News

Chicago Crypto ATMs Fuel Drug Money Laundering, Scams

CHICAGO, Ill. — Cryptocurrency ATMs in Chicago have become a hub for illicit activities, including drug money laundering and sophisticated scams, according to law enforcement officials and experts. The city, home to 1,167 crypto ATMs, has seen a surge in their use by drug traffickers and fraudsters targeting vulnerable individuals.

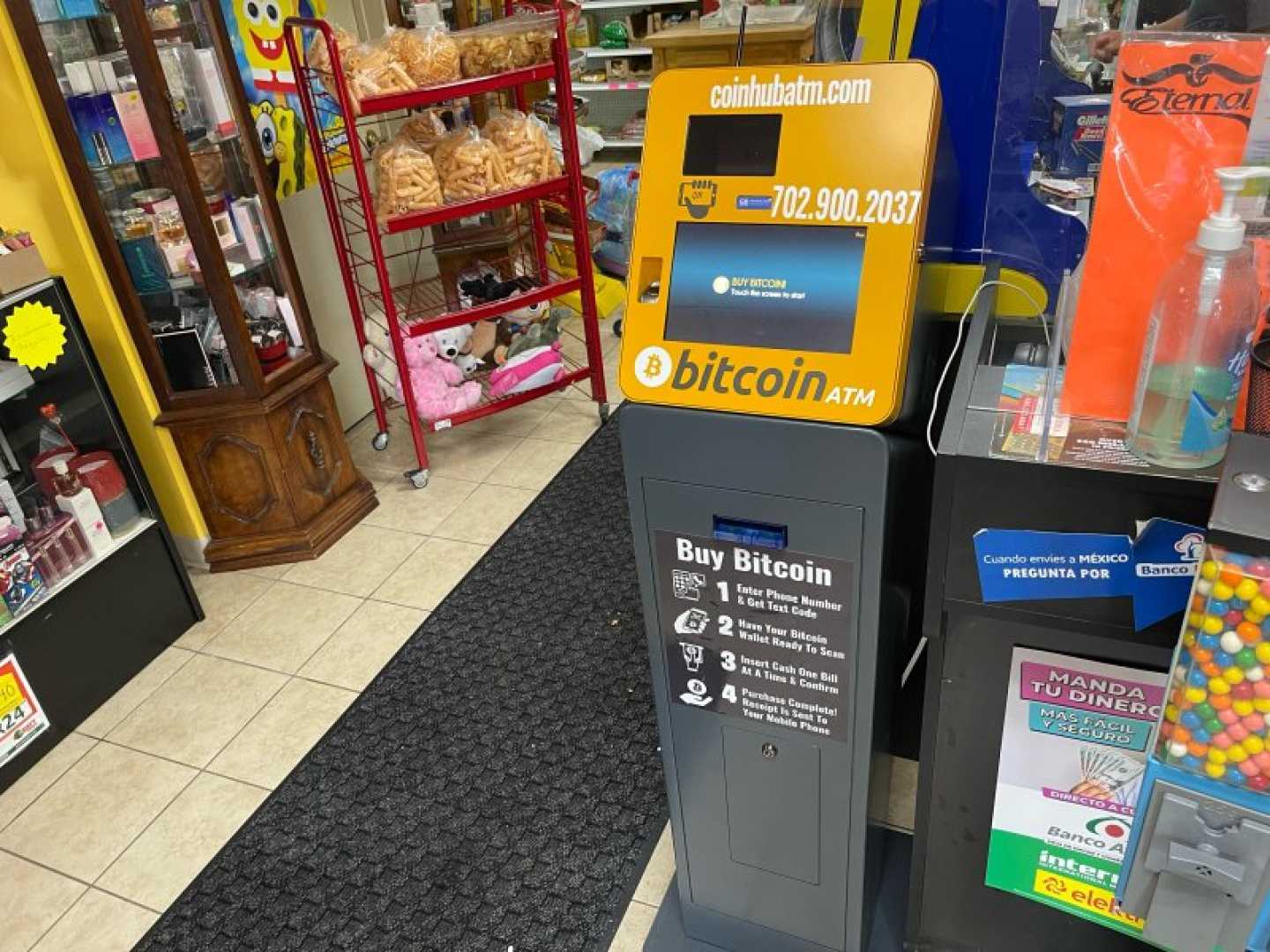

Bitcoin, the most widely recognized cryptocurrency, gained notoriety over a decade ago for its role in darknet drug markets like Silk Road. Today, the loosely regulated machines, often found in currency exchanges, convenience stores, and gas stations, are being exploited to convert cash into crypto and vice versa, with transaction fees reaching up to 30%.

“Virtual currency continues to be a popular and growing method used to launder illicit proceeds derived from drug sales,” the U.S. Drug Enforcement Administration (DEA) stated in a recent report. The agency highlighted Chicago as a hotspot for such activities, with criminals from other states flocking to the city due to its high concentration of crypto ATMs.

In addition to drug-related crimes, the machines are increasingly used in scams. Victims are often directed to deposit cash into crypto ATMs under false pretenses, such as paying a fake utility bill or sending money to a fraudulent love interest. Once the funds are converted into cryptocurrency, they are nearly impossible to recover.

Legislation introduced in the Illinois Senate last year aimed to regulate crypto ATMs and cap usage fees, but the bills failed to gain traction. State Sen. Bill Cunningham, a Chicago Democrat, expressed concern that some lawmakers were hesitant to regulate the industry, fearing it might lend legitimacy to an unproven sector.

President-elect Donald Trump, a vocal supporter of cryptocurrencies, has promised to deregulate the industry, raising concerns among government watchdogs. Critics argue that such moves could exacerbate the misuse of crypto ATMs for illegal activities.

Court records reveal the extent of the problem. In one case, a Florida man used a bitcoin ATM at a vape shop to launder over $32,000 in drug proceeds. Kevin Fusco, 37, was sentenced to three years in prison in 2017 but was later arrested again for drug trafficking while on probation.

Experts warn that criminals are increasingly using artificial intelligence to manipulate victims into sending money through crypto ATMs. “It’s the whack-a-mole that law enforcement and criminals have played really since the beginning of time,” said Ari Redbord, a former federal prosecutor and global head of policy at TRM Labs.

Despite efforts to combat the issue, the Federal Trade Commission reported that fraud losses at bitcoin ATMs skyrocketed from $12 million in 2020 to $114 million in 2023. The agency noted that these figures likely represent only a fraction of the actual harm, as most fraud goes unreported.

As the crypto ATM industry continues to grow, lawmakers and law enforcement face an uphill battle to curb its misuse. “When I founded the company, I’m like, ‘I don’t want to build something dirty,’” said Marc Jason Grens, co-founder of DigitalMint, a former crypto ATM operator. “But like any industry, the black markets take advantage of it because there’s no regulation.”