Business

Lululemon’s Price Target Dropped by Analysts, Stock Shows Mixed Ratings

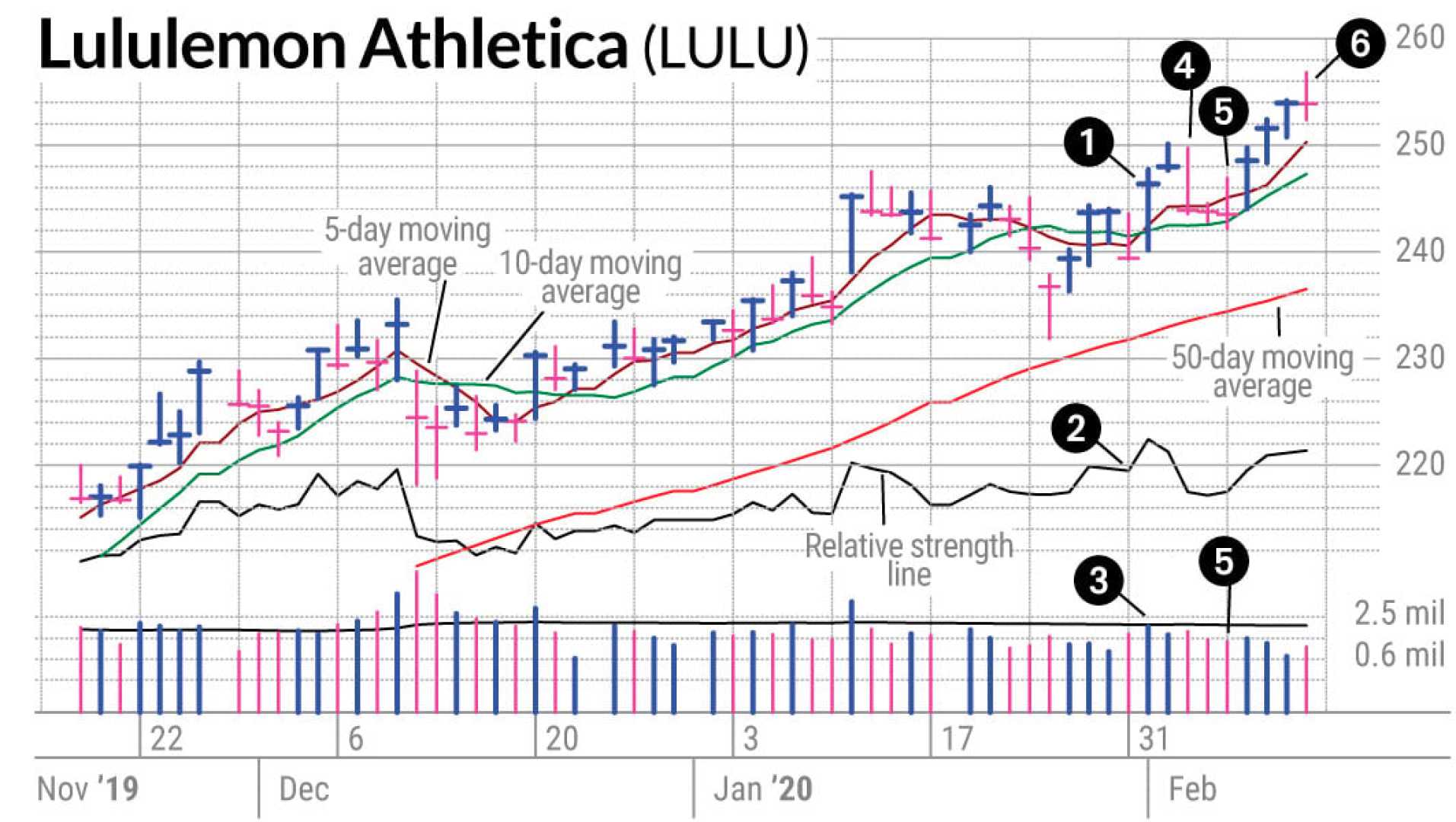

New York, NY — Analysts at Robert W. Baird have reduced the price target for lululemon athletica from $340.00 to $260.00 in a note to investors on Monday. The company currently holds an “outperform” rating, suggesting potential growth despite the target cut. This new price reflects a possible upside of 34.76% from the stock’s last closing price.

Other investment firms have also weighed in on lululemon’s stock. UBS Group lowered its target from $330.00 to $290.00, maintaining a “neutral” rating as of June 6. Barclays set a new price target of $209.00, down from $270.00, on August 6. Conversely, TD Securities increased their price target slightly from $370.00 to $373.00, rating the stock as a “buy.” Stifel Nicolaus also rated the stock as a “buy,” adjusting their target from $353.00 to $324.00 on June 6. Jefferies Financial Group, however, went in the opposite direction, lowering their target to $200.00 and rating the stock as “underperform.”

Currently, there is a varied consensus on lululemon. One analyst has a sell rating, thirteen have issued holds, sixteen have provided buy ratings, and one gave a strong buy rating. According to MarketBeat.com, the stock now holds a consensus rating of “Moderate Buy” with an average target price of $327.15.

Lululemon’s stock opened at $192.93 on Monday, having a 1-year low of $185.95 and high of $423.32. The company’s market capitalization is $23.12 billion, coupled with a price-to-earnings ratio of 13.07 and a beta of 1.16. In its latest quarterly earnings report on June 5, lululemon posted earnings of $2.60 per share, matching estimates and showing a revenue increase to $2.37 billion.

In noteworthy company news, the CEO sold 27,049 shares on June 27 at an average price of $235.69, totaling approximately $6.4 million. This sale led to a 19.66% decrease in their ownership. The filing is available through the SEC.

Institutional investors control 85.20% of lululemon’s stock, with notable recent transactions including N.E.W. Advisory Services LLC’s investment in the first quarter, and Cornerstone Planning Group LLC increasing its stake by over 500% during the same period.

Lululemon Athletica Inc., along with its subsidiaries, designs and distributes athletic apparel targeted at both women and men, including products for yoga, running, and training, as well as fitness accessories.