Business

Palo Alto Networks Q4 Earnings Exceed Estimates, Stock Rises 6%

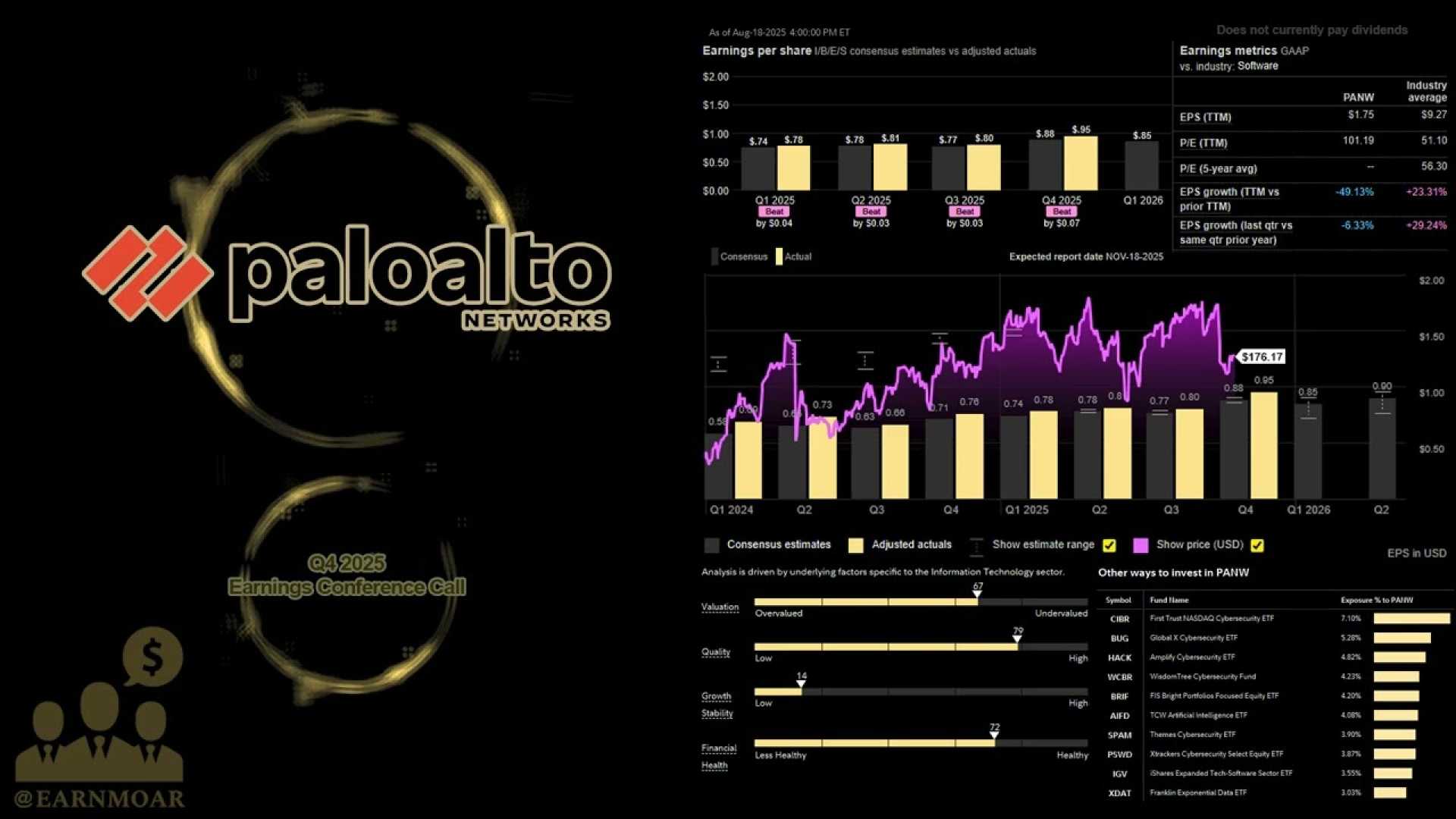

Palo Alto, California – Palo Alto Networks recently announced its Q4 results for fiscal year 2025, concluding in July. The tech company reported earnings that beat analyst expectations, while its revenue aligned with forecasts. Following this positive news, shares surged more than 6% in after-hours trading.

The company’s optimistic outlook for fiscal 2026 fueled investor enthusiasm. Despite some analysts noting that the stock is trading at a premium, its solid operational performance and financial stability support the valuation. Analysts noted that Palo Alto Networks has a history of favorable returns following earnings announcements.

Palo Alto Networks’ report showed significant metrics across four key areas: growth, profitability, financial stability, and resilience during downturns. Notably, its profit margins were reported to exceed those of many competitors in the cybersecurity sector.

With shares now priced around $185, analysts suggest the stock carries potential for a 15% upside based on an average price target of $214. However, the competitive landscape poses risks that could influence valuations moving forward.

The analysis indicates that for investors willing to tolerate higher risk over a 3- to 5-year period, Palo Alto Networks could provide substantial long-term gains, despite its current premium in the market.

Additionally, the comparison with peers shows that Palo Alto Networks maintains favorable metrics versus competitors like Fortinet and CrowdStrike, which also trade at higher multiples relative to their revenues.