Business

YieldMax ETF Faces Scrutiny Amid Ongoing Market Concerns

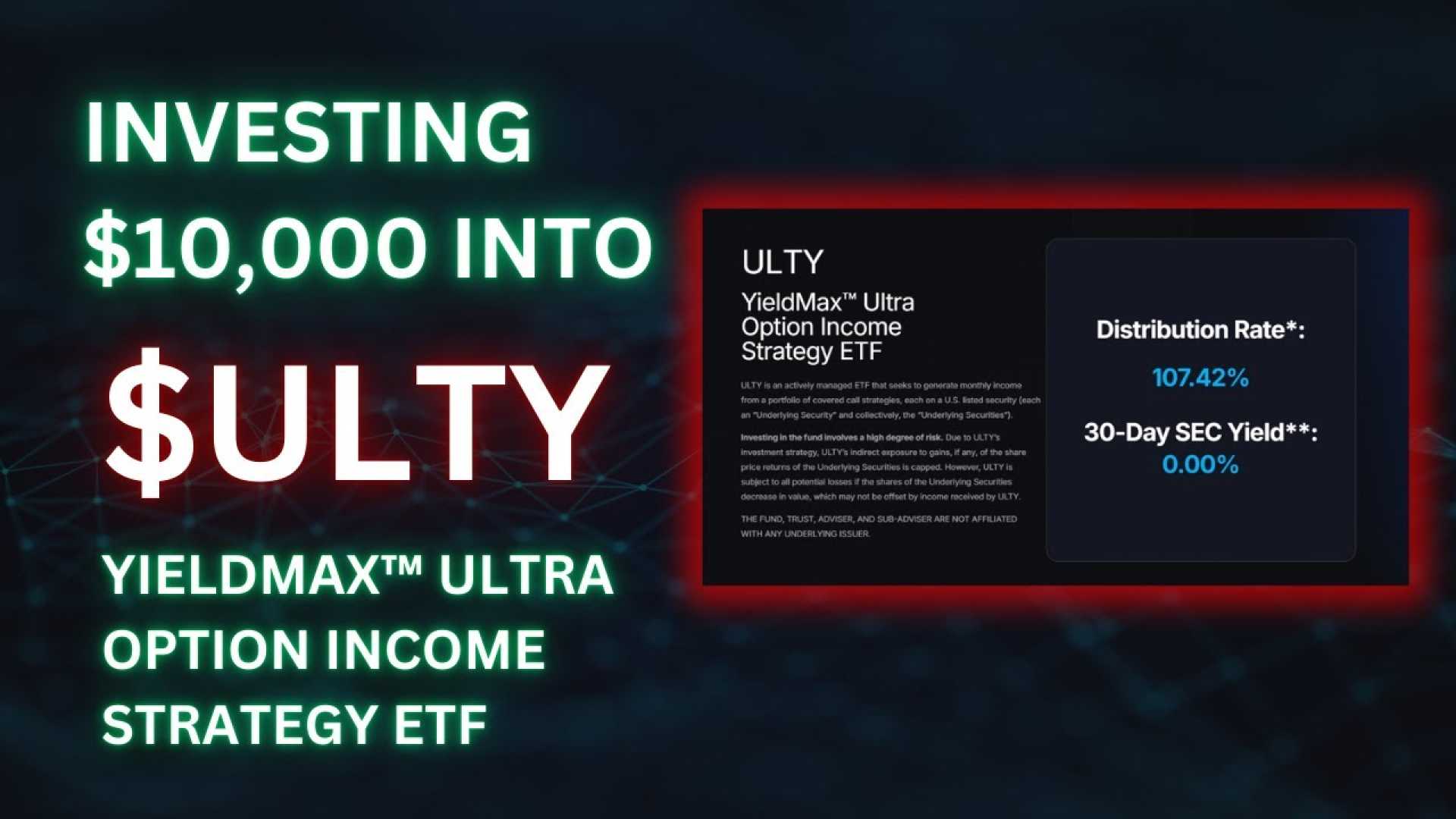

CHICAGO, IL – The YieldMax Ultra Option Income Strategy ETF (ULTY) has gained attention for its high yield opportunities, boasting distributions equivalent to 126% of its market price in the past year. However, questions about the fund’s long-term viability are emerging as market volatility continues to fluctuate.

Since its launch on Feb. 28, 2024, the fund has utilized an options strategy to generate income, mainly through selling call options on a portfolio of around 20 individual stocks. Despite its impressive yields, a decline in the fund’s distribution rate to approximately 88% has raised concerns about its sustainability.

“Despite the eye-popping yields, shareholders weren’t really making money,” said an analyst. “The fund lost 2.25% on a total return basis from its inception through February 2025.”

In response to disappointing returns, from November 2024, the fund enacted a more conservative strategy, introducing options collar strategies. This method mixes buying put options with selling call options to manage potential losses. By March 2025, the fund shifted to a weekly dividend schedule to align its income collection more closely with shareholder payouts.

From March 10 to Aug. 13, 2025, ULTY reported a total return of 27.7%, outperforming the Nasdaq 100 index, which saw an 18.4% return in the same timeframe. However, the fund’s net asset value (NAV) fluctuated, starting at $6.31 per share and dropping to $6.08 per share in early April after market disturbances.

Market volatility plays a crucial role in the fund’s performance, allowing it to capitalize on high option premiums. Yet, challenges remain, as approximately 40.8% of the fund’s recent distribution was classified as a return of capital, raising red flags about sustainability. Concerns are growing regarding the fund’s ability to maintain its high distributions in less favorable market conditions.

“More money has been lost reaching for yield than at the point of a gun,” noted Raymond DeVoe, Jr., capturing the underlying caution surrounding this investment approach.

Both analysts and potential investors remain skeptical about the fund’s risk-reward ratio, particularly as it concentrates its portfolio around just 25 stocks. There are worries about the increasing costs of put options and the fund’s capacity to generate enough income without eroding shareholder value.