Business

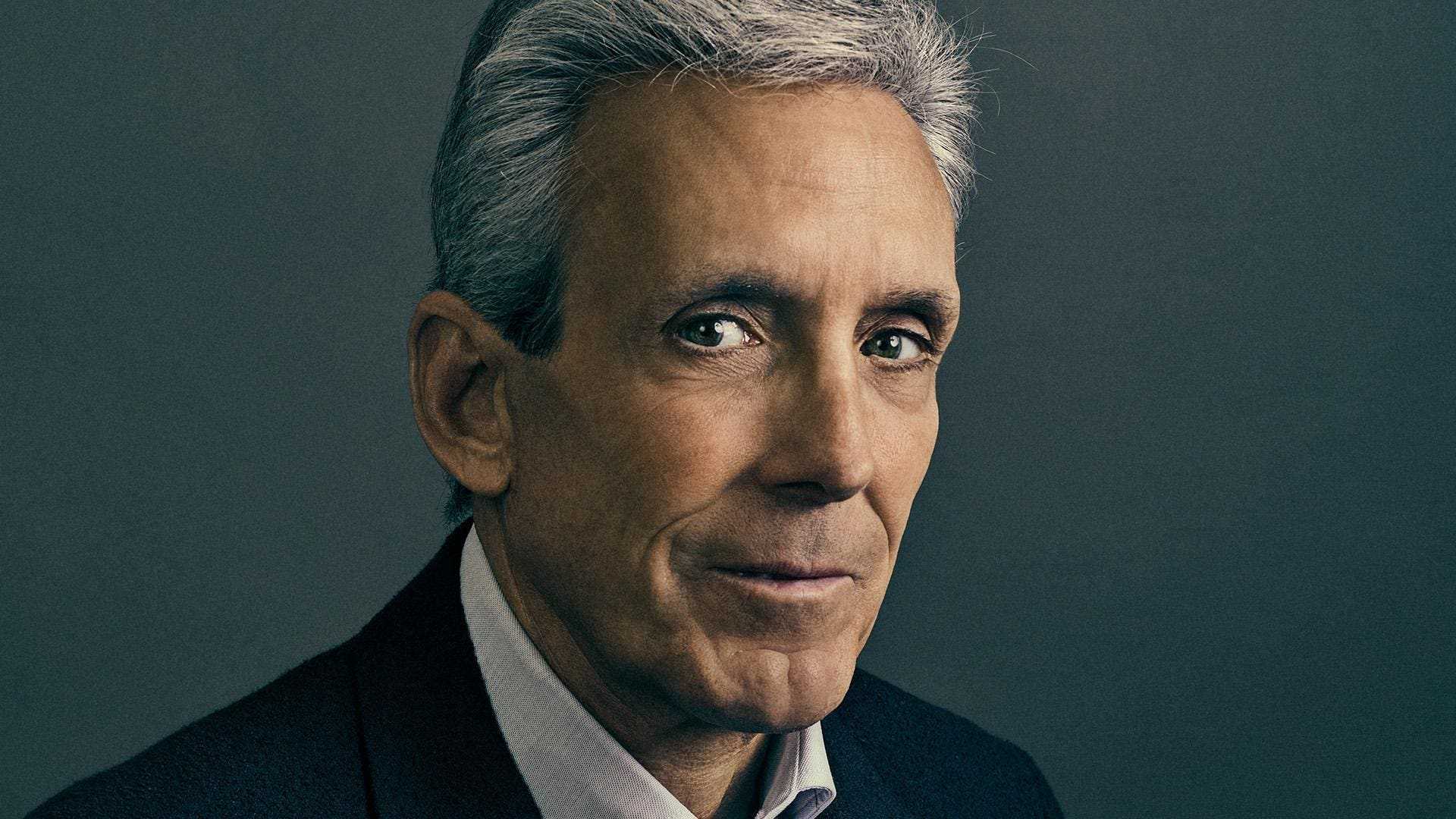

Real Estate Mogul Charles Cohen Faces $1.1 Billion Debt Crisis

NEW YORK, N.Y. – Real estate billionaire Charles Cohen, owner of Cohen Brothers Realty, is grappling with mounting debt and vacancies across his portfolio of prime office towers and properties. Forbes estimates his net worth has plummeted from $3.7 billion in 2022 to $1.6 billion, as his real estate holdings lose value and tenants flee to newer, amenity-rich skyscrapers.

Cohen, who took over his family’s firm in the 1980s, expanded it into a portfolio of midtown Manhattan office towers, design centers, and theater chains. However, the pandemic and rising interest rates have left him struggling to make payments on at least $1.1 billion in debt. In November 2023, four of his properties were lost in one of New York’s largest foreclosure auctions, with creditor Fortress Investment Group acquiring most of the assets for just under $150 million.

“If you run a negative story, it’s going to hurt me,” Cohen told Forbes, citing refinancings and new leases he claims are in the works. “It makes it harder for us to rent when people think there’s a problem that really isn’t a problem.”

Cohen’s troubles began with the pandemic, which emptied offices and shuttered his theaters. At least six of his buildings are more than 20% vacant, with three less than 60% occupied. His properties have struggled to compete with newer skyscrapers offering luxury amenities. High interest rates have also made refinancing difficult, and when Cohen did refinance, it was on unfavorable terms.

In November 2023, Fortress Investment Group sued Cohen for repayment of a $534 million loan secured by several properties. Cohen counter-sued, but the legal battle has been costly. A judge ruled in October 2023 that Cohen must pay a personal guaranty of up to $187 million, which he is appealing. Fortress also accused Cohen of shielding personal assets, including transferring ownership of his $50 million yacht and $20 million Greenwich home to offshore entities.

Despite the setbacks, Cohen remains optimistic. “We’re doing fine. We’ve got leasing challenges, which everyone has, but we’ve got good buildings,” he said. His firm is working on renovations and new leases, including a $13 million lobby upgrade at 3 Park Avenue. Cohen is also pursuing condo conversions at several properties, though some projects face legal and financial hurdles.

Looking ahead, Cohen is focusing on a new 23-story office tower in West Palm Beach, Florida, set to break ground in March 2025. The project, part of a growing “Wall Street South” trend, has already secured leases for six floors. “We’ve got leasing activity underway already,” Cohen said.

As for the legal battles, Cohen vows to fight on. “I’m not paying that personal guaranty. I’ve got defenses, I’ve got an appeal pending,” he said. “It’s not over by a long shot.”