Business

UK Stocks Rise on Optimism Over Potential Trump Tariff Rollbacks

London, UK — Stock prices in London were up midday Wednesday, buoyed by optimism that U.S. President Donald Trump might consider rolling back tariffs if negotiations with Canada and Mexico progress. This sentiment comes as the service sector in the UK showed only marginal growth in January, and activity in the eurozone slowed.

Russ Mould, an investment director at AJ Bell, noted, “European and Asian markets were on the front foot on Wednesday amid hopes that Donald Trump might partially wind back tariffs if deals could be struck with Canada and Mexico. Investors are looking for any signs that Trump is open to deals.”

The FTSE 100 index rose by 36.85 points, or 0.8%, reaching 8,795.85. The FTSE 250 climbed 282.74 points, or 1.4%, to 20,233.24, and the AIM All-Share increased by 6.86 points, or 1.0%, to 693.73. Additionally, all Cboe indices saw gains: the Cboe UK 100 rose 0.6%, the Cboe UK 250 surged 1.7%, and the Cboe Small Companies index crept up by 0.1%.

Mould further explained, “There was a clear shift in investor sentiment from risk-off to risk-on,” reflecting a departure from safer investments in utilities and pharmaceuticals to riskier sectors like mining and airlines. For instance, midday winners included Antofagasta (up 5.4%), easyJet (up 4.1%), and Mondi (up 5.9%). Conversely, Severn Trent led the laggards with a decline of 3.8%.

Having recently forecasted pretax profit surpassing expectations, Games Workshop leaped 5.9%, garnering Mould’s commentary on the company’s resilience. He stated, “[Its] recent promotion to the FTSE 100 puts pressure on management to keep delivering good news.”

On the FTSE 250, Breedon emerged as a standout performer, climbing 15%. Despite cutting its dividends significantly, the firm expressed optimism about sales progress in 2025.

The broader impact of the U.S. trade policies remains a concern. U.S. Commerce Secretary Howard Lutnick indicated potential amendments to the tariff framework, which might alleviate investor anxieties over a full-blown trade war.

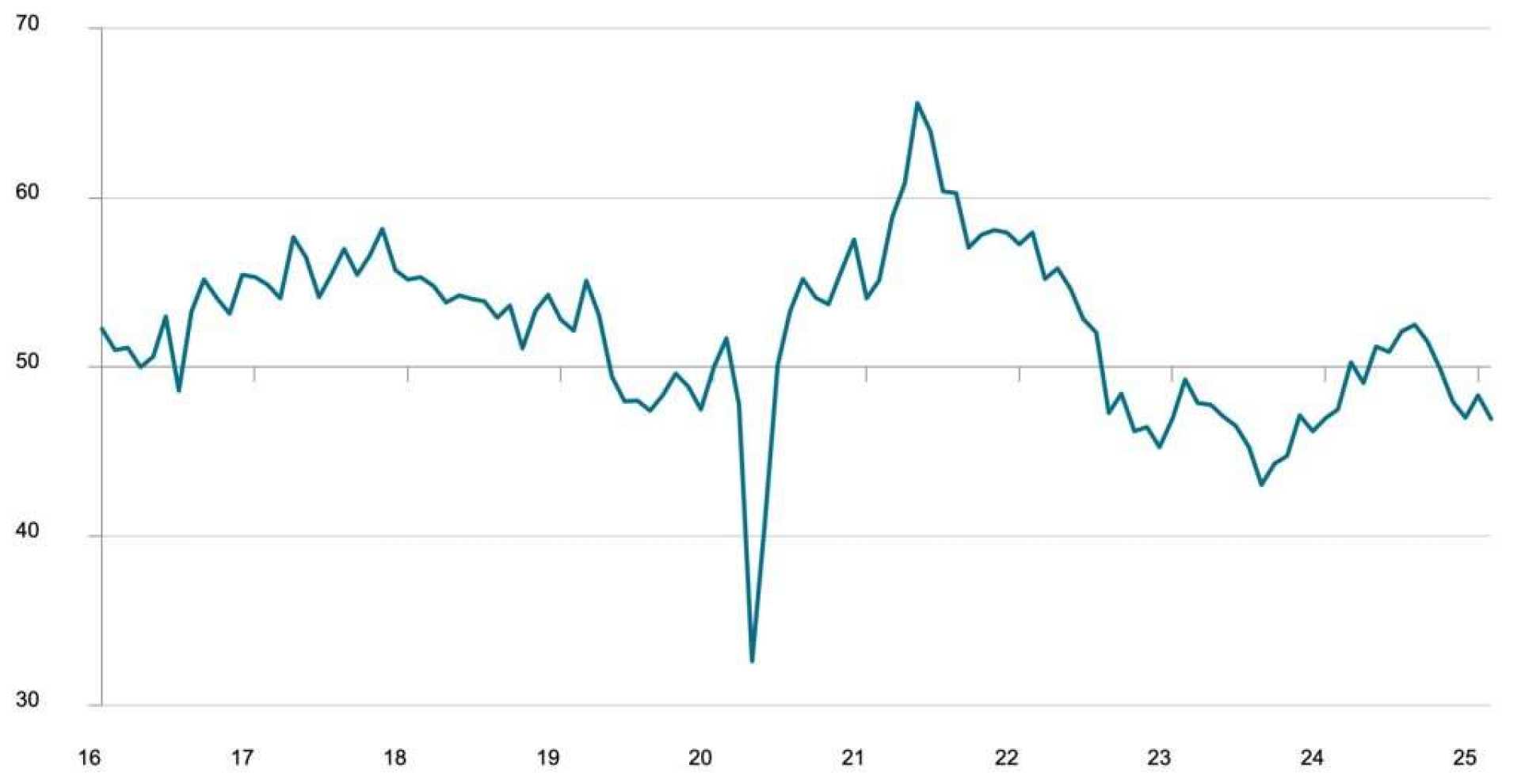

In additional news, the UK service sector data shows vulnerability, with the S&P Global UK services business activity index rising slightly to 51.0 points in February from 50.8 in January. Though still above the neutral mark, the growth pace signifies minimal expansion.

Across the Channel, European markets also reacted positively, with the French CAC 40 gaining 1.9% and Germany’s DAX 40 up by 3.3%. Mould attributed the DAX’s ascendancy to political proposals for increasing investments in the construction sector.

“The DAX has been quite the stock market darling this year, taking many investors by surprise and putting U.S. equities firmly in the rear-view mirror,” Mould remarked. The anticipated EUR500 billion investment in infrastructure could strengthen the German construction sector’s competitiveness.

Additionally, Eurostat reported that eurozone producer prices rose by 0.8% in January, signaling a steady economic pulse in the region.

In the forex market, the pound was quoted at USD1.2819 midday, a rise from the previous day, while the euro also appreciated to USD1.0676. On Wall Street, stock futures indicate a positive opening, with the Dow Jones Industrial Average anticipated to rise by 0.5%.

With several U.S. economic releases still to come, economists remain vigilant regarding how trade negotiations evolve and their broader implications for market stability.