Business

Millennials Surpass Boomers in Retirement Savings Participation

Washington, D.C. – In a notable shift, millennials have outpaced baby boomers in participating in retirement savings accounts. As of 2022, 61.5% of millennials held retirement accounts, compared to the 57% of boomers, according to U.S. Census data.

The increase in millennial participation is attributed to a variety of retirement plan options available today, including the widespread adoption of 401(k) plans. A study by Vanguard revealed that retirement plan participation rates across all age groups increased by over 32% between 2006 and 2021. This surge is partly due to features like automatic enrollment, which rose from 11% in 2006 to 50% by 2021.

Megan Yost, senior vice president at Segal, explained the key differences between pension plans and 401(k) accounts. “Pension plans provide guaranteed income in retirement, while 401(k) plans function as savings accounts, requiring individuals to manage their funds,” she said.

Millennials are also taking advantage of target-date funds (TDFs), which allow for a diversified mix of stocks and bonds that become more conservative as retirement approaches. Currently, about 47% of automatic enrollment 401(k) plans offer TDFs.

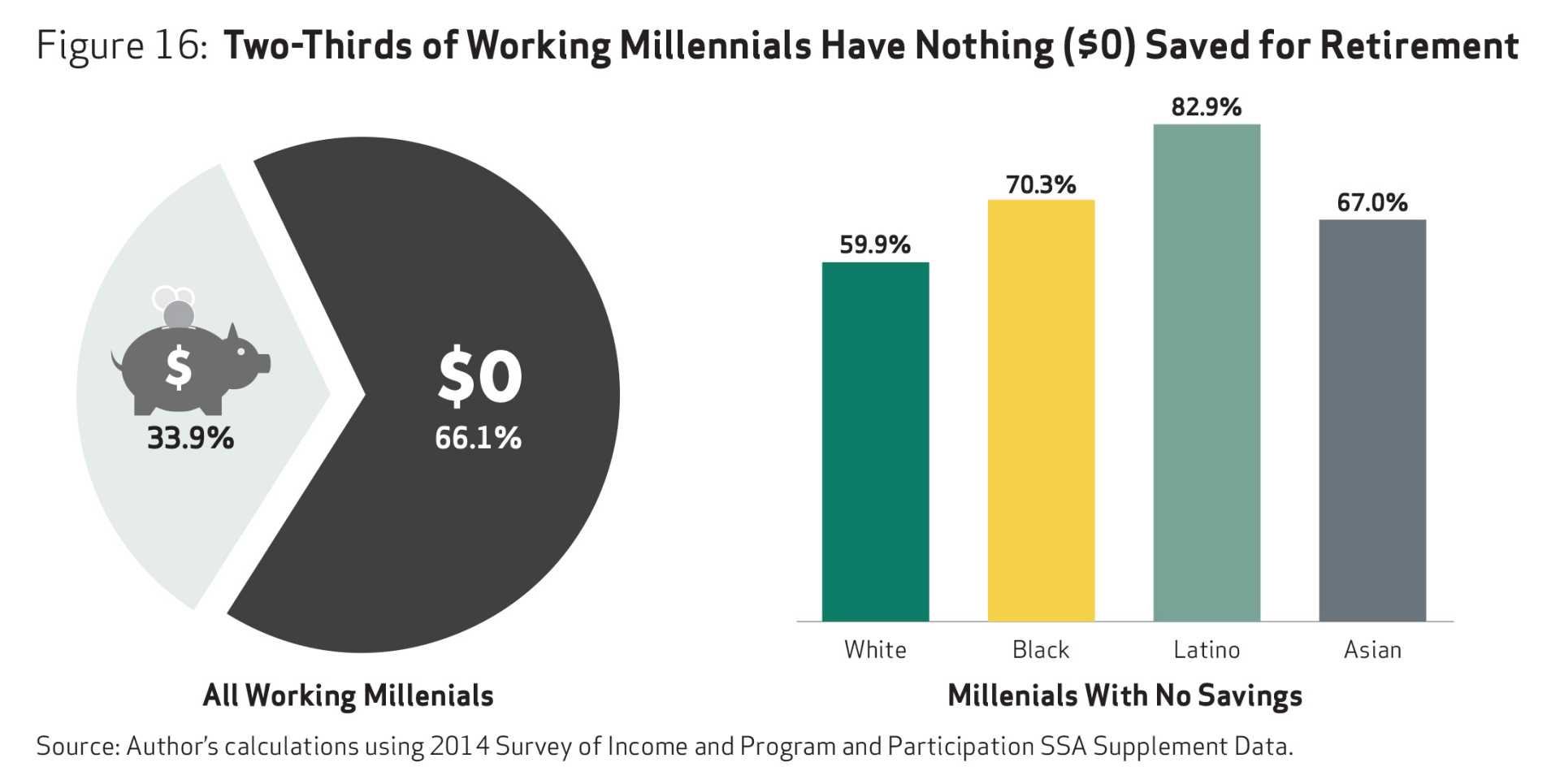

Despite their proactive approach to retirement, many millennials face significant financial challenges. A study by TIAA found that 42% of young adults live paycheck to paycheck, and two-thirds cannot manage an unexpected expense. These financial strains often hinder their ability to save.

Child care costs have surged, averaging $15,600 annually per child, which impacts many families’ budgets. Moreover, medical debt has now overtaken student loans as a major debt source, with 11% of millennials citing it as their primary financial burden.

Additionally, homeownership remains out of reach for many millennials. According to a Northwestern Mutual survey, 58% of millennials not currently homeowners believe buying a home will never be financially feasible. Factors like high mortgage rates and a competitive housing market contribute to this sentiment.

While millennials have adopted saving habits earlier than previous generations, they remain susceptible to financial challenges that impact their overall well-being.

Yost noted, “There are fewer single-family homes available today than when millennials’ parents were their age. Home prices and interest rates are higher, affecting affordability.”

The findings highlight both the efforts millennials are making towards retirement planning and the obstacles they must navigate in their financial journeys.