Business

Mortgage Rates Drop Slightly Amid Economic Uncertainty

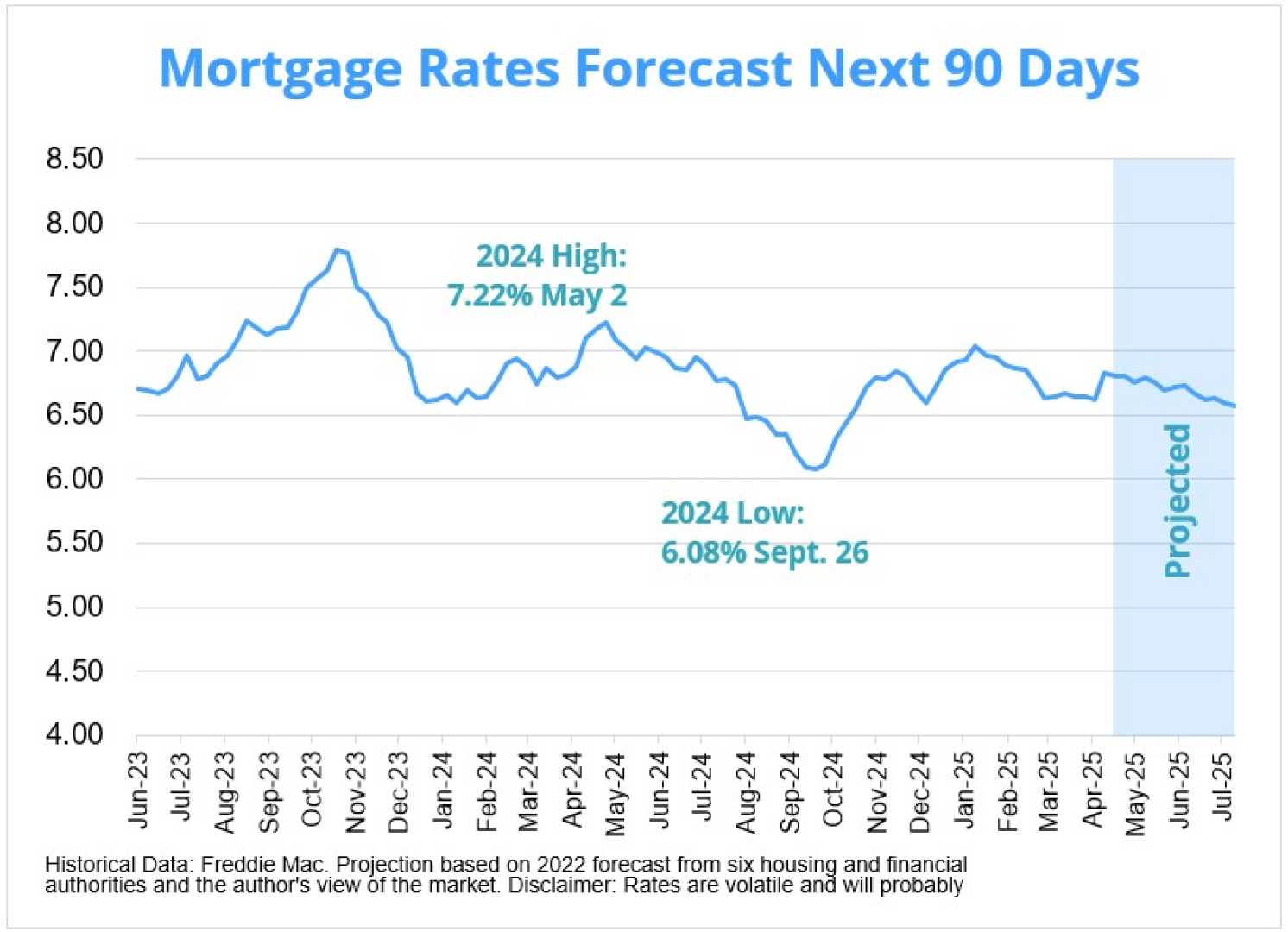

WASHINGTON, D.C. — After three weeks of rising mortgage rates, the average 30-year fixed-rate mortgage fell to 6.85% on June 5, down from 6.89% a week earlier, according to Freddie Mac.

This decline marks 20 consecutive weeks where the rate has remained below 7%. “Mortgage rates near 7% are keeping mortgage activity in a holding pattern,” said Bob Broeksmit, CEO of the Mortgage Bankers Association.

Despite the drop, refinance and home purchase applications remain higher than last year, with expectations that mortgage rates will decrease further to 6.6% by the end of 2025, which may boost demand.

Danielle Hale, chief economist at Realtor.com, advised home shoppers to be prepared for fluctuating rates. “Home shoppers in June would be wise to anticipate some volatility and be prepared to respond nimbly,” Hale noted.

Throughout 2023, mortgage rates varied significantly, dipping as low as 6.09% and climbing as high as 7.79%. Predictions for June 2025 suggest rates will stay within the range of 6.8% to 6.9%. “The fate of the 30-year mortgage rate in the near term rests with the bond market and that market’s reactions to long-run U.S. debt and deficit,” said an expert from Cotality.

Bank of America anticipates a marginal decrease, while others fear rising rates due to climbing Treasury yields and potential budgetary concerns.

Market volatility continues as inflation rates hover above the Federal Reserve’s target. The Fed has made rate cuts to combat previous inflation spikes but may reconsider their strategy amid uncertainty.

Mortgage rates remain below historical averages since the peak in 2023, and experts predict a downward trend in 2025, fueled by expectations of a cooled economy.

Additionally, it is important for mortgage shoppers to understand the different types of mortgage products available. This includes VA loans for veterans, FHA loans, and USDA loans for rural properties. Each type offers unique benefits based on individual circumstances.

As conditions remain dynamic, prospective borrowers are encouraged to shop around for the best rates and terms based on their financial positions.