Health

ACA Insurers Propose Largest Premium Hike Since 2018

Washington, D.C. — As the deadline for 2026 rate filings approaches, ACA Marketplace insurers are proposing a median premium increase of 15%, marking the largest hike since 2018. This increase is linked to rising healthcare costs and significant policy changes.

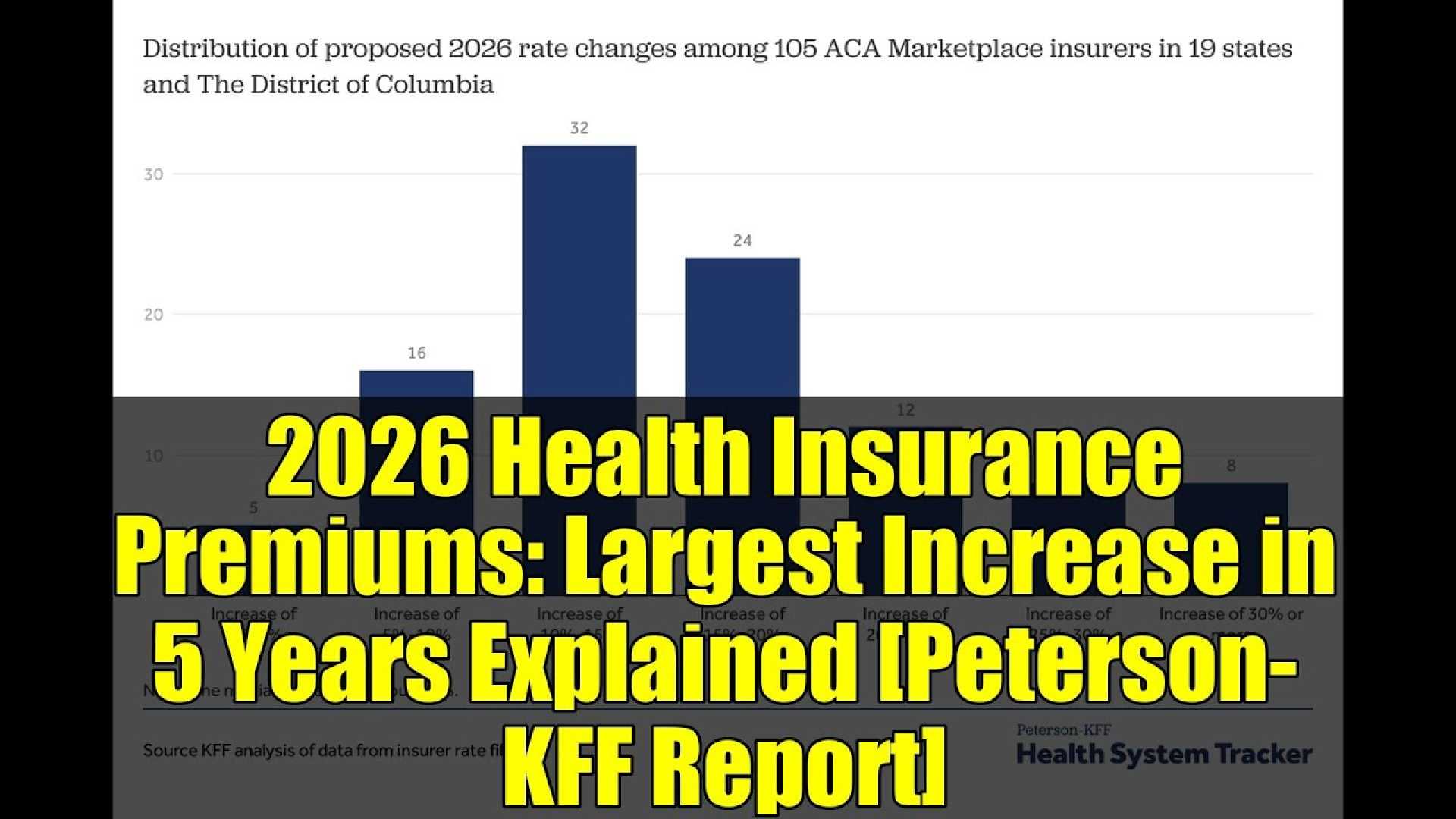

The analysis, conducted by KFF and the Peterson Center on Healthcare, examined preliminary filings from 105 insurers across 19 states and Washington, D.C. Most insurers are seeking hikes of 10% to 20%, while 27% are proposing increases of 20% or more.

This surge in premiums comes as insurers cite the expiration of enhanced premium tax credits at the end of 2025 as a key contributor. If Congress does not extend these tax credits, which have helped subsidize costs for ACA enrollees over the past five years, premiums for subsidized individuals could rise significantly.

“The out-of-pocket change for individuals will be immense,” said JoAnn Volk, co-director of the Center on Health Insurance Reforms at Georgetown University. “Many won’t actually be able to make ends meet and pay premiums.”

Health insurers attribute the proposed increases to a combination of factors, including increased costs for medical services, labor expenses, and the anticipated impact of tariffs on pharmaceuticals and medical supplies, expected to add approximately 3% to premiums.

Insurers have also reported increases in medical usage and specific drug costs, particularly for obesity treatments, as contributing factors to their rate filings. “The underlying medical cost trends are in line with last year’s reports,” said Cynthia Cox, a KFF vice president.

The finalized rate changes for 2026 are expected to be released later this summer, just before the open enrollment period beginning on November 1. There remains uncertainty around the potential political actions Congress may take to extend the enhanced tax credits, which could significantly affect premium levels and consumer enrollment in the ACA Marketplace.