Business

Senate Votes Down Bill Regulating Stablecoins Amid Tensions

Washington, D.C. – Crypto executives faced a setback on Thursday when the Senate failed to advance a bill aimed at regulating stablecoins. The proposed legislation aimed to create a light-touch regulatory approach but was met with opposition from Democrats who claimed they had not seen the final text.

Despite the failure, insiders expect Democrats to eventually support the bill once they can claim improvements have been made. Reports indicate that a modified version of the GENIUS Act could allow major tech companies to develop their own digital currencies. The Democrats secured an amendment that would prevent presidents, their families, and certain government officials from issuing or sponsoring digital assets.

The backdrop for this legislative battle includes concerns about former President Donald Trump‘s involvement in the crypto market. Trump’s World Liberty Financial has issued a stablecoin, USD1, deemed to enrich his business interests. With Republicans holding the Senate majority, they were unlikely to support any measures that could harm Trump’s crypto ventures.

The vote followed a contentious debate in which some senators argued that the vote to proceed was essential for implementing necessary changes to the bill. Senator Bill Hagerty (R-TN) claimed that a no vote on cloture would effectively aim to eliminate the crypto industry. Meanwhile, Senator Ruben Gallego (D-AZ) urged for more time to review the proposed text before moving forward.

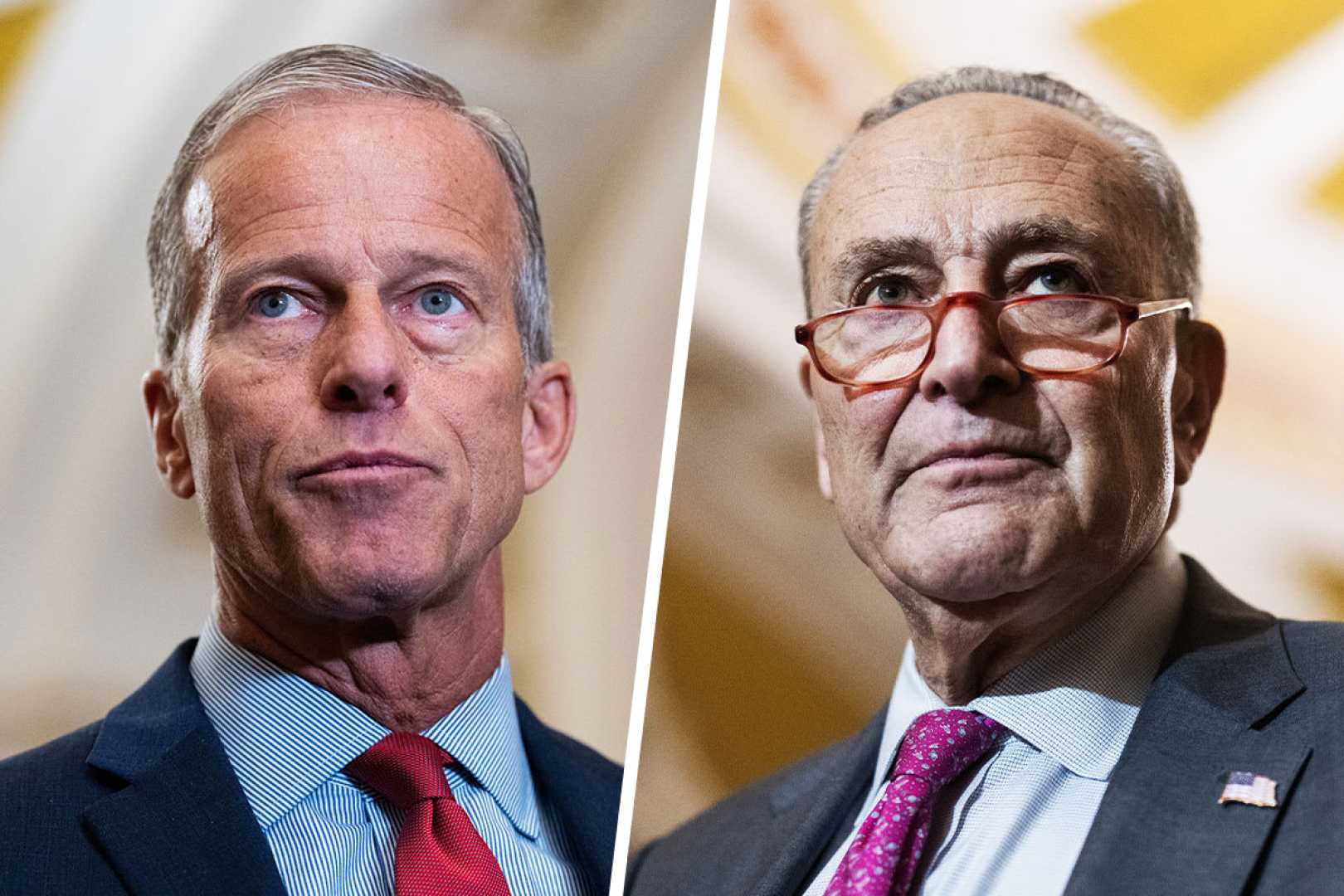

The vote ultimately fell largely along party lines, with all Democrats present voting against advancement, including co-sponsors of the bill. Senate Majority Leader John Thune (R-SD) noted that various versions of the bill had been crafted in response to Democratic concerns, questioning what more Democrats needed.

Gallego expressed hesitancy about rushing the process, stating, “we need time to educate our colleagues.” He sought to combine today’s vote with a planned debate vote next week, a request that was denied by Lummis.

As the situation develops, the broader implications of stablecoins remain. Critics have raised concerns that the GENIUS Act does not adequately address issues such as lack of deposit insurance for stablecoins and their ties to illicit transactions. Corey Frayer of the Consumer Federation of America described stablecoins as unstable, underscoring a need for substantial reforms beyond what the current bill provides.

Democrats are expected to reconsider their position next week once legislative text is finalized, but the outcomes remain uncertain as tensions persist.