News

US Retail Spending Indicates Strong Economic Performance in September

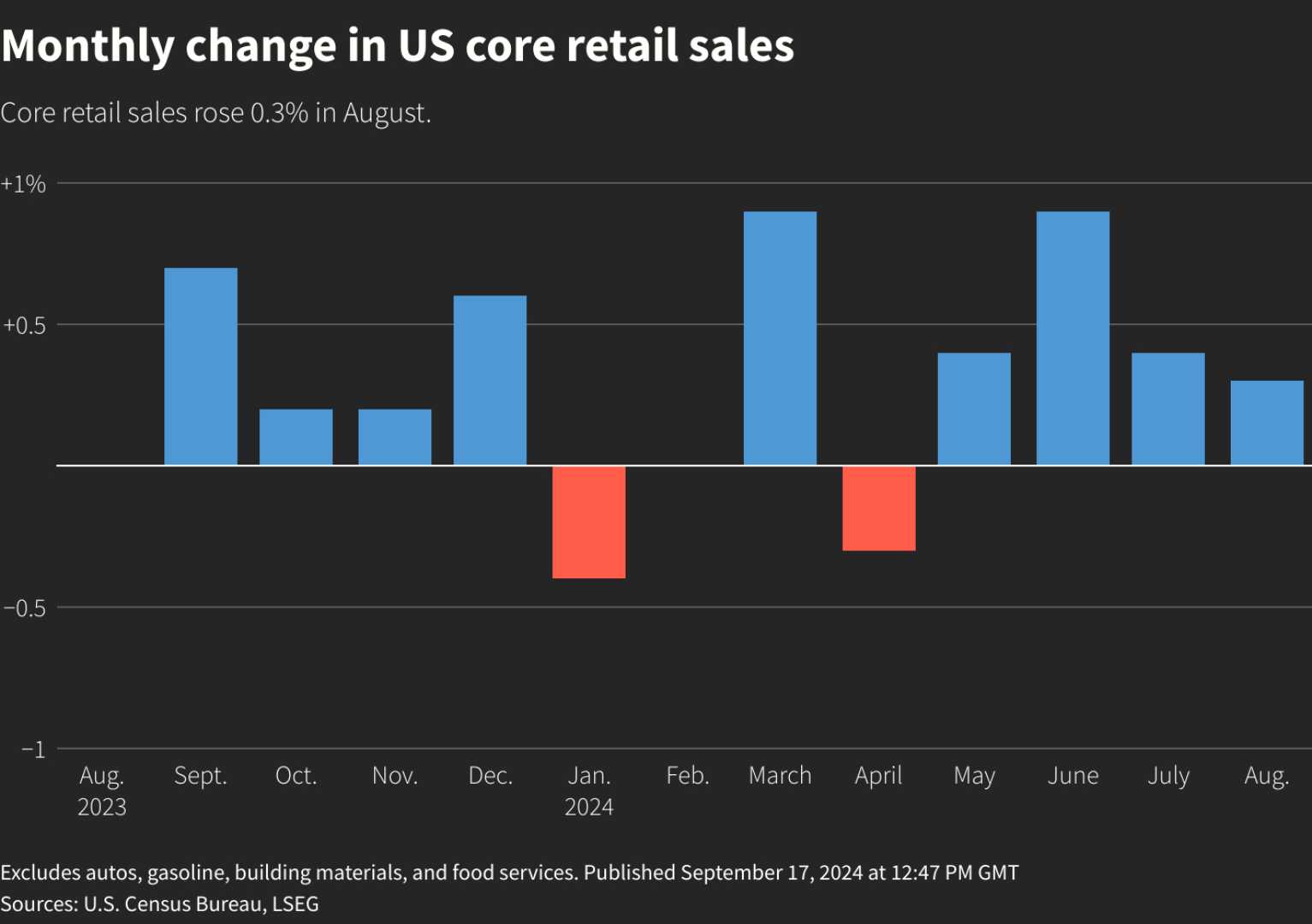

American consumer spending demonstrated resilience in September 2024, according to a report by the U.S. Commerce Department released Thursday. The data revealed a seasonally adjusted increase of 0.4% in retail sales from the previous month, exceeding the unrevised 0.1% growth recorded in August and surpassing the 0.3% rise anticipated by economists polled by Dow Jones.

Excluding automotive sales, retail spending showed an even stronger performance with a 0.5% increase, compared to the expected 0.1% rise. The figures have been adjusted for seasonal variations but not for inflationary impacts, with the consumer price index rising by 0.2% during the same month.

September’s retail sales growth was supported by significant increases in spending at miscellaneous store retailers (up 4%), clothing stores (up 1.5%), and bars and restaurants (up 1%). These gains offset declines at gas stations, where sales fell by 1.6% due to decreased fuel prices, and at electronics and appliance stores, which saw a 3.3% drop, as well as furniture and home furnishing outlets, which decreased by 1.4%.

On a related note, initial filings for unemployment benefits also displayed a positive trend, decreasing to a seasonally adjusted 241,000 for the week, as reported by the U.S. Labor Department. This represents a decline of 19,000 from the previous week and surpassed the forecast of 260,000. The drop in jobless claims occurred despite the recent hurricanes Helene and Milton, which caused significant damage in the Southeast.

These economic data reports prompted an uptick in stock market futures and a rise in Treasury yields. The sustained consumer activity, which constitutes approximately two-thirds of all U.S. economic function, coupled with wage stability, indicates that the economy is likely resisting recessionary pressures.

In efforts to further buttress the economy, the Federal Reserve implemented a half percentage point reduction in its benchmark interest rates the previous month. Federal Reserve Chair Jerome Powell has conveyed aims to reduce rates further to avert any weakening in the labor market, aligning with the Fed’s confidence that inflation is trailing back towards its 2% goal.

The data from the Commerce Department underscores the significant role of consumer spending in the economic landscape, comprising around 70% of the United States’ economic activity.