Business

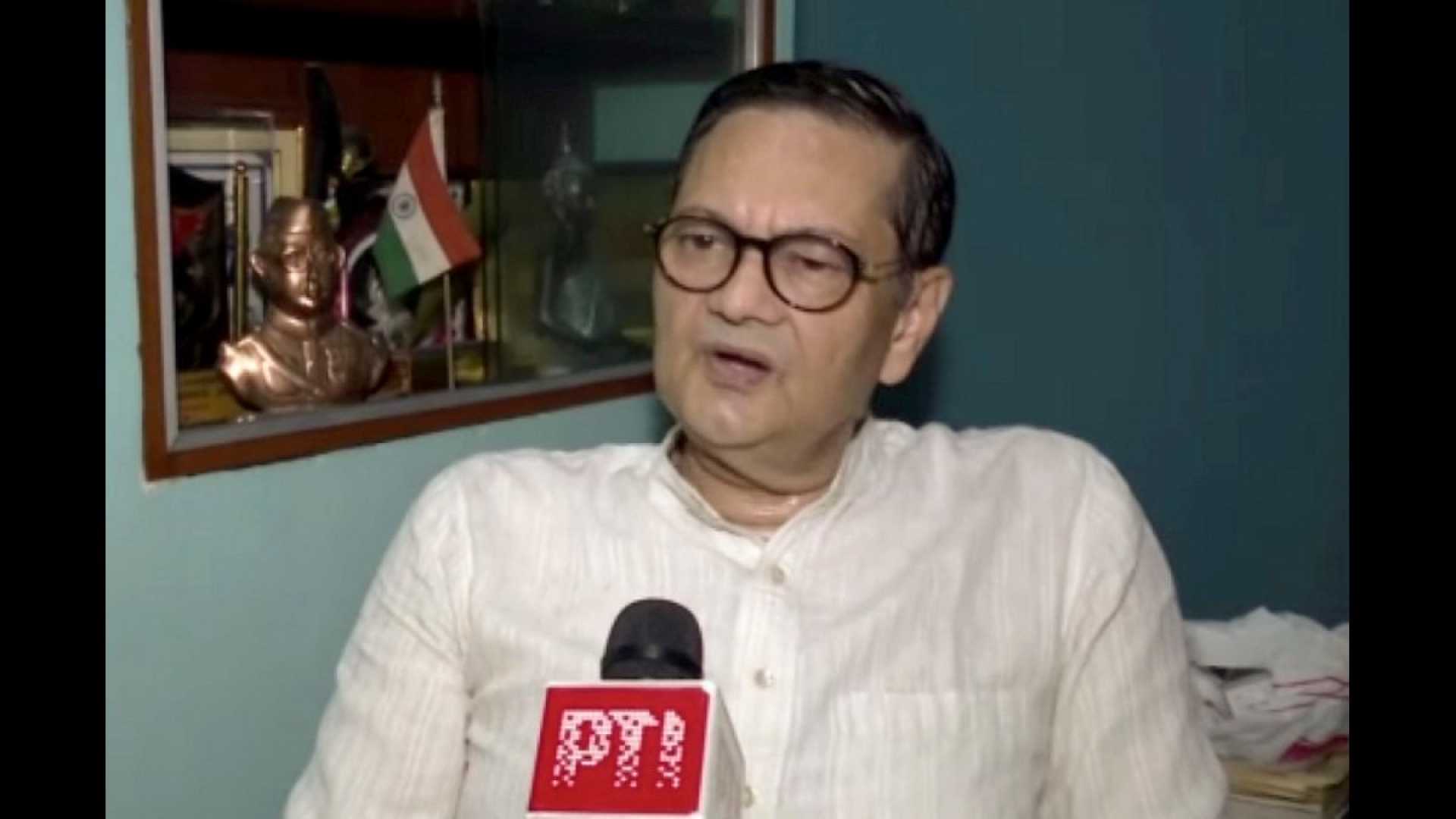

Subhash Chandra Accuses SEBI Chairperson of Corruption Amid Ongoing Investigations

Subhash Chandra, the chairman emeritus of Zee Entertainment Enterprises, has leveled serious allegations against Madhabi Puri Buch, the chairperson of the Securities and Exchange Board of India (SEBI). Chandra’s accusations come in light of ongoing investigations into alleged fund diversion involving over ₹2,000 crores from Zee Entertainment.

Chandra, aged 73, has described the allegations against him as part of a broader scheme he claims involves corruption at SEBI. He has cited a specific instance where an individual named Manjit Singh approached him in February proposing to resolve outstanding issues at SEBI for a fee.

“I firmly believe that the SEBI chairperson is corrupt. Her and her husband’s income, which was approximately ₹1 crore annually prior to her appointment, has surged to ₹40-50 crores per year. This matter requires thorough investigation by the media and regulatory bodies,” stated Chandra.

Sources have indicated that SEBI’s inquiries into Chandra’s financial dealings reveal a significantly larger scale of fund diversion from Zee than previously estimated. As a consequence, fresh show-cause notices are being prepared to be issued to both Chandra and his son, Puneet Goenka.

Chandra further alleged that former ICICI Bank CEO Chanda Kochhar had provided substantial sums of money to Buch, claiming that they communicated extensively, reportedly making about 20 calls per day.

He alleged collusion, stating, “It was Kochhar and her husband, alongside Madhabi Puri Buch and her spouse, operating together. This arrangement resulted in significant monetary transactions directed to Buch from ICICI while she served as the Whole Time Member of SEBI.”

Although he maintains these accusations, there has been no response from Buch regarding Chandra’s claims at the time of this report.

In August 2023, SEBI issued a directive barring Chandra and his son from holding significant roles within four group firms. Previous investigations have implicated Chandra in fraudulent activities linked to Shirpur Gold Refinery, another firm associated with the Essel Group.

The scrutiny by SEBI has been cited as a factor that disrupted a $10 billion merger deal between Zee and the Indian subsidiary of Japan’s Sony, illustrating the far-reaching consequences of the ongoing investigations.

Chandra has also criticized SEBI for imposing penalties on two mutual fund companies that had invested in his group, expressing concern over the regulatory body’s actions against him and his family.