Business

Nvidia Becomes First Company to Reach $4 Trillion Market Value

New York, NY — Nvidia reached a market value of $4 trillion on Wednesday, becoming the first publicly traded company to achieve this milestone. Shares of Nvidia rose by 2.5% shortly after the market opened, setting an intraday record that pushed its valuation above $4 trillion.

The chipmaker has enjoyed remarkable growth, hitting approximately a 20% increase this year alone, largely fueled by its critical role in the ongoing artificial intelligence boom. Analysts attribute Nvidia’s rapid ascent to the growing demand for its chips, which play a vital role in powering AI data centers operated by major corporations, including Microsoft, Amazon, and Google.

Nvidia surpassed Apple and Microsoft to be the first to reach the $4 trillion mark. Apple, which began the year valued at around $3.9 trillion, faced challenges linked to tariff issues under former President Donald Trump. Throughout the year, Nvidia and Microsoft exchanged positions as the world’s most valuable company before Nvidia climbed ahead.

Global spending on artificial intelligence infrastructure is projected to exceed $200 billion by 2028, according to market research forecasts. Nvidia reported revenue of $44.1 billion, a 69% increase from the previous year.

“Nvidia is the foundation for the AI Revolution,” remarked Dan Ives, an analyst at Wedbush Securities, pointing to the company’s influential role in shaping the AI landscape.

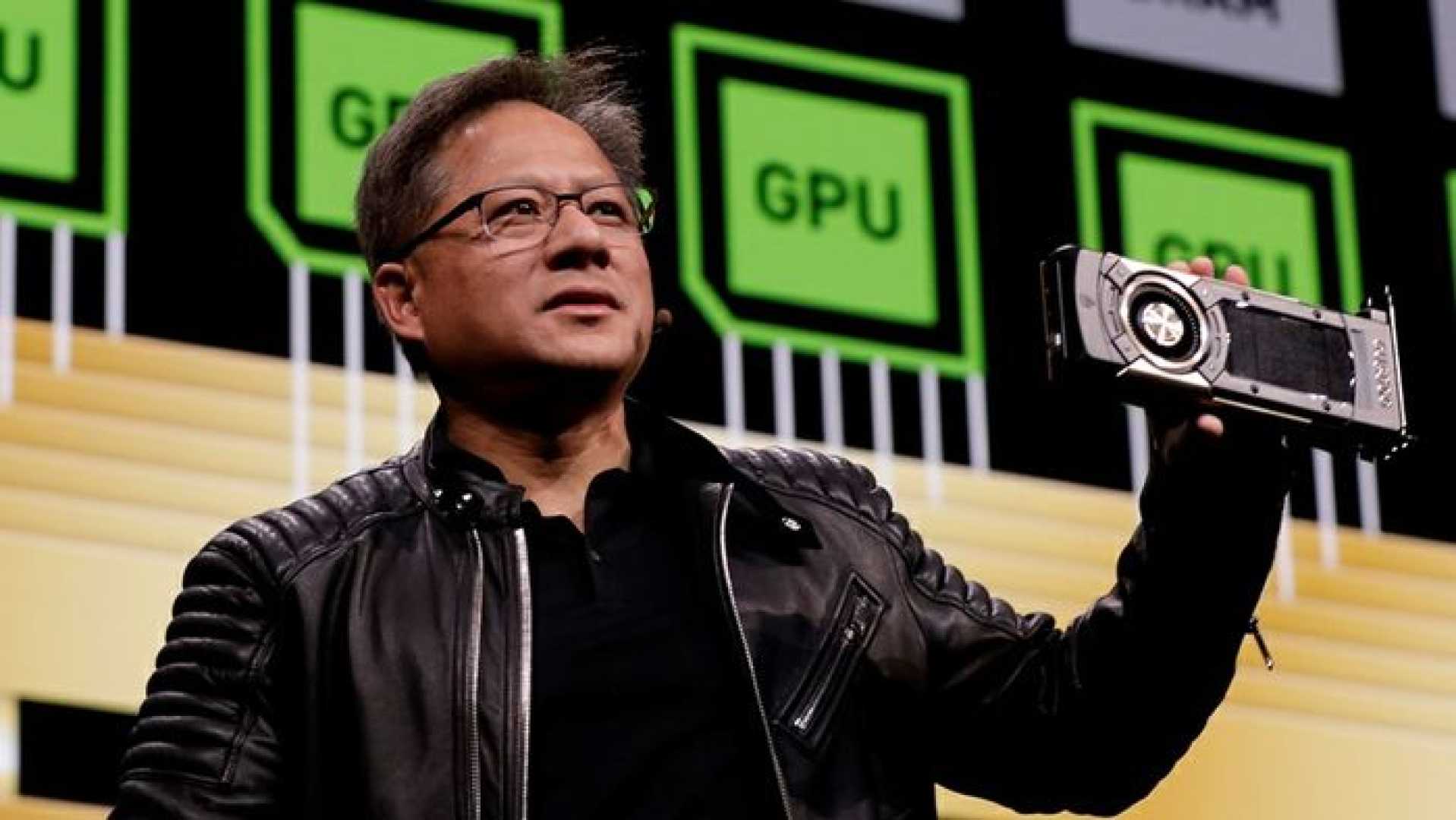

Founded in 1993, Nvidia gained fame for its graphics processing units, especially enjoyed by PC gamers, but is now expanding into sectors like autonomous transportation. During its annual developers’ conference this past March, the company revealed plans for its enhanced Blackwell chip designed to better support advanced AI models.

Nvidia’s CEO, Jensen Huang, has emerged as one of the world’s wealthiest individuals, currently ranked tenth with a net worth of approximately $140 billion. His connections with political leaders, including former President Trump, have raised his profile beyond the tech industry.

Despite its successes, the company faces challenges, particularly from emerging competitors and regulatory barriers affecting its chip sales to China. Earlier this year, Nvidia disclosed a $2.5 billion revenue shortfall due to restrictions on its AI chip exports to China.

Huang remains optimistic about the company’s prospects, stating that AI will soon become integral across various industries. “We’re at the beginning of that,” he said during a recent earnings call.

Market analysts predict further growth for Nvidia, with expectations for the company to potentially achieve a $6 trillion market cap by 2028.