Business

Pound Options Trading Hits Record High Amid UK Economic Fears

LONDON, UK — The pound sterling faced intense pressure on Wednesday as trading in pound options surged to its highest level since the currency’s near-collapse in 2022. Data from the Depository Trust and Clearing Corp. revealed that trading volumes reached 13.7 billion pounds ($16.9 billion) on Jan. 8, triple the previous day’s activity and the highest since September 2022, when former Prime Minister Liz Truss‘s mini-budget triggered a market crisis.

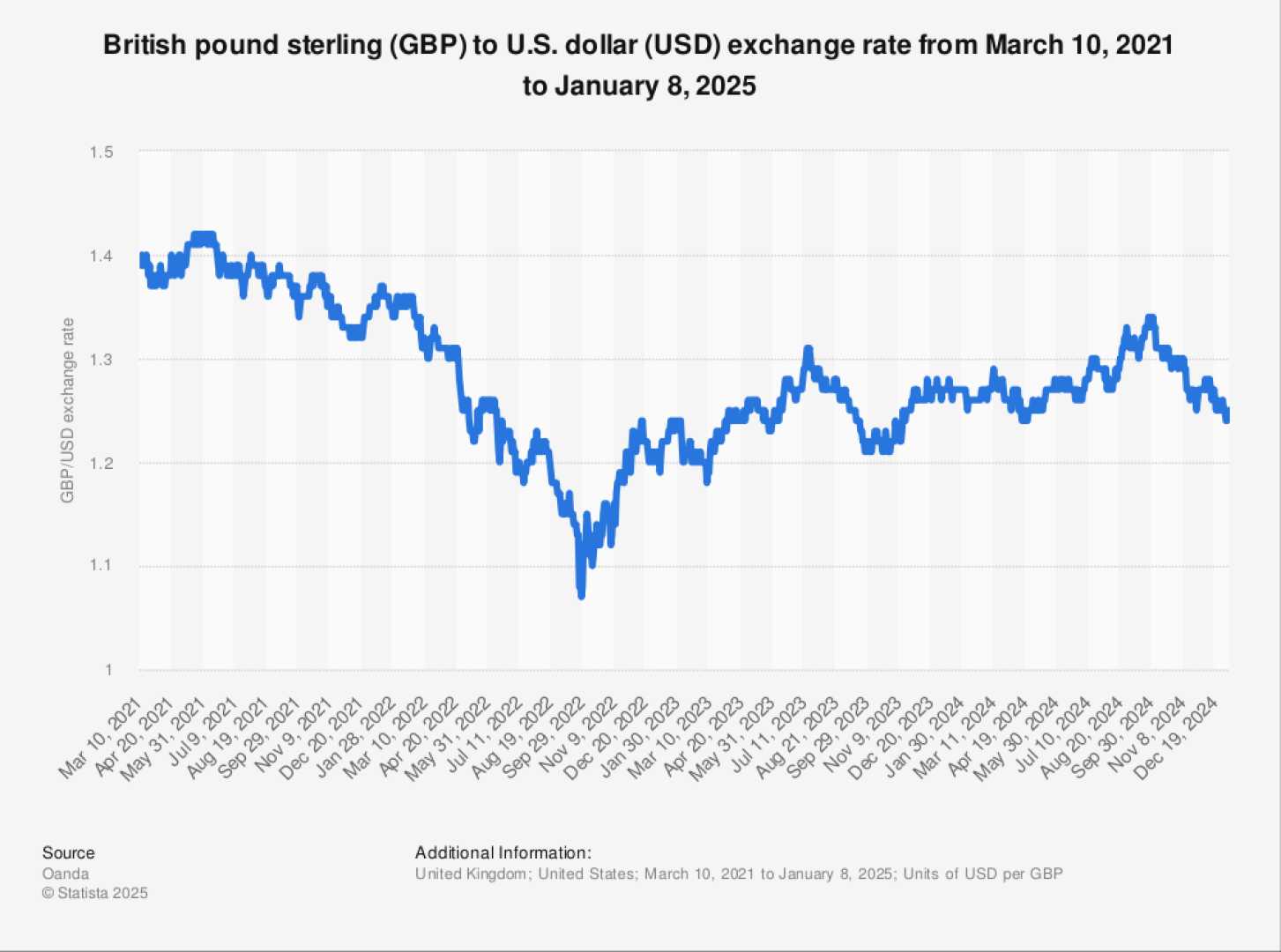

Investors are increasingly betting on a weaker pound, with some options targeting a drop to 1.15 against the dollar, a 7% decline from current levels, according to Nomura International Plc. Hedge funds have also piled into bearish put options, reflecting growing concerns about the UK’s economic stability. The pound fell to its lowest level since November 2023 on Thursday, exacerbating fears of a repeat of the 2022 currency crisis.

“This year has ushered in significant market volatility with the UK in focus,” said Sagar Sambrani, a senior foreign-exchange options trader at Nomura in London. He noted that digital options targeting the 1.15 to 1.19 range over three to six months have become particularly popular, drawing parallels to the fiscal sustainability concerns that roiled markets in 2022.

Euro-sterling options targeting 0.85-0.87 in the one- to three-month range also saw heightened activity, Sambrani added. The frenzied trading in the $300 billion-plus currency options market mirrored a spike in UK government bond yields, which hit their highest levels in over a decade on Wednesday. Rising inflation, debt sustainability worries, and potential US tariffs are weighing heavily on UK assets, further undermining investor confidence.

The pound’s decline has been accompanied by a surge in hedging costs. The price to hedge the pound’s downside over the next week, compared with its upside, rose sharply, while three-month implied volatility—a measure of expected currency movement—reached its highest level since April 2023. Traders are now bracing for US payrolls data due on Friday, which could further pressure the pound if it signals continued strength in the American labor market.

“The pound’s recent decline versus the dollar has led to an increase in demand for bearish put options,” said Con Davelis, head of FX option trading at National Australia Bank Ltd. in Sydney. This has driven implied volatility and the relative price of put options “significantly higher this week,” he added.

As the UK grapples with economic uncertainty, the pound’s vulnerability underscores the challenges facing policymakers and investors alike. The currency’s performance in the coming weeks will likely hinge on both domestic fiscal decisions and global economic trends.