News

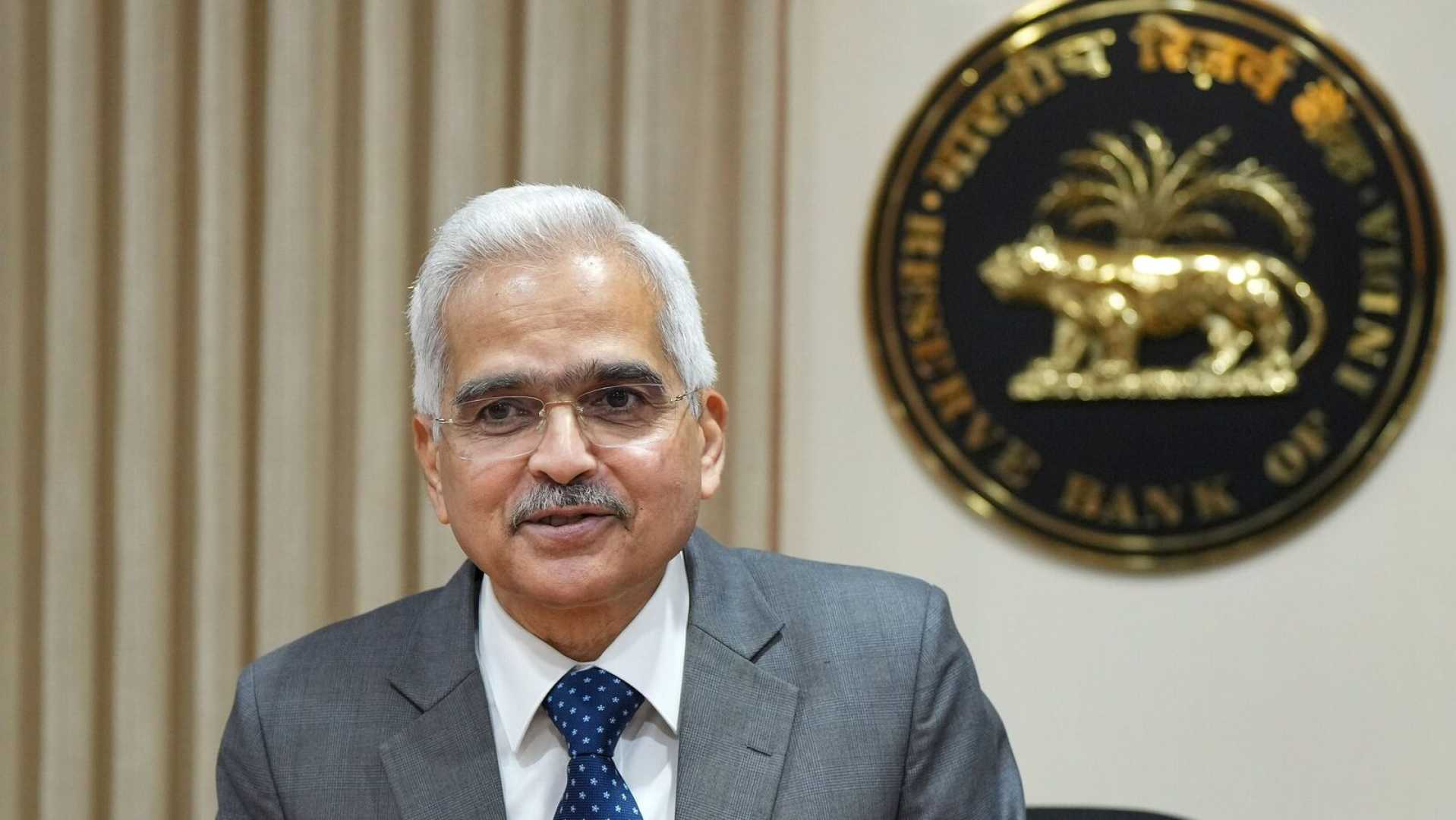

RBI Governor Shaktikanta Das Warns NBFCs Against Aggressive Growth Strategies

On October 9, Reserve Bank of India (RBI) Governor Shaktikanta Das issued a critical warning to Non-Banking Financial Companies (NBFCs) about pursuing aggressive and unsustainable growth trajectories. Speaking during the Monetary Policy Committee (MPC) announcements, Governor Das acknowledged the significant growth of NBFCs over recent years but expressed concerns about some entities focusing on growth at the expense of sound risk management and sustainable business practices.

Governor Das highlighted that, although the overall NBFC sector retains a healthy status, certain outliers are adopting a “growth-at-any-cost” mindset. He specifically pointed to Microfinance Institutions (MFIs) and Housing Finance Companies (HFCs) as examples of entities emphasizing excessive returns on equity and aggressively pushing business targets.

The RBI Governor emphasized that such approaches could lead to elevated interest rates and substantial indebtedness for borrowers, presenting potential threats to overall financial stability if left unaddressed. He urged both banks and NBFCs to diligently assess their exposure levels, especially in unsecured lending segments, and cautioned against focusing solely on returns driven by aggressive business targets.

Governor Das noted that certain NBFCs are imposing interest rates that verge on usurious, warning that this practice could have dire consequences for borrowers. “Self-correction is the desired outcome of this message,” said Das, emphasizing the need for entities to internally address these issues. Nonetheless, he reassured that the RBI is closely monitoring developments and will take necessary action if required.

Moreover, Das stressed the significance of NBFCs adopting sustainable business models prioritizing compliance and adherence to fair practices. He assured that while the entire sector is not being generalized, the central bank is actively engaging with outliers to ensure the maintenance of financial stability.