Business

XRP Surges 350% Amid Legal Wins and Institutional Adoption

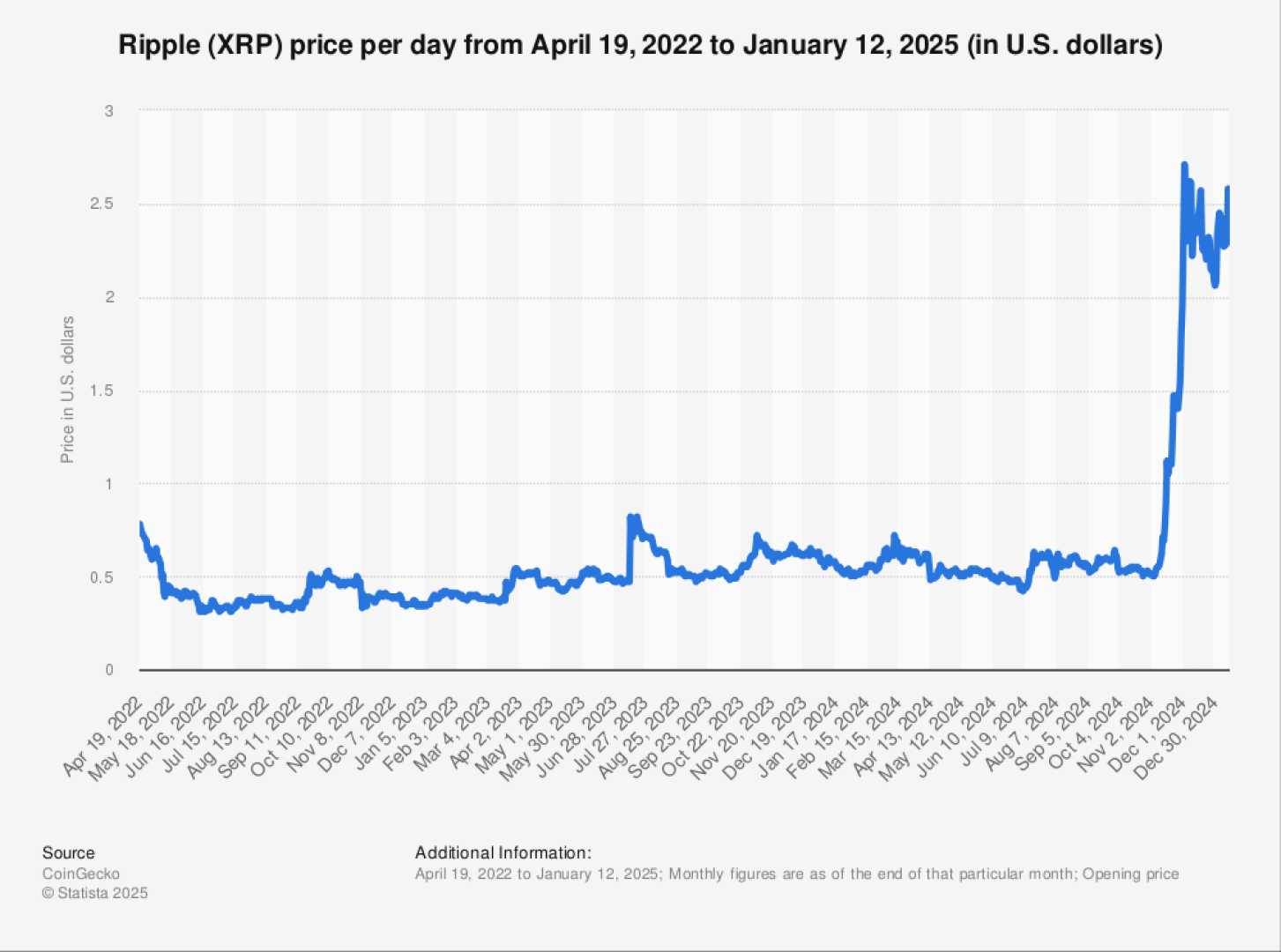

SAN FRANCISCO, Calif. — XRP, the cryptocurrency created by Ripple Labs, has experienced a meteoric rise, surging over 350% in value since early November 2024. With a market capitalization of AUD 145.6 billion, it now ranks as the third-largest digital asset, surpassing financial giants like Mastercard and Morgan Stanley. The rally reflects growing confidence in XRP’s potential as a global payment solution.

The surge has been fueled by speculative enthusiasm among retail investors, who see XRP as a viable alternative for international payments. Unlike Bitcoin, which is often viewed as digital gold, and Ethereum, which powers decentralized finance applications, XRP positions itself as a utility token for seamless cross-border transactions. Retail investors have flocked to forums like r/XRP, where over 600,000 members celebrate milestones and encourage holding the token.

Ripple Labs has actively promoted XRP as a global payment standard, emphasizing its near-instant settlements and minimal transaction fees. The company has partnered with over 300 financial institutions, including American Express, Santander, and SBI Holdings. Its On-Demand Liquidity (ODL) service, which uses XRP for real-time international payments, is now operational in over 40 markets worldwide, including Bhutan’s central bank.

XRP’s rally also coincides with Ripple’s legal victories against the U.S. Securities and Exchange Commission (SEC). In late 2024, Judge Analisa Torres ruled in Ripple’s favor, stating that XRP itself was not a security under federal law. Although the SEC has appealed the decision, the ruling significantly boosted market confidence. Ripple’s leadership expressed optimism that regulatory clarity would improve under the new administration, led by crypto-friendly Chair Paul Atkins.

Ripple has further expanded its offerings with the launch of Ripple Liquid USD (RLUSD), a stablecoin backed by cash and U.S. Treasuries. RLUSD aims to bridge the gap between traditional currencies and digital assets, enhancing XRP’s utility by simplifying conversions between fiat and crypto. Ripple’s President stated that RLUSD makes transactions faster and more secure, supporting XRP’s ecosystem.

Institutional demand for XRP has surged, with the launch of XRP exchange-traded funds (ETFs) in December 2024. Major financial firms like BlackRock, Fidelity, and Vanguard were among the first to offer XRP-backed products, attracting over AUD 7.5 billion in investments within weeks. Crypto platforms such as CME Group have introduced XRP futures, while Crypto.com offers high-yield interest products tied to XRP.

Eric Steinman, a crypto investment strategist, noted that institutional investors now view XRP as a promising high-reward asset. Despite its rapid rise, XRP faces criticism from skeptics who argue that its price increase mirrors speculative bubbles from past cycles. However, with legal victories, increased institutional adoption, and expanding use cases through ODL and RLUSD, XRP appears well-positioned for sustained growth in the evolving crypto landscape.

As of January 2025, XRP’s market cap stands at AUD 145.6 billion, with a 24-hour trading volume of AUD 7.3 billion. Its price has increased by 343% over six months and 379% year-on-year. While the future remains uncertain, XRP’s growing utility and institutional interest suggest it will remain a key player in the cryptocurrency market.