Business

Analysts Remain Bullish on Microsoft Ahead of Q1 Earnings Report

REDMOND, Wash. — Analysts are optimistic about Microsoft Corporation ahead of its Q1 FY2026 earnings report set to be released on October 28, 2025. Despite brief fluctuations in sentiment, the company’s leadership in artificial intelligence (AI) and cloud services continues to garner strong support from financial analysts.

UBS recently maintained a “Buy” rating on Microsoft, raising its price target to $650 as of October 22, highlighting the growth of its Azure cloud platform and improved demand among enterprises. On October 20, Bank of America echoed this sentiment by also issuing a “Buy” rating with a target of $640, noting Microsoft’s significant deal activity and anticipated revenue upsurge in Q1, estimating potential revenue could reach up to $77 billion.

Cantor Fitzgerald reiterated its “Overweight” stance, commending the company’s transition beyond Windows 10, which opens up new revenue avenues through enhanced cloud services and security products. This reflects the company’s multiple growth catalysts amid a rapidly changing technology landscape.

On a broader scale, Microsoft has been heavily investing in AI capabilities and cloud infrastructure. Their cloud division, Azure, is noted as a key growth driver, with revenue increasing by 39% in the most recent quarter, outpacing competitors like Amazon‘s AWS and Google Cloud.

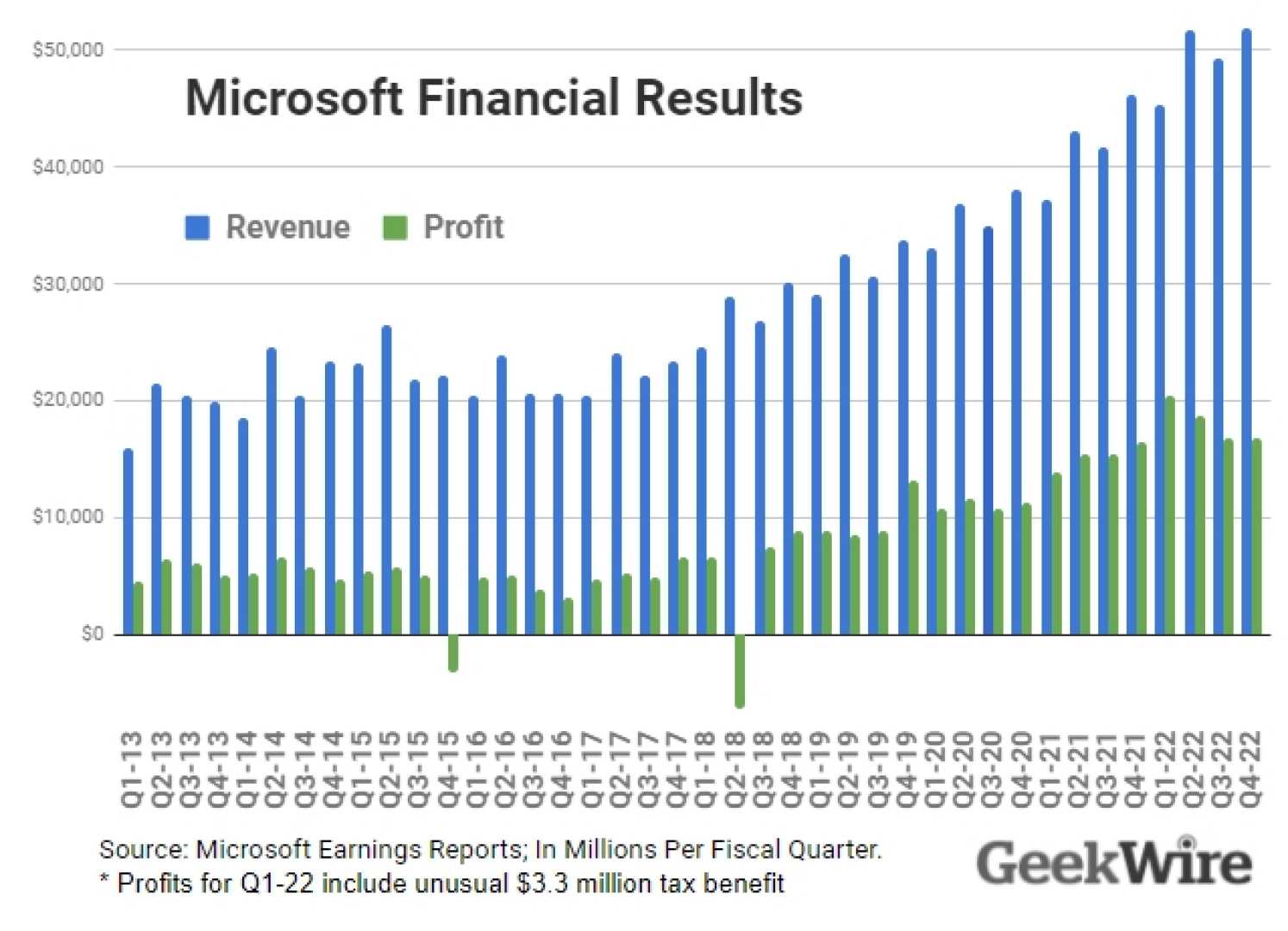

In a recent earnings report for the fiscal year 2025, Microsoft recorded $281.7 billion in revenue, an increase of 15% year-over-year. The positive results were largely attributed to high demand for Azure and AI-related services.

As investors await the upcoming earnings announcement, analysts are keenly watching the performance of Microsoft’s AI offerings, particularly the adoption of Copilot within the Office applications. Strong enterprise demand for these new tools could signal further growth and impact revenue positively.

Sentiment on Wall Street remains optimistic, with 32 out of 34 analysts rating Microsoft as a “Buy”. The average consensus price target suggests a healthy upside remains, reinforcing the belief in Microsoft’s capacity to leverage its position as a leader in the AI and cloud computing sectors.