Business

Stocks Surge Amid Earnings Reports, Alphabet Shares Plummet

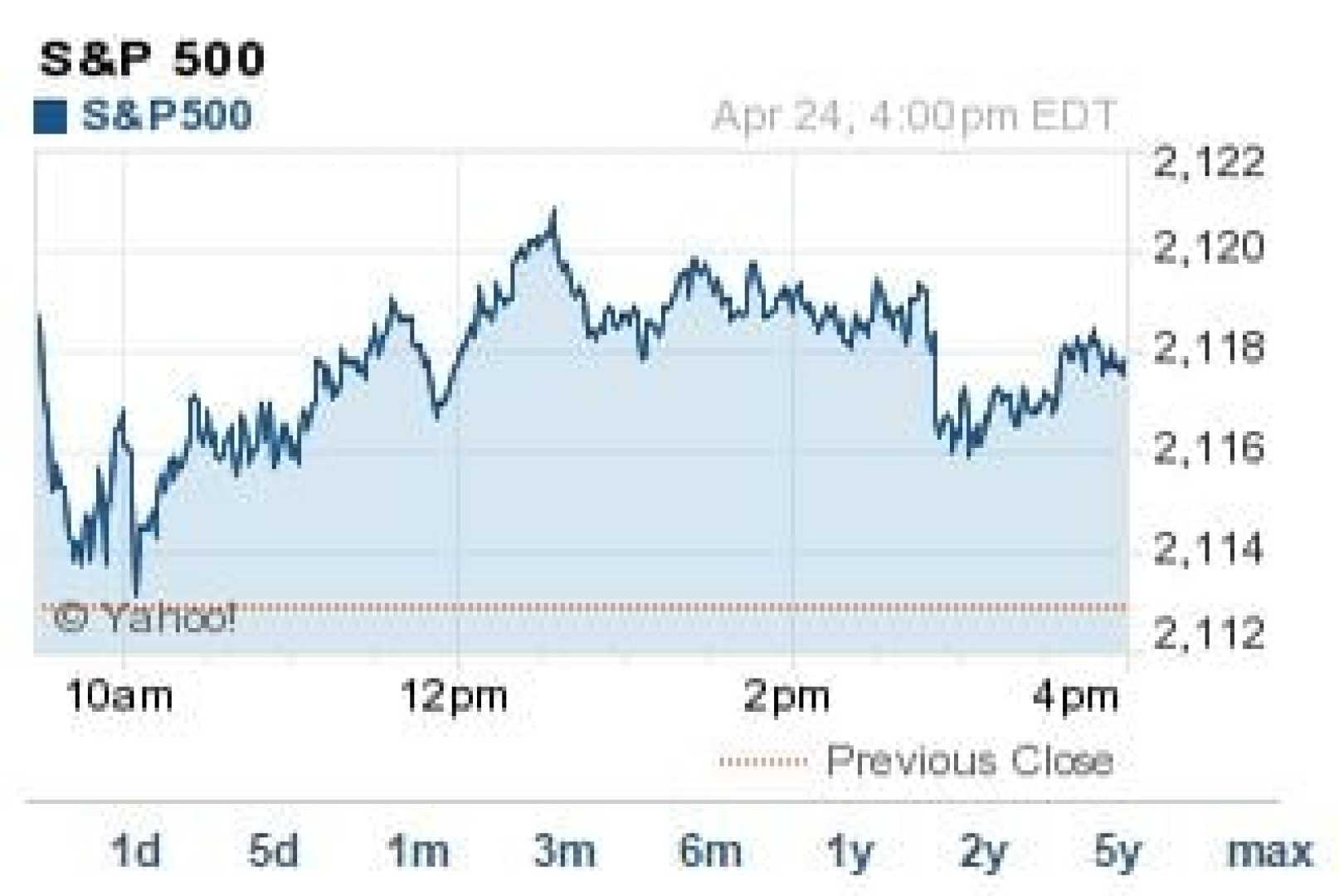

NEW YORK, NY – Stock prices surged on Wednesday as major indexes neared record highs, responding to a wave of earnings reports and ongoing geopolitical concerns. The Dow Jones Industrial Average and the S&P 500 both climbed by 0.7% and 0.4%, while the tech-heavy Nasdaq managed a 0.2% gain.

The equities market rebounded from earlier volatility that arose from concerns around a potential global trade conflict, reigniting investor confidence amidst complex economic signals. Both the Dow and S&P 500 are now less than 1% shy of their all-time closing records.

A significant boost came from the semiconductor sector, where Nvidia and Broadcom saw their stocks rise by 5% and 4%, respectively. This spike followed announcements from Alphabet, Google’s parent company, which disclosed plans to allocate nearly $75 billion toward capital expenditures this year, with a substantial focus on artificial intelligence infrastructure. The news reinforces expectations that chipmakers will continue to benefit from Big Tech’s demand for AI technologies.

However, Alphabet’s shares fell sharply by 7% on Wednesday, closing at $191.33, following a disappointing cloud revenue report for the fourth quarter and raised spending targets that cast doubt on the immediate financial benefits of such investment. ‘Investors will need to wait for Alphabet’s AI investments to pay off,’ noted analysts from UBS.

Despite Alphabet’s struggles, other large-cap tech stocks exhibited mixed performance. Amazon and Tesla each fell by 2.4% and 3.6%, whereas Apple, Microsoft, and Meta Platforms experienced little change by the end of the session.

In the wake of earnings releases, several companies saw significant stock movements. Notably, Advanced Micro Devices experienced a 6% drop after disappointing data center sales figures, while Uber Technologies shares plunged nearly 8% as the rideshare company’s guidance fell short of Wall Street’s expectations.

Conversely, shares of several companies rose following quarterly earnings surprises. Johnson Controls surged 12% after reporting strong fiscal first-quarter results, and both Mattel and Johnson Controls spiked by over 10% each.

Bitcoin‘s value in late-afternoon trading stood at $96,600, down from a high of $99,200 earlier in the day, while gold futures rose by 0.3%, reaching approximately $2,885 an ounce. WTI crude oil futures, however, fell by 2%.

In a related development, shares of Super Micro Computer jumped 8% for the second consecutive session after the firm announced it would provide an essential business update next week.

The yield on the 10-year Treasury note, a barometer for interest rate expectations, fell to 4.42% from 4.51%, marking its lowest level of 2025.