Business

Trump Eases Tension Over Fed Chair and Trade Policies

WASHINGTON, D.C. — President Donald Trump calmed market fears Wednesday after backing down from threats to remove Federal Reserve Chair Jerome Powell amid rising tensions over trade policies, particularly with China. Following alarming conversations with his top advisers and major CEOs, Trump’s remarks in the Oval Office sparked a rally on Wall Street.

On Tuesday, Trump told reporters, “I never did” intend to dismiss Powell, relieving anxiety among investors and administration officials who were concerned about a potential power struggle. The Dow Jones Industrial Average surged by 678 points, a 1.73% increase, while the S&P 500 and Nasdaq also saw notable gains.

The markets responded favorably to statements made by Treasury Secretary Scott Bessent, who indicated that Trump was seeking to ease the trade war with China. “We are happy about the return of stability to the markets,” one financial strategist noted.

Bessent emphasized that reaching a balance in trade relations with China could take two to three years, highlighting ongoing uncertainties. As tensions have flared over tariffs imposed by the Trump administration, CEOs from major retailers, including Walmart and Target, expressed their concerns directly to Trump during a private meeting. They warned of significant disruptions in supply chains that could lead to empty store shelves.

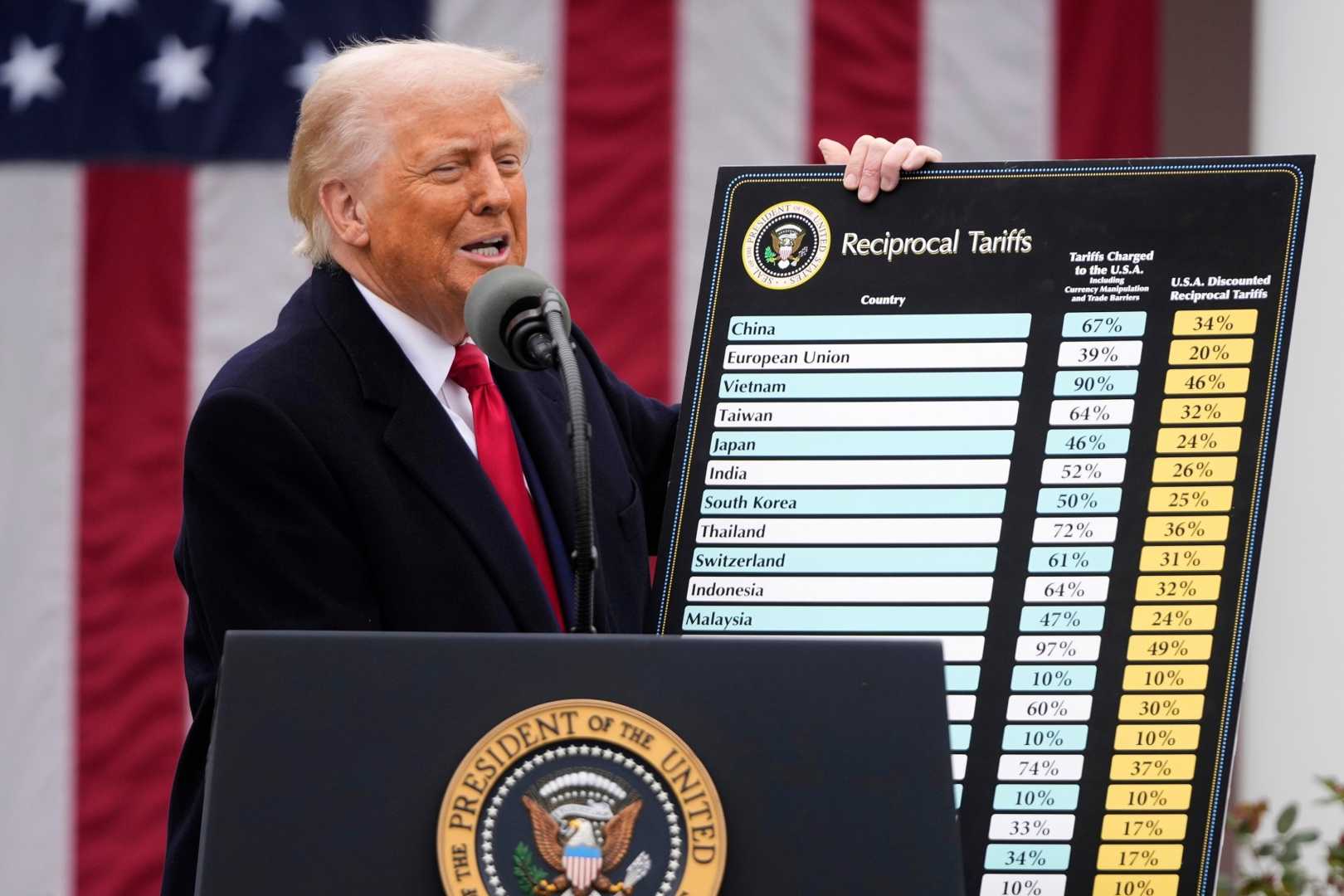

During his remarks, Trump maintained a positive outlook, stating that his administration aims for a “fair deal” with China and that all negotiations “are going very well.” His comments signaled a shift as he addressed the rising economic fallout from his tariff policies.

Moreover, the latest market fluctuations came as investors flocked back to U.S. Treasury bonds, pushing down the benchmark 10-year yield to 4.36%. The volatility in financial markets had stemmed from the president’s earlier confrontational stance towards Powell, which had left many business leaders uneasy about the future.

CEO Doug McMillon of Walmart warned Trump that the trade war could intensify supply chain issues by summer. The retail sector has felt immediate pressure from Trump’s tariffs, leading to growing concerns from business leaders about the economic implications.

In the backdrop of these developments, press secretary Karoline Leavitt defended the president’s criticisms of the Fed during a press briefing, alleging political motives behind the Fed’s decision-making process. However, Powell has consistently denied any political influence in his actions.

Amid fears of legal challenges and market turmoil, White House officials had previously assessed firing Powell as a risky move, ultimately data from key economic players influenced Trump’s decision to steer clear of such actions for the moment.

As the administration navigates these turbulent waters, Trump’s approach appears to have shifted toward seeking cooperation and maintaining market confidence.