Business

Top S&P 500 ETFs for 2025: Key Funds to Consider

NEW YORK, NY — The S&P 500 Index, a critical benchmark for the U.S. stock market, has shown an average annual return of about 10 percent over the long term. Many investors seek exposure to the index through exchange-traded funds (ETFs).

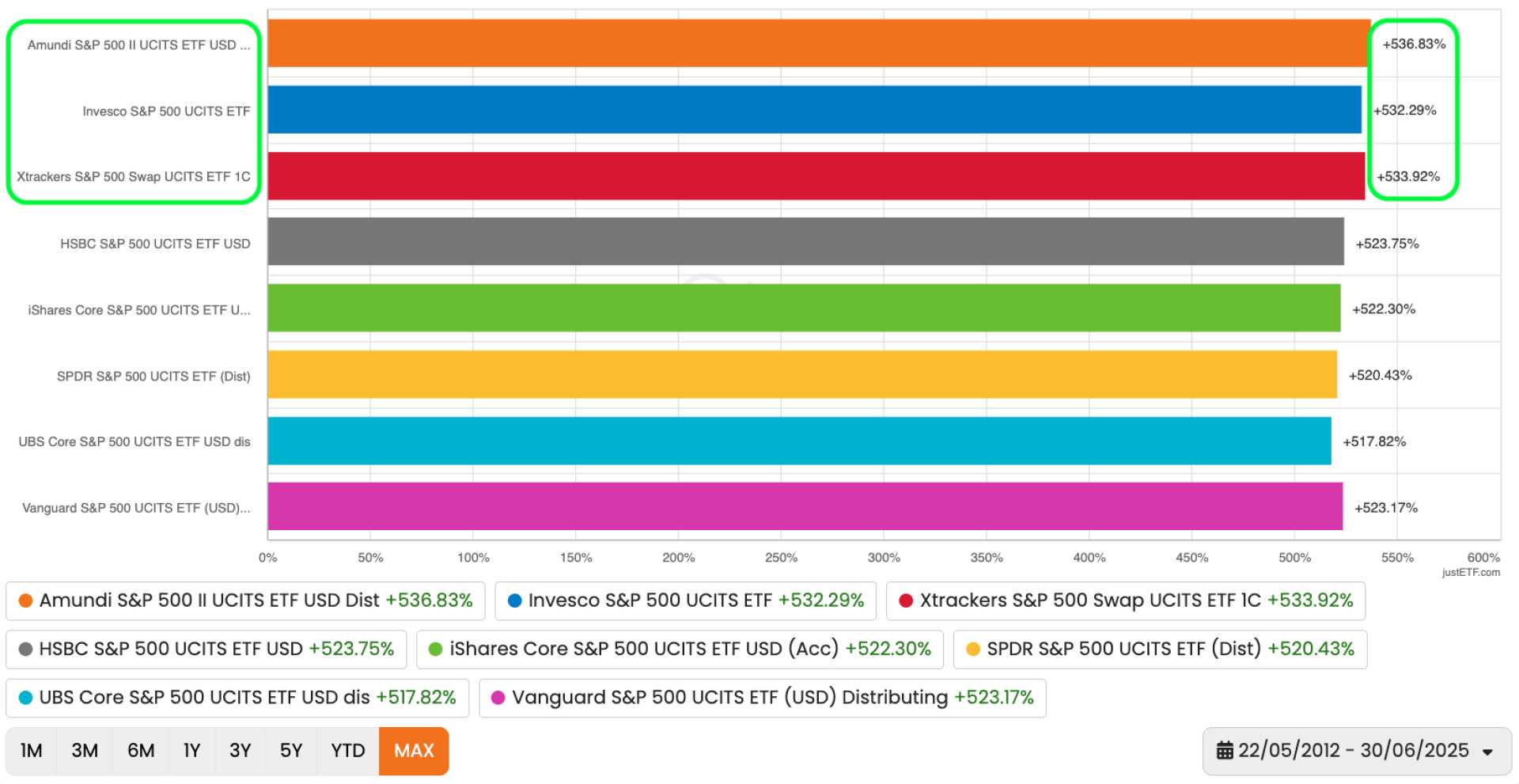

Investors can easily buy ETFs that replicate the index’s performance, such as funds that invest in stocks weighted by their market capitalization. These funds are typically passively managed and reflect official changes to the index. Here are some top S&P 500 ETFs to consider based on their performance and expense ratios as of July 31, 2025.

The Vanguard S&P 500 ETF is a popular choice with a five-year annualized return of 16.1 percent and an expense ratio of 0.03 percent. Similarly, the iShares S&P 500 ETF also boasts a 16.1 percent return and the same low expense ratio.

The State Street SPDR S&P 500 ETF Trust, known as the granddaddy of U.S. ETFs, has a five-year annualized return of 16 percent but comes with a higher expense ratio of 0.095 percent. Another State Street fund offers an expense ratio of 0.02 percent with a comparable return of 16.1 percent.

Several funds provide alternative exposures, such as equal-weighted approaches. The Invesco S&P 500 Equal Weight ETF, for instance, has a five-year annualized return of 13.5 percent and a 0.20 percent expense ratio, which may benefit investors when smaller stocks perform well.

For growth-focused investors, the iShares S&P 500 Momentum ETF has a five-year return of 16.7 percent and an expense ratio of 0.18 percent. Meanwhile, the iShares S&P 500 Value ETF provides a five-year annualized return of 14.3 percent at the same expense ratio.

Warren Buffett has advised investors to buy the S&P 500 index instead of picking individual stocks. Buying an S&P 500 fund is simple and accessible through various brokerage accounts.

Many investors favor these ETFs due to low fees and strong returns, making them a staple in retirement and investment portfolios.

The Vanguard, iShares, and State Street funds listed present dependable options for investing in the U.S. equity market.