Business

Nvidia’s Q3 2025 Earnings Awaited as Wall Street Anticipates Big Growth

Santa Clara, California — Nvidia Corp. is set to reveal its third-quarter fiscal 2025 earnings on November 19, drawing intense scrutiny from investors and analysts alike. Wall Street forecasts the company’s revenue will reach approximately $54.8 billion, driven by surging demand for its AI chips.

Despite growing concerns about potential overinvestment in artificial intelligence, analysts remain optimistic. They predict a remarkable 56% increase in revenue year-over-year, with earnings per share expected to climb to $1.25, reinforcing Nvidia’s dominance in the AI hardware sector. Morgan Stanley has even adjusted its stock price target to $220, citing the anticipated robust performance stemming from the rollout of Blackwell GPUs.

Barclays also raised its target, predicting the third-quarter revenue will surpass previous estimates. The bank estimates full-year compute revenue could hit $37 billion. However, production levels for Blackwell GPUs are slightly below expectations, creating a cautious outlook amidst high demand.

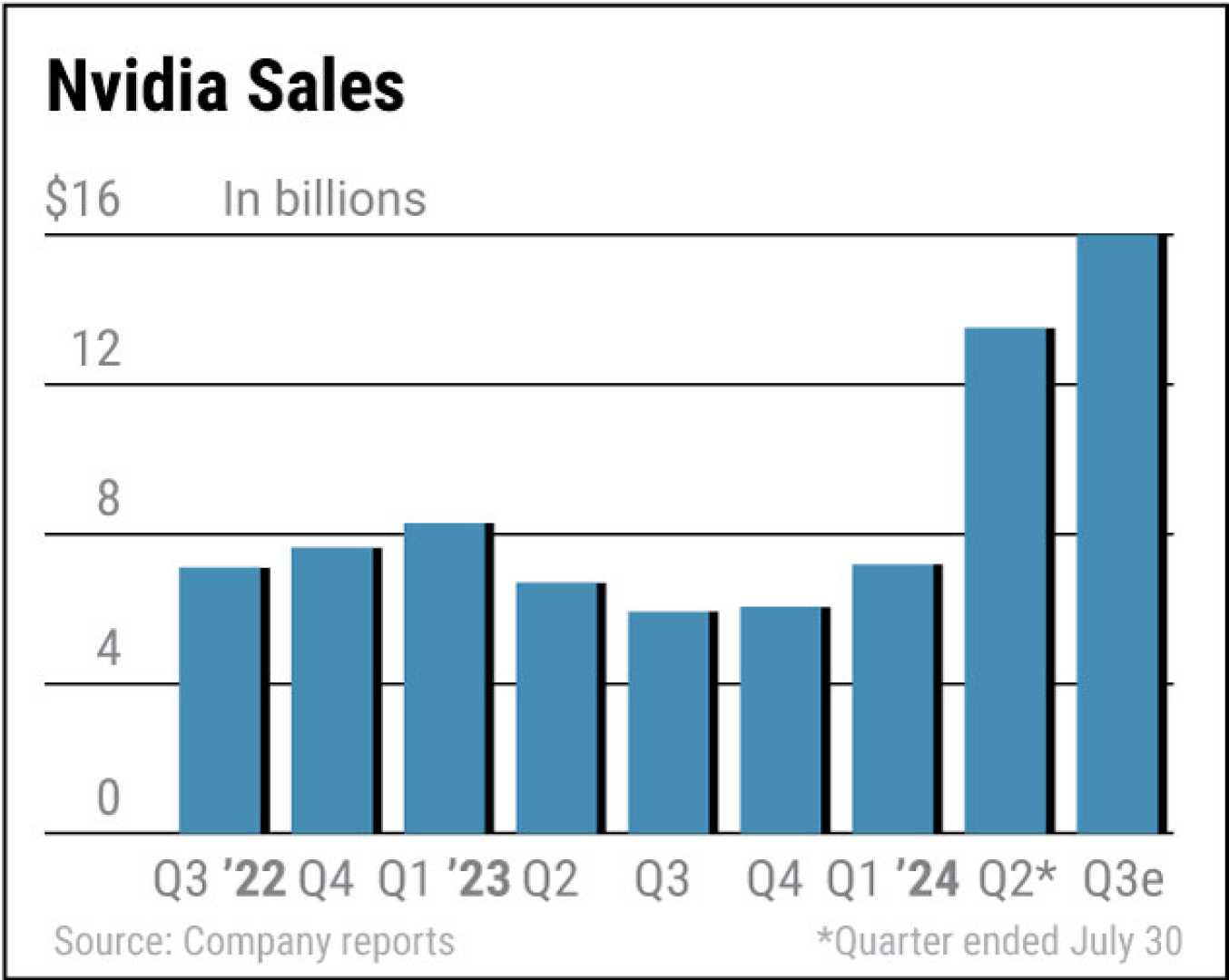

Nvidia’s sales have already exceeded analysts’ forecasts in prior quarters, with the second-quarter fiscal 2025 results reflecting $30 billion in revenue, marking a 15% increase from the previous quarter. These results highlighted the company’s solid gross margins, which stood at 75%, indicating operational efficiency in a competitive market.

While many investors are excited about Nvidia’s performance potential, there are undercurrents of fear surrounding an AI bubble, as highlighted by Yahoo Finance. The upcoming earnings report is seen as a crucial indicator of the AI boom’s sustainability. Investors are particularly watchful of indicators that might signal either robust ongoing demand or the risks of overcapacity in the AI segment.

Nvidia’s CEO, Jensen Huang, recently expressed confidence in the ongoing shift towards AI computing, stating, ‘The age of AI is in full steam.’ This assertion aligns with analysts predicting that Nvidia will maintain its pivotal role in the U.S. technology rally that’s been underway since 2023.

As the report date approaches, attention will also be fixed on Nvidia’s strategic decisions regarding production and market adaptation, especially amid ongoing global trade tensions. Whether the company can deliver on these high expectations remains to be seen.