Business

XRP Faces Bearish ‘Death Cross’ Amid Market Uncertainty

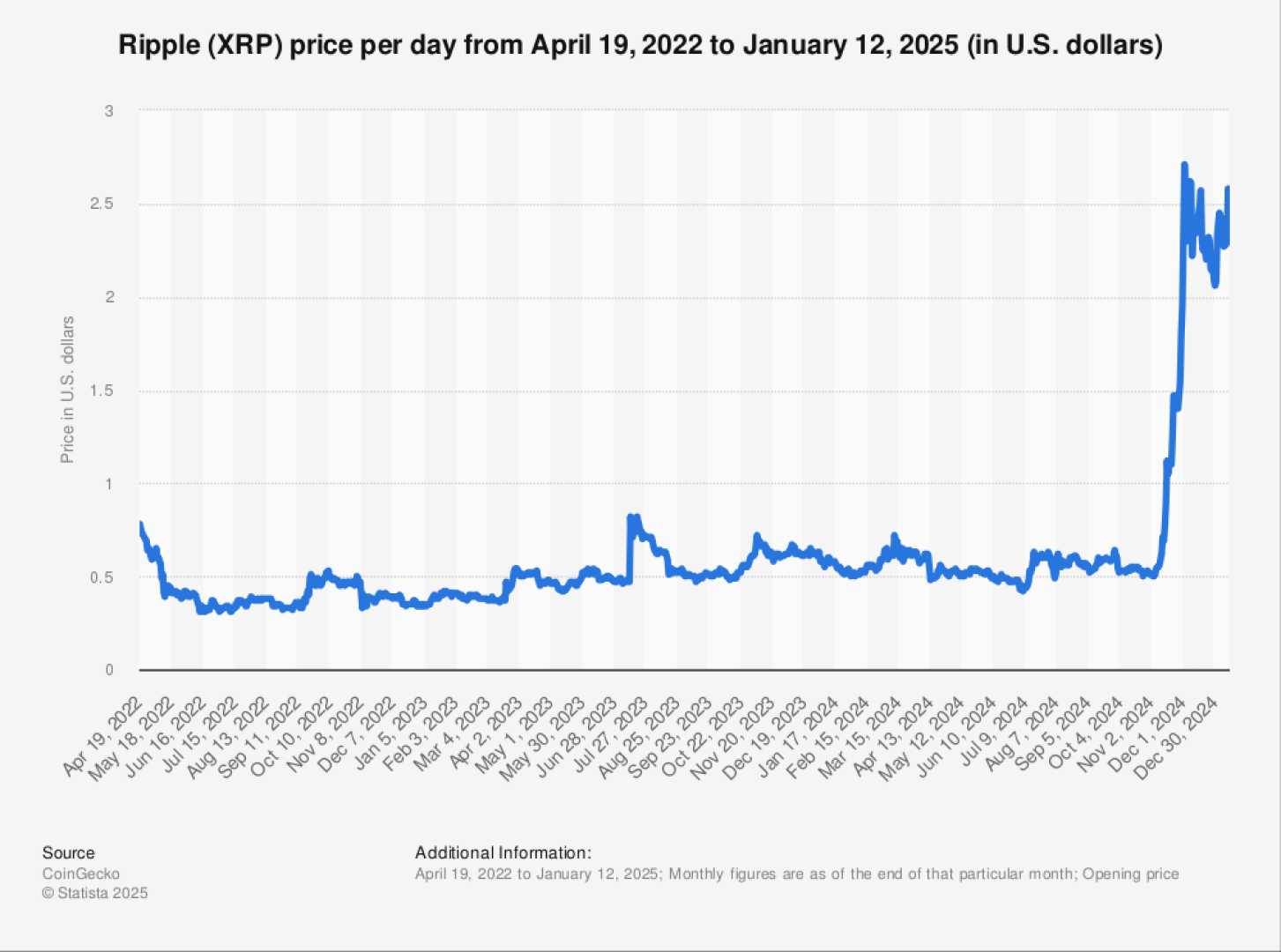

NEW YORK, Jan. 27, 2025 – XRP, the cryptocurrency primarily used for cross-border payments through Ripple Labs, has recently shown a bearish “death cross” signal on its hourly chart, raising concerns among investors about its short-term price trajectory. The death cross, which occurs when a short-term moving average crosses below a long-term moving average, suggests potential further declines in price.

Despite the bearish signal, XRP has seen a 1.03% price increase in the last 24 hours, trading at $3.18 at the time of writing. However, technical indicators remain mixed, making it challenging to predict the cryptocurrency’s next move. The Relative Strength Index (RSI) on various time frames remains in positive territory, indicating potential bullish momentum, but sustained price movements above key resistance levels are needed for confirmation.

XRP reached a high of $3.365 on Jan. 20, but the bears have since held firm. The cryptocurrency has been range-bound between $2.91 and $3.40, with buyers defending the $2.91 support level. If this support holds, XRP could break above $3.40, signaling the start of an upward trend to $4 and eventually $4.84. On the downside, the crucial support level to watch is $2.81. A break below this level could see XRP fall to $2.51, where the 50-day Simple Moving Average (SMA) lies.

Institutional hesitation and regulatory challenges are also weighing on XRP. The Chicago Mercantile Exchange (CME) recently ruled out the possibility of listing futures contracts for XRP, along with Solana‘s SOL token, citing a lack of institutional demand. This decision contradicts earlier optimism fueled by Ripple Labs CEO Brad Garlinghouse‘s meeting with former President Donald Trump, which had raised hopes for friendly regulation under the new administration.

The ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) further clouds XRP’s outlook. Institutional investors are likely to remain cautious until the regulatory overhang is resolved. Technical indicators, such as the Mayer Multiple and Moving Average Convergence Divergence (MACD), also suggest weakening upside momentum, with XRP’s price failing to sustain above $3.

XRP’s performance is closely tied to broader market dynamics, particularly Bitcoin‘s price action. As with most cryptocurrencies, XRP often follows Bitcoin’s lead, and any downward pressure on Bitcoin could drag XRP lower. The cryptocurrency’s Market Value to Realized Value (MVRV) ratio is currently at an extremely high level, indicating that many investors are sitting on unrealized profits. Profit-taking by these investors could further contribute to downward pressure on XRP’s price.

Despite the bearish signals, some analysts remain optimistic. Crypto tsar David Sacks recently stated that XRP will be exempt from capital gains tax for U.S. crypto investors, which could provide some support. However, traders should remain cautious and monitor both market developments and XRP’s price action closely in the coming weeks.