Business

Rocket Lab Stock Surges Following Strong Q3 2024 Results and Analyst Price Target Hike

Rocket Lab USA Inc. (RKLB) has seen a significant surge in its stock price following the release of its strong third-quarter 2024 financial results and a notable hike in the price target by a Wall Street analyst.

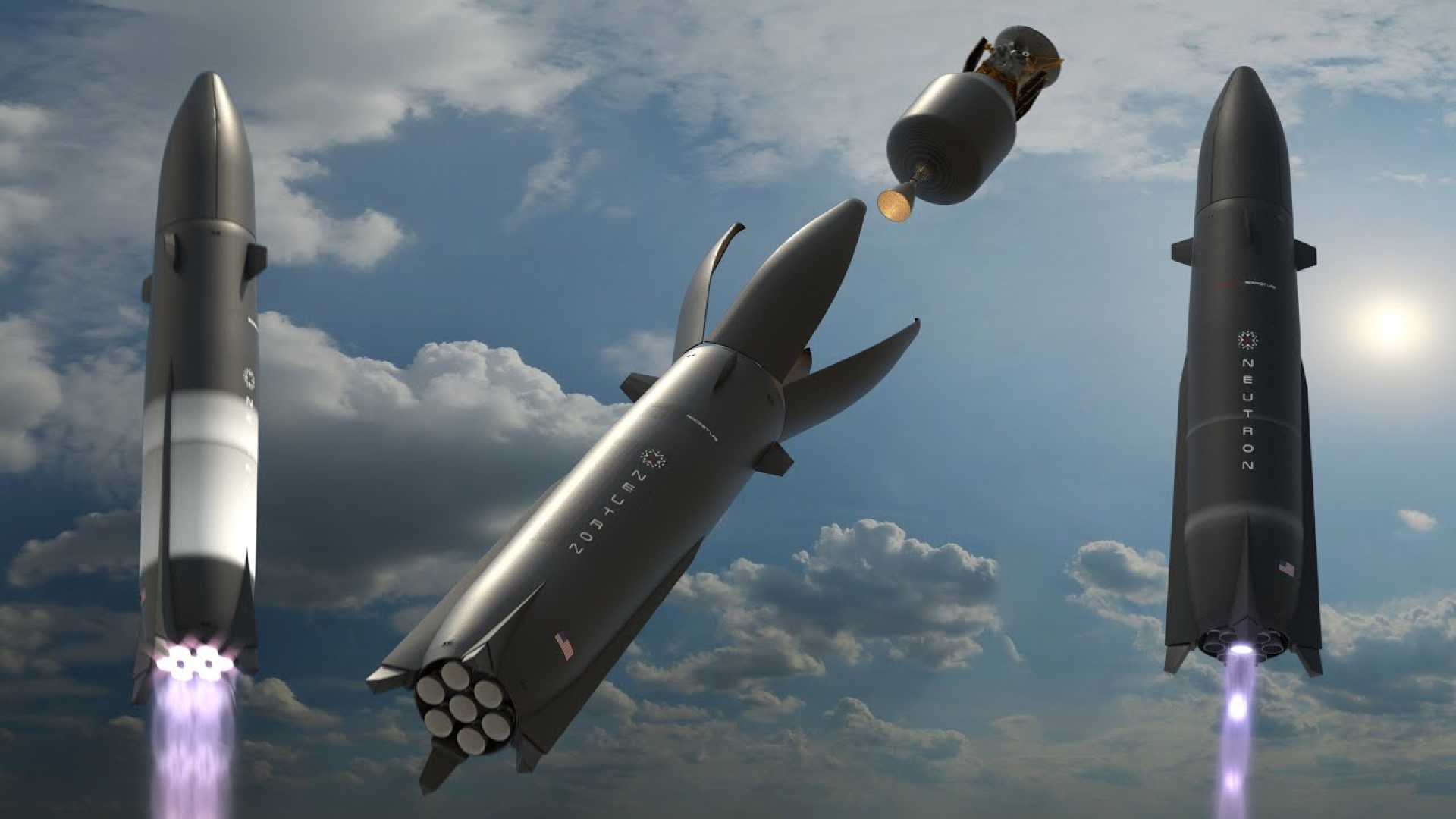

In its Q3 2024 report, Rocket Lab announced a 55% year-on-year revenue growth to $105 million, along with a backlog of $1.05 billion. The company achieved a record 12 Electron launches year-to-date and secured $55 million in new launch contracts, marking a 67% price increase since its debut. Notable developments include signing multiple Neutron launches with a commercial constellation customer and completing spacecraft for NASA‘s ESCAPADE Mars mission. For Q4 2024, Rocket Lab guides to record revenue of $125-$135 million, with expected GAAP Gross Margins of 26-28% and an Adjusted EBITDA loss between $27-29 million.

The stock’s upward momentum was further bolstered by Stifel analyst Erik Rasmussen, who raised his price target for Rocket Lab from $9 to $15 per share. This 67% increase follows a meeting with Rocket Lab’s CFO, Adam Spice, during Stifel’s Midwest One-on-One Conference. Rasmussen expressed confidence in the company’s ability to successfully deliver the Neutron rocket, which is crucial for expanding Rocket Lab’s market share in the space launch sector.

The Neutron rocket, slated for its inaugural launch in mid-2025, will significantly enhance Rocket Lab’s capabilities by allowing it to transport much heavier payloads into space. This development aligns with the company’s strategy to expand its services and cater to clients requiring larger payload capacities.

Despite some analysts forecasting a mixed outlook, with an average 12-month stock price forecast of $6.89, the current market sentiment remains bullish, driven by the company’s robust financial performance and promising future projects.