Business

Rocket Lab’s Stock Drops Amid Mixed Market Signals and Analyst Optimism

HUNTINGTON BEACH, Calif. — Rocket Lab USA‘s stock has faced a recent decline, dropping by 6.3% as investor concerns grow amid fluctuating market conditions. The company’s shares closed at $24.30 on February 22, down from a previous close of $25.93. This decline comes after a year marked by significant achievements in the aerospace industry, where Rocket Lab secured its position as the No. 2 launch service provider in the U.S.

Despite the stock’s recent downturn, analysts remain optimistic about Rocket Lab’s future. Citigroup raised its price target for the stock from $22 to $35, maintaining a ‘buy’ rating. Similarly, Stifel Nicolaus increased its target from $26 to $31, reinforcing confidence in Rocket Lab’s long-term growth potential, while Bank of America elevated its estimate from $10 to $30.

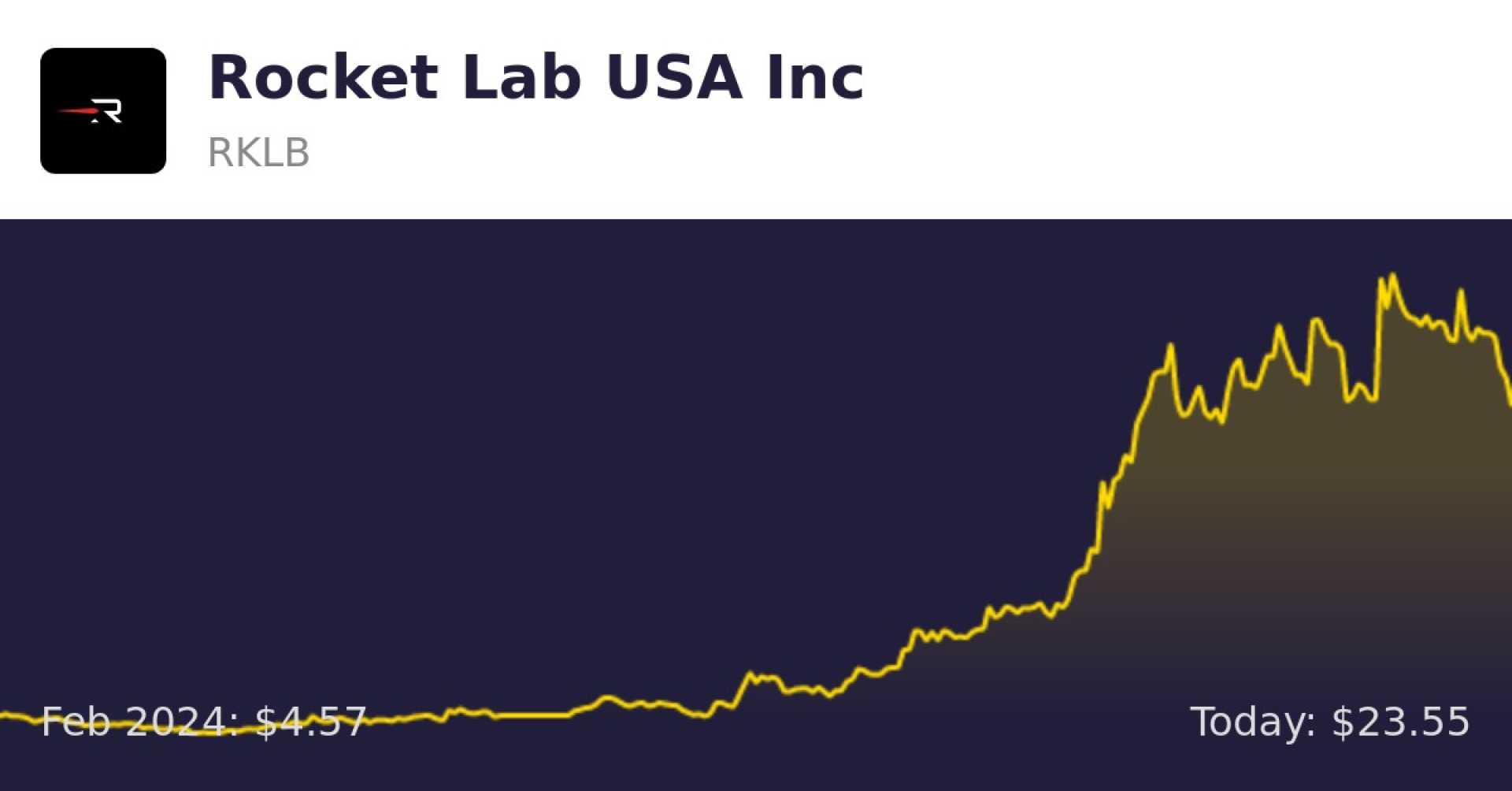

Rocket Lab’s stock has surged by approximately 480% over the past year, following a record of 16 successful launches. The company’s flagship Electron rocket has proven its capability in deploying small satellites, making it a vital player in this niche market.

As demand for rocket launches continues to grow, Rocket Lab’s revenue increased by 65% year-over-year, reaching $304 million in the first three quarters of the last year. The company’s gross profit has more than doubled to $79 million as it seeks to capitalize on opportunities in both launch services and space systems.

However, Rocket Lab is grappling with a significant operating loss of $138 million during the same period, attributed mainly to high administrative expenses. This financial strain raises concerns among investors about the company’s path to profitability. Analysts predict that Rocket Lab could achieve breakeven by 2026, requiring an annual growth rate of 51% to align with this timeline.

Insider trading has also drawn attention following the stock’s decline. Recently, Chief Operating Officer Frank Klein sold 35,968 shares, and Chief Financial Officer Adam Spice disposed of 62,511 shares. While insider selling can create apprehension among investors, it may also reflect personal financial planning rather than signaling a lack of confidence in the company’s trajectory.

Rocket Lab’s latest endeavor, the Neutron rocket, aims to enhance its payload capacity and compete more directly with leader SpaceX, whose Falcon 9 can launch payloads of up to 13,000 kilograms compared to Electron’s 300 kilograms. Rocket Lab has also secured contracts for additional launches in collaboration with international clients, including three missions with a Japanese Earth-imaging company in 2026.

Despite its recent challenges, the overall market sentiment towards Rocket Lab remains cautiously optimistic, with institutional investors holding approximately 71.78% of shares. As the company navigates a competitive aerospace landscape, the success of its upcoming Neutron rocket and continued growth in launch services will be crucial for rebuilding investor confidence.

As Rocket Lab continues to innovate within the rapidly evolving space sector, investors must weigh both short-term fluctuations and long-term growth potential when deciding on their investments. Upcoming earnings announcements are expected to provide further insights into the company’s financial standing and order backlog exceeding $1 billion.