Business

Scott Galloway Proposes Bold Ideas to Secure America’s Retirement Future

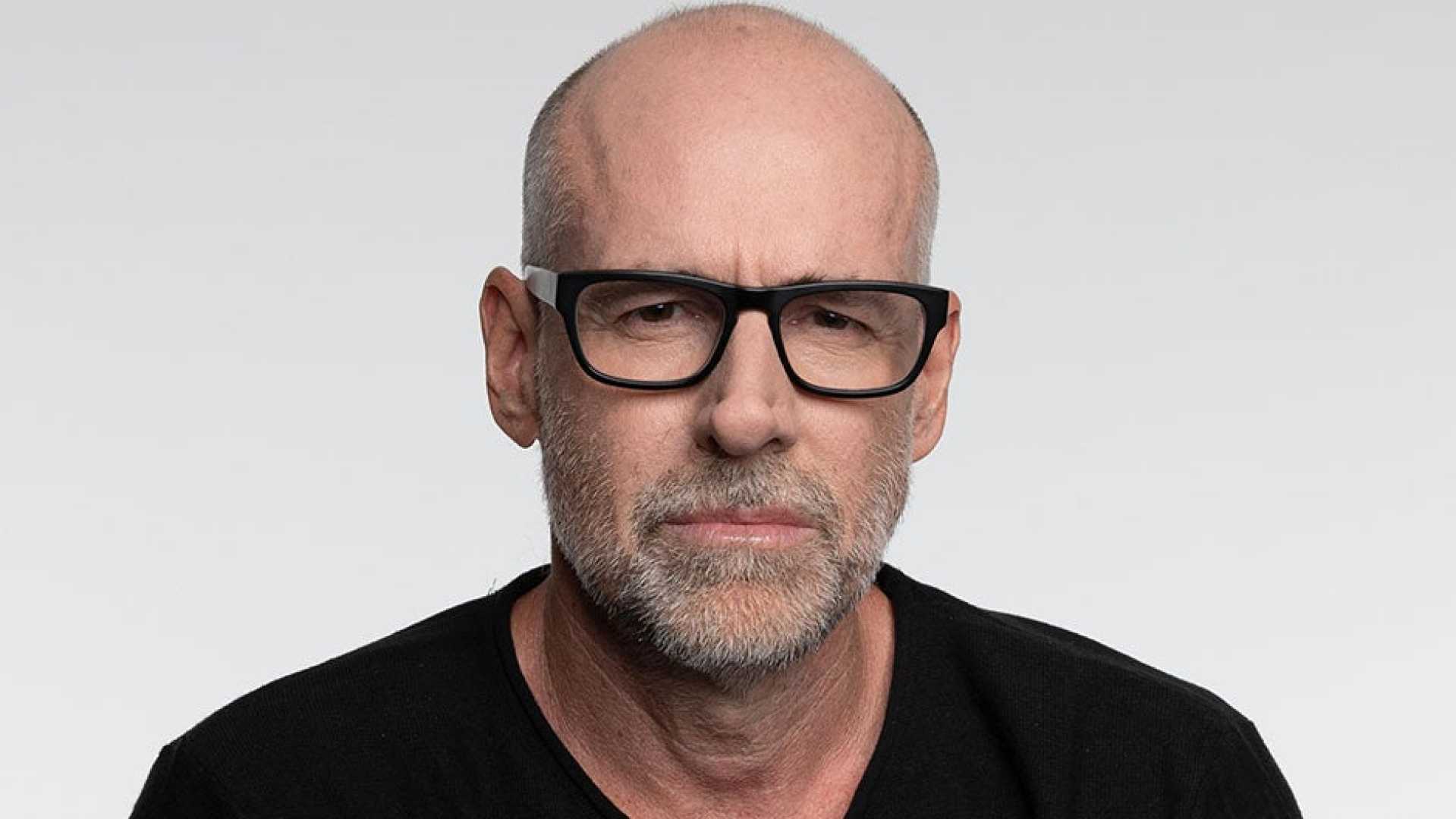

NEW YORK, N.Y. — Scott Galloway, a finance expert and New York University professor, is advocating for significant changes to the future of retirement and Social Security in the United States. In his recent discussions, Galloway, author of “The Algebra of Wealth,” emphasizes the urgent need for a reevaluation of how Social Security benefits are distributed.

With Social Security trust funds predicted to be depleted by 2033, potentially leaving retirees to receive only 80% of their due benefits, Galloway insists that legislative action is essential to avert a crisis. “Old people keep living longer, and they vote,” he stated in his book. “We’re more likely to get rid of schools, the space program, and half the Navy before we fail to fund Social Security.”

Galloway suggests implementing means-testing to ensure that benefits are directed only to those who truly need them. He argues that wealthier individuals should not receive benefits simply because they have paid Social Security taxes. “Most beneficiaries withdraw two to three times the amount they contribute through Social Security taxes,” he said. “Those who are exceptionally wealthy shouldn’t be guaranteed benefits.”

The professor is critical of the current tax structure, stating that the upper class is not contributing a fair share. “I pay a mere $9,000 in Social Security taxes each year, the same as someone earning $160,000 annually,” he noted. He believes these funds should be reserved for those who genuinely need assistance.

Despite concerns surrounding Social Security’s sustainability, Galloway remains optimistic that the program will not run out of funds entirely. He urges Americans to consider alternative retirement plans, promoting the creation of passive income as a means to achieve financial security.

“You could apply the principles of this book and, with some luck and a lot of hard work, be living on a boat in the Caribbean by age 40, never earning another dollar,” Galloway writes. He argues that the key to financial independence is generating more passive income than one’s “burn rate,” or the amount of money spent annually.

Galloway advises, “Rough out your projected expenses for a year and add them up. Bump it 20% to cover taxes (30% if you expect to live in California, New York, or another high-tax state). That’s your annual burn rate.”

To build wealth, he recommends multiplying the burn rate by 25 to determine the required asset base needed to generate sufficient passive income.

As the future of Social Security hangs in the balance, Galloway’s ideas may provide a roadmap for Americans concerned about their financial futures.