Business

Record Federal Student Loan Delinquencies as Payments Resume

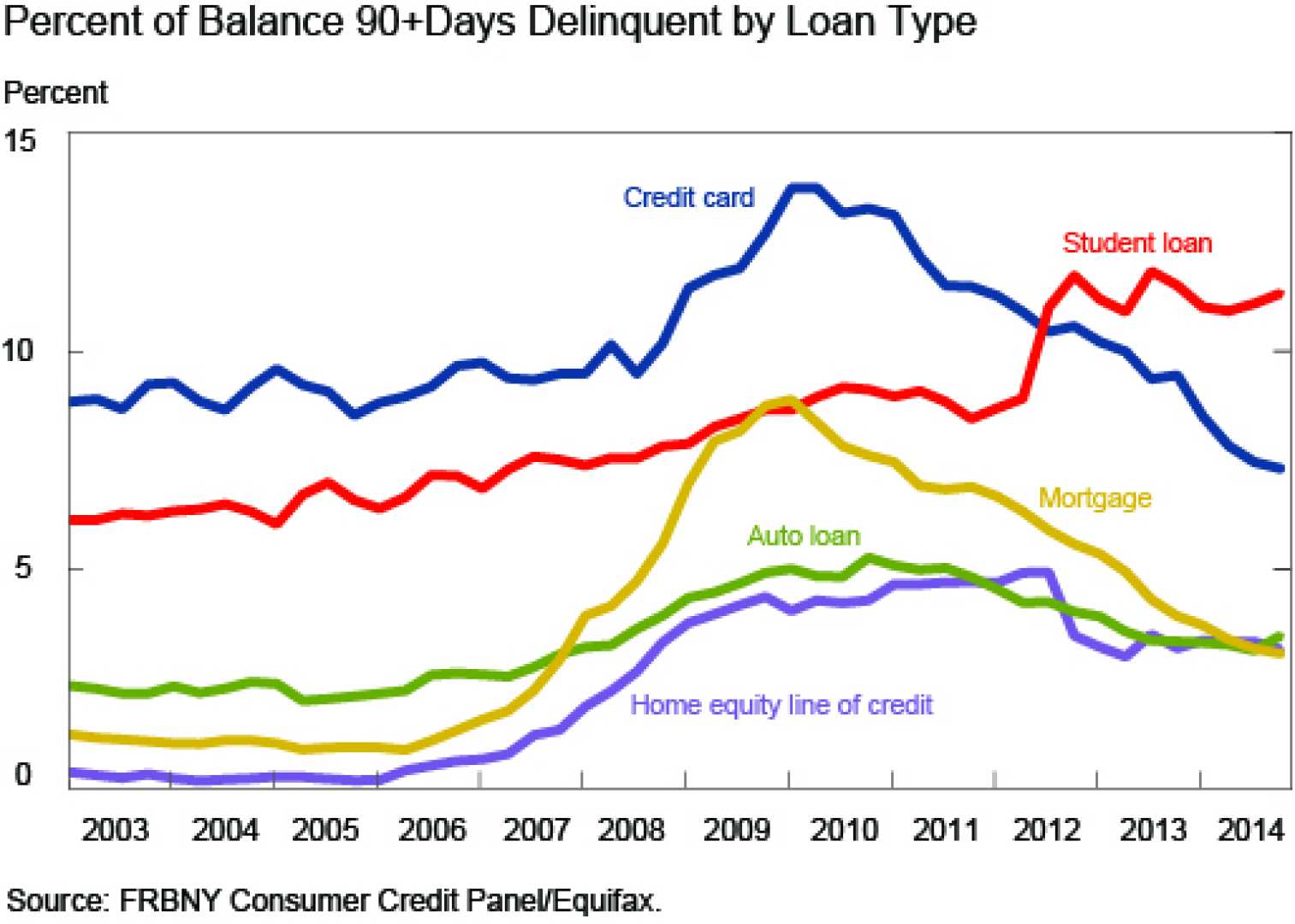

CHICAGO, June 24, 2025 (GLOBE NEWSWIRE) — A troubling trend has emerged as nearly one in three federal student loan borrowers are at risk of defaulting on their payments. According to new data from TransUnion, 31% of federal loan borrowers were 90 days or more past due as of April 2025. This figure marks a significant increase from 20.5% in February 2025 and is nearly triple the 11.7% recorded before the COVID-19 pandemic.

As the U.S. Department of Education resumed collection activities on defaulted student loans, approximately 5.8 million borrowers found themselves behind on their payments. The looming deadlines for payments have caused concern among financial experts, as about 1.8 million borrowers are projected to default as early as July 2025.

The consequences of falling behind are severe. Delinquent borrowers have seen a dramatic drop in their credit scores—averaging a decline of 60 points, according to TransUnion’s report. Over 20% of those who are now considered delinquent were previously in prime credit risk brackets, illustrating the widespread impact of the payment resumption.

Commenting on the situation, Michele Raneri, vice president and head of U.S. research and consulting at TransUnion, said, “We continue to see more and more federal student loan borrowers being reported as 90+ days delinquent, making a larger number of consumers vulnerable to entering default.” He also noted that despite the alarming figures, only 0.3% of the delinquent borrowers have officially entered default status as of now.

TransUnion warns that failure to address these delinquencies can lead to aggressive collection efforts, including potential wage garnishments. The data underscores the importance for borrowers to communicate with their loan servicers about available repayment options, such as income-driven repayment plans, to avoid the risk of default.

In an era where student debt affects millions, the rise in delinquencies signals a critical challenge for borrowers to manage their financial obligations. “Options may include income-driven repayment or other payment plans specific to their situation,” added Raneri.