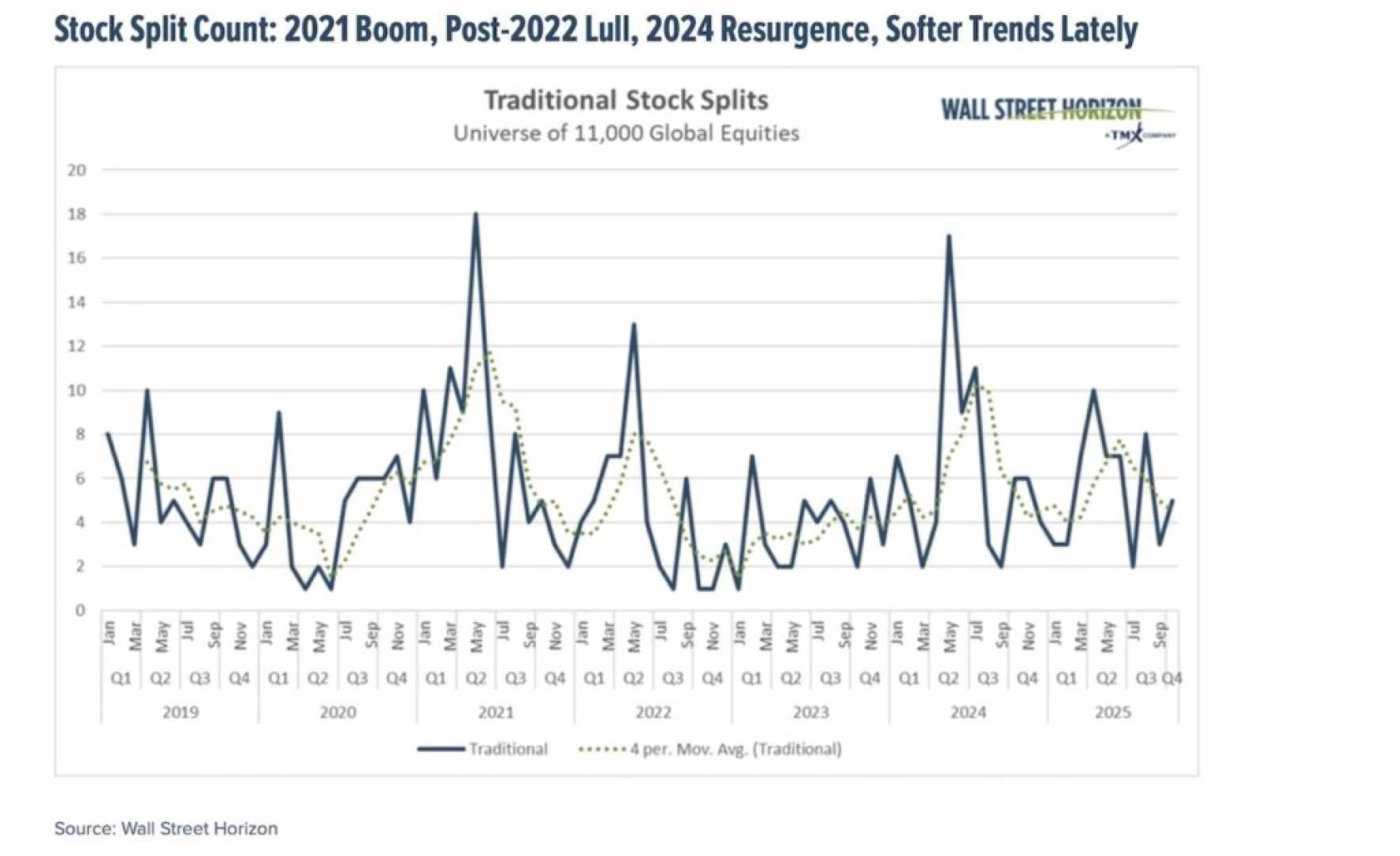

Netflix currently holds a Morningstar Rating of 2 stars, trading at a 45% premium to its fair value estimate. The company’s stock has seen quiet activity in stock splits throughout 2025 until this recent announcement.

Previously, in this quarter, ServiceNow also announced a five-for-one stock split following strong earnings results. Netflix’s stock split comes in a context where numerous tech companies are also choosing to split their shares.

As the split approaches, analysts and investors are keenly observing how these changes will affect Netflix’s stock performance in the coming months.